JPMorgan has maintained a neutral stance on Premier Energies Ltd. after the company reported an improving demand graph for DCR cells on one hand, but potential delays in the ramp-up of new cell lines on the other.

DCR or Domestic Content Requirement pertains to regulations that mandate a certain percentage of components in solar panels to be sourced domestically.

In its report, the research firm mentioned that management expects local premiums to sustain for a while. "While sector dynamics appear supportive, currently elevated margins appear at risk to eventual capacity growth (in a high RoCE, relatively low capex, low entry tech barrier business) and to delays in demand," it stated.

Premier Energies expects a rise in domestic demand through open access projects, utility scale solar projects, PM-KUSUM and CPSU schemes, and rooftop solar projects.

"The company is confident that the current 25GW market can double over the next few years and with their 10GW capacity across wafer, cells and modules, they will be able to capture 20% of the market share that will also meet the DCR norms," as per the report.

While capacity is growing, there is delay in ramping up new cell lines, according to the management. Foreign demand appears strong, but the company's focus is on domestic demand, "The US Budget Reconciliation Bill proposes changes to incentives for solar installations in the country. If passed in the current form, this could lead to accelerated installations by 2028 (the date after which incentives decline)... However, the company remains more focused on domestic markets in the near term, while keeping an eye out for export opportunities," stated the research note.

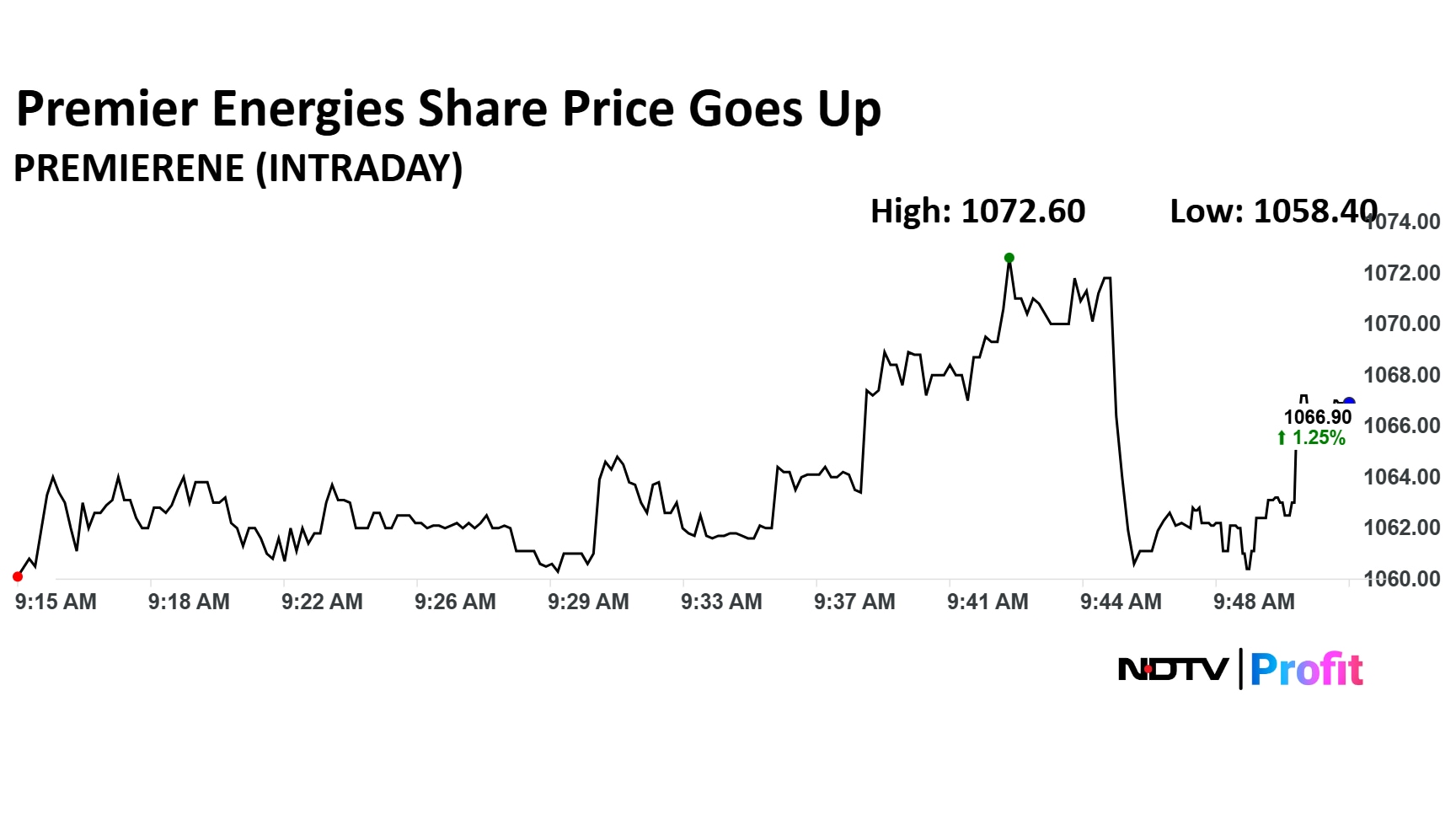

Premier Energies Share Price Today

The scrip rose as much as 1.05% to Rs 1064.80 apiece, the highest level since June 6. It pared gains to trade 0.87% higher at Rs 1,062.90 apiece, as of 9:50 a.m. This compares to a 0.36% advance in the NSE Nifty 50 Index.

Share price has fallen 21.50 % on a year-to-date basis. Total traded volume so far in the day stood at 0.15 times its 30-day average. The relative strength index was at 39.45.

Out of four analysts tracking the company, one maintains a 'buy' rating, one recommends a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 5.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.