Shares of Poonwalla Fincorp Ltd. rose nearly 3% on Monday after its board approved plans to raise Rs 500 crore.

The company will issue non-convertible debentures on a private placement basis to eligible investors, according to the exchange filing on Monday. The NCDs will have a face value of Rs One Lakh and an aggregating amount of Rs 500 crore.

The company further added that it will issue 50,000 secured, redeemable, rated, listed, non-convertible debentures in series 'C2' of fiscal 2025-2026. Additionally, Poonawalla Fincorp will pay a coupon rate of 2% over and above the coupon rate for any delay in payment of the principal amount of the NCDs.

In May, the company had approved the issuance of NCDs up to Rs 2,500 crore. The NCDs are proposed to be listed on the BSE through fresh issuance under the PFL NCD Series 'B2' financial year 2025-26 with a base issue of Rs 1,125 crore. A green-shoe option will retain oversubscription up to Rs 375 crore, aggregating to Rs 1,500 crore, according to the company.

An NCD is a fixed-income instrument that provides structured returns to investors. As NCDs are unsecured and not backed by assets, the market participants evaluate the issuing company's creditworthiness and debt-servicing capacity before allotment.

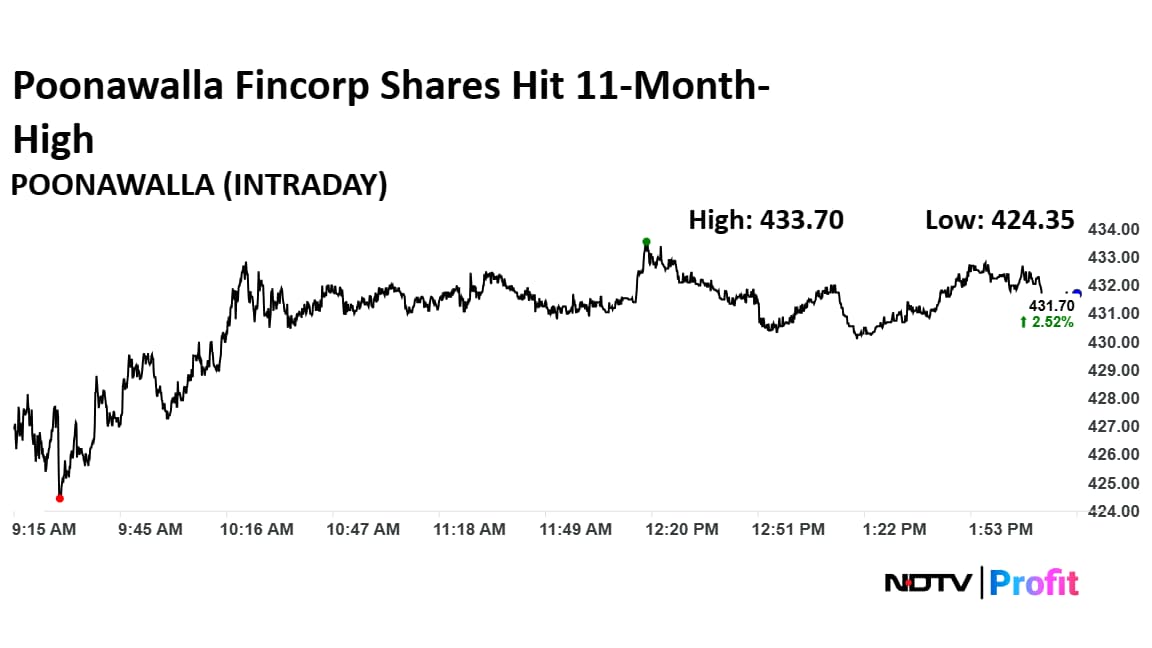

Poonawalla Fincorp Shares Advance

The shares of Poonawalla Fincorp rose as much as 2.99% to Rs 433.70 apiece, the highest level since July 8, 2024. It pared gains to trade 2.46% higher at Rs 431.50 apiece, as of 2:17 p.m. This compares to a 0.36% advance in the NSE Nifty 50 Index.

It has fallen 7.34% in the last 12 months and risen 37.22% year-to-date. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 65.

Out of eight analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold', and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 8.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.