The shares of PB Fintech Ltd. rose over 2% after Citi Research on Friday hiked its target price to Rs 2,150 per share from Rs 2,000 earlier. However, Macquarie maintained an Underperform rating.

The hike in target price comes after the company reported strong third quarter results. The Policybazaar and Paisabazaar parent delivered sustained improvement in adjusted Ebitda margins and robust growth in its core retail health and life insurance segments, Citi said in its note on Friday.

The brokerage said that the company has seen a remarkable 42% year-on-year growth in new business, driven by a 47% increase in retail health and life premiums, with retail health growing around 60%. This demonstrates strong momentum in the core business, even as the company faces challenges at Paisabazaar.

Despite these headwinds, PB Fintech continues to exhibit robust margins, cost control initiatives, and encouraging new origination models, according to Citi.

The company's new business growth in core annuity businesses remains strong, with fresh premiums in retail health growing at 60% in annual terms. This growth is supported by continued investments in expanding the sales force, improved brand awareness, and a robust claims backbone. Citi remains optimistic about PB Fintech's ability to sustain a growth rate of over 40% year-on-year in new business over the coming quarters.

PB Fintech's expansion into new initiatives, particularly in the Point of Sales Person channel, shows promising results said the brokerage.

Macquarie on the other hand has maintained an Underperform rating on PB Fintech with a target price of Rs 1,530. The company's third quarter performance showed a profit miss, primarily driven by higher costs. While the momentum in the insurance segment remains strong, revenues from credit continue to decline.

Additionally, valuations for PB Fintech are considered expensive, Macquarie said.

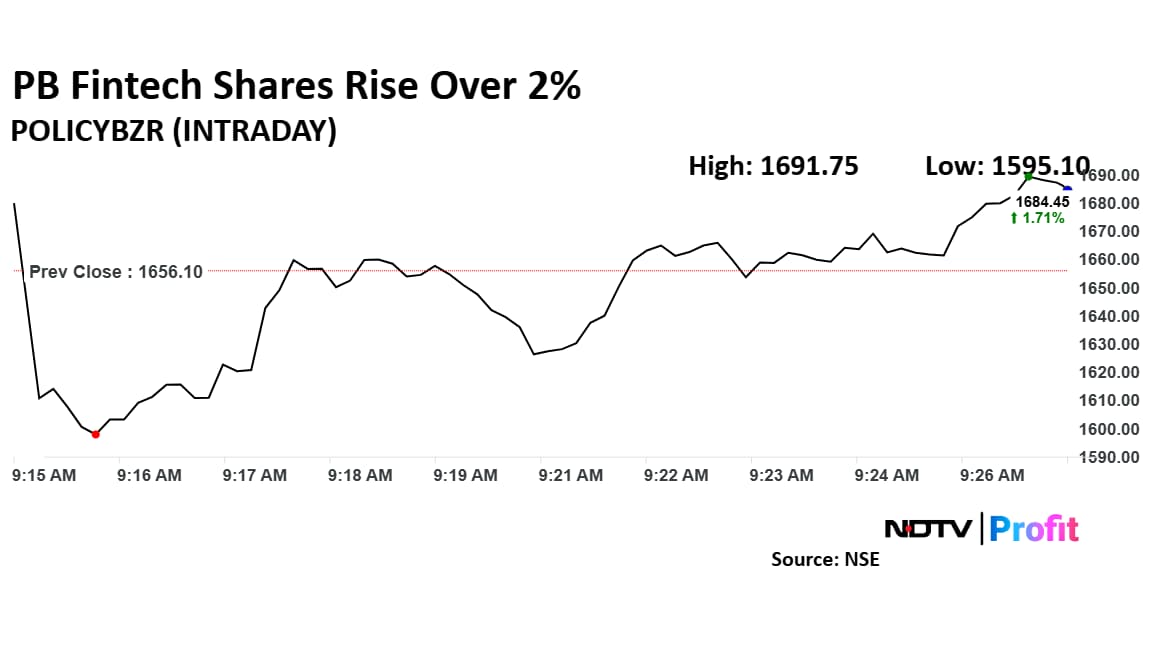

The shares of PB Fintech rose 2.15% in early trade Friday, recovering from a fall of 3.68%. It pared losses to trade 2.68% higher at Rs 1,642 apiece, as of 9:26 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has risen 66.78% in the last 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 39.

Out of 20 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 60.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.