HSBC Global Research has initiated coverage on PB Fintech—the parent company of Policybazaar and Paisabazaar—with a 'buy' rating and a target price of Rs 2,550, signaling a 19% upside from its current market price of Rs 2,142 per share.

The brokerage's bullish outlook is driven by PB Fintech's dominant position in the online insurance and credit marketplace, alongside its robust growth potential and improving profitability.

PB Fintech, operating India's largest online insurance marketplace, holds a 93% market share in the online aggregator space. The company's early mover advantage and extensive customer base of 86.9 million place it far ahead of peers, as per the report.

HSBC highlighted its diversified product offerings, partnerships with over 50 insurance companies, and use of cutting-edge technology as key competitive advantages.

The brokerage forecasts a revenue compound annual growth rate of 27% between fiscals 2025 and 2028, driven by an increase in cross-selling, better renewal rates, and expansion into tier-2 and tier-3 cities.

The brokerage expects profit after tax to grow at a CAGR of 66% during the same period, supported by operating leverage and cost optimisation.

With India's insurance penetration still low, PB Fintech is well-positioned to tap into the underpenetrated markets for health, protection, and savings products, according to the brokerage. The company's physical presence in over 200 cities and growing contributions from non-metro regions will drive growth. Improved cross-sell ratios and higher renewal premiums are expected to provide revenue stability, it said.

HSBC also noted potential challenges from regulatory changes and rising competition. However, PB Fintech's established brand and superior customer experience will mitigate these risks, it said.

The brokerage identified risks, including regulatory disruptions, deferred commission rates due to new surrender norms, and potential difficulties in scaling newer initiatives. Despite these, PB Fintech's strong execution and technology-driven approach will help sustain growth, HSBC said.

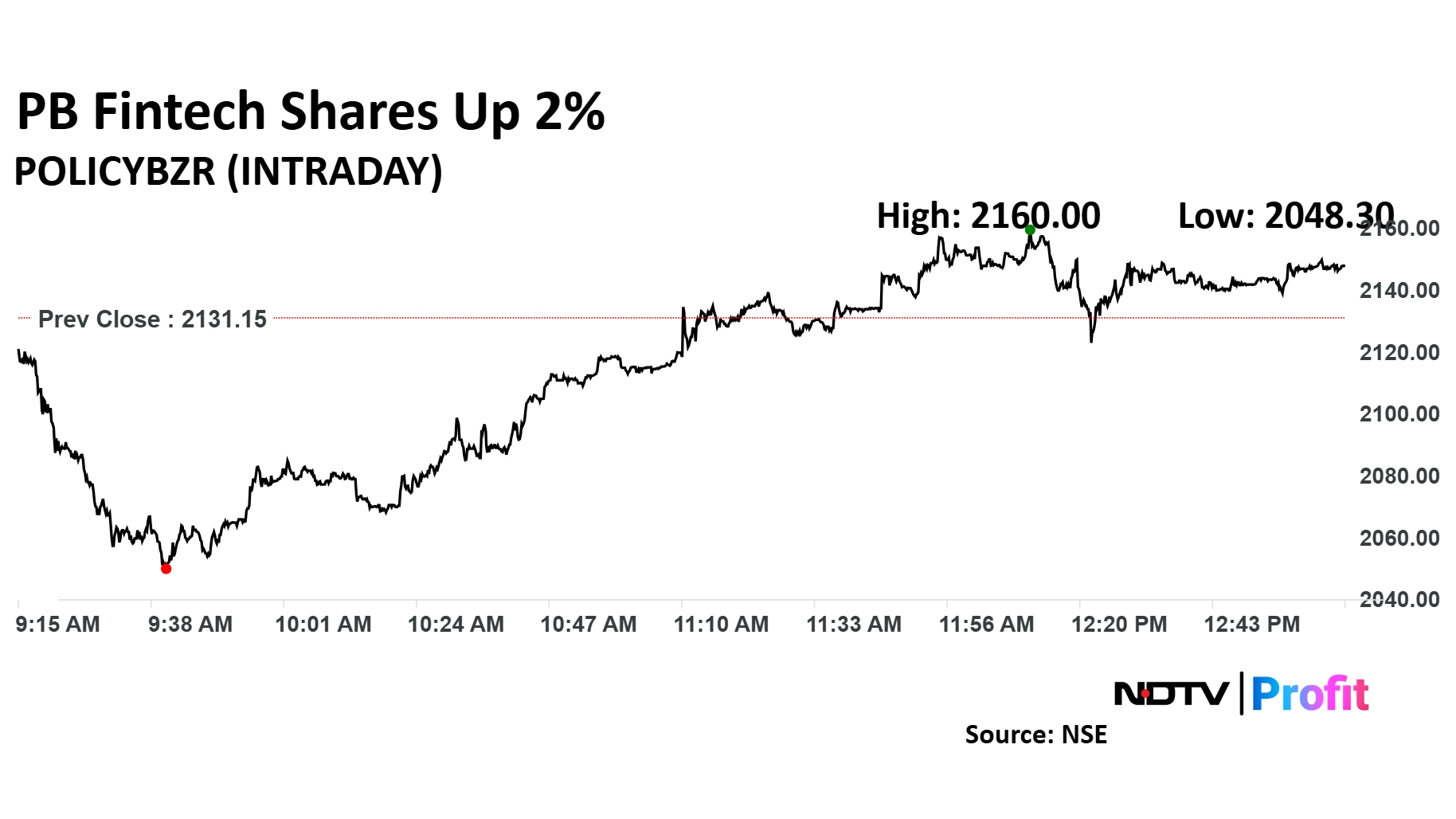

PB Fintech Share Price Today

The scrip rose as much as 1.35% to Rs 2,160 apiece. It pared gains to trade 0.50% higher at Rs 2,141.70 apiece, as of 12:48 p.m. This compares to a 0.28% decline in the NSE Nifty 50.

It has risen 171.64% year-to-date. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 79.92.

Out of 20 analysts tracking the company, eight maintain a 'buy' rating, five recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 21.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.