Brokerages expect Paytm's business model transition to a payments company as the Reserve Bank of India's curbs on Paytm Payments Bank kick-in after the March 15 deadline.

On Thursday, the National Payments Corporation of India also approved a third-party application provider license for Paytm, enabling continuity of UPI payments. This would be executed via four banks, Axis Bank, Yes Bank, HDFC Bank and State Bank of Bank, which would become payment service provider banks for Paytm.

Most brokerages see this as a positive development with the TPAP approval ensuring smooth customer transition.

Here's how brokerages see the road ahead for Paytm:

Jefferies

TPAP approval removes last remaining regulatory challenge for smooth transition of customers and merchants

Business model may become similar to payment service providers like PhonePe, Google Pay, PineLabs etc., given it may lose access to banking license

Change in business model may push for deeper engagement with banks

May dip into Rs 85 billion cash reserves for spends on retaining users

February 2024 data shows around 8% month-on-month hit to UPI value/volumes

Expect quantum of impact to be limited to <20% from January 24 levels

Path to normalisation for lending business to provide clarity on revenve/EBITDA trajectory

Attrition of users and merchants key monitorable

Jefferies maintains 'not rated'

UBS

Expect Paytm's share in the digital payments industry to come down to 17% in FY25E, driven by loss of wallet business and merchant/customer churn.

Expect loan origination to be on pause for most of Q4 and pick-up in FY25E.

Forecast loan disbursements to decline 5% YoY in FY25E

Expect a 2% decline in overall revenues in FY25E

UPI handles' migration and four new payment service providers to remove existing transactional linkages between Paytm and Paytm Payments Bank.

May operate in a manner similar to competitors like Google Pay and PhonePe.

Investor focus is likely to shift to operational performance over regulatory headwinds.

The extent of churn in customers and merchants base and the loss in GMV share are key monitorable

Maintains a target price of Rs 510 apiece.

Morgan Stanley

TPAP license approval and partnership with four banks a positive development

Await an update on potential impact to Paytm's businesses during Feb'24 and updated commercials for Paytm as Paytm Payments Bank's business moves to other banks

Maintains 'equal-weight' with a target price of Rs 555.

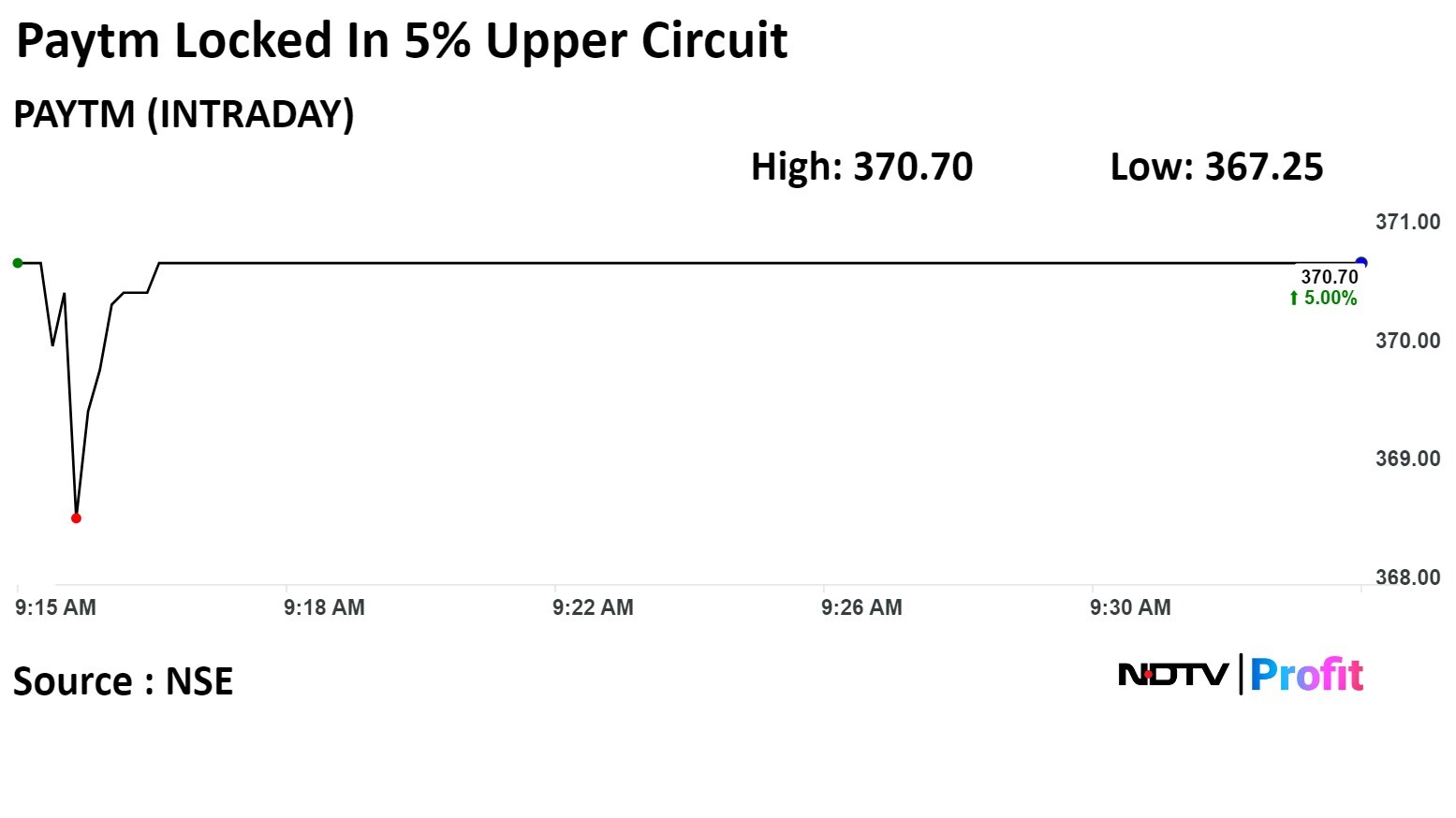

The Paytm stock was locked in the upper circuit of 5%, rising to Rs 370.70 apiece, the highest level since March 11. It remained locked in the upper circuit, as of 09:36 a.m. This compares to a 0.47% decline in the NSE Nifty 50 Index.

It has declined 35.29% in 12 months. Total traded volume so far in the day stood at 1.67 times its 30-day average. The relative strength index was at 37.38.

Out of 14 analysts tracking the company, six maintain a 'buy' rating, three recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside 83.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.