- Indian auto sector poised for significant upcycle, says BofA analysis

- BofA raises target prices for major Indian auto companies

- Two-wheeler market shifting to upgrader segment from entry-level demand

The Indian automotive players' share prices are zooming ahead as the sector is poised for a significant upcycle, according to BofA. In line with this bullish view, the brokerages have also hiked the target price for all the companies it covers. The brokerage firm's positive outlook on the sector is driven by what it calls the 5Cs of the auto cycle, like credit, crude, cost, cash flows and compliance.

BofA's analysis points to specific trends within different vehicle segments. The two-wheeler market is transforming into an upgrader market, a notable shift from the previous reliance on a recovery in the entry-level segment driven by rural demand.

For the passenger vehicle segment, the focus is shifting from premiumisation to penetration, though the report emphasises that product offerings and innovation remain crucial for success.

Players like Eicher Motors, Maruti Suzuki, Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, TVS Motors and Hyundai have gotten notable target hikes. The only company with an "underperform" rating is Ola, despite a slight increase in its target price.

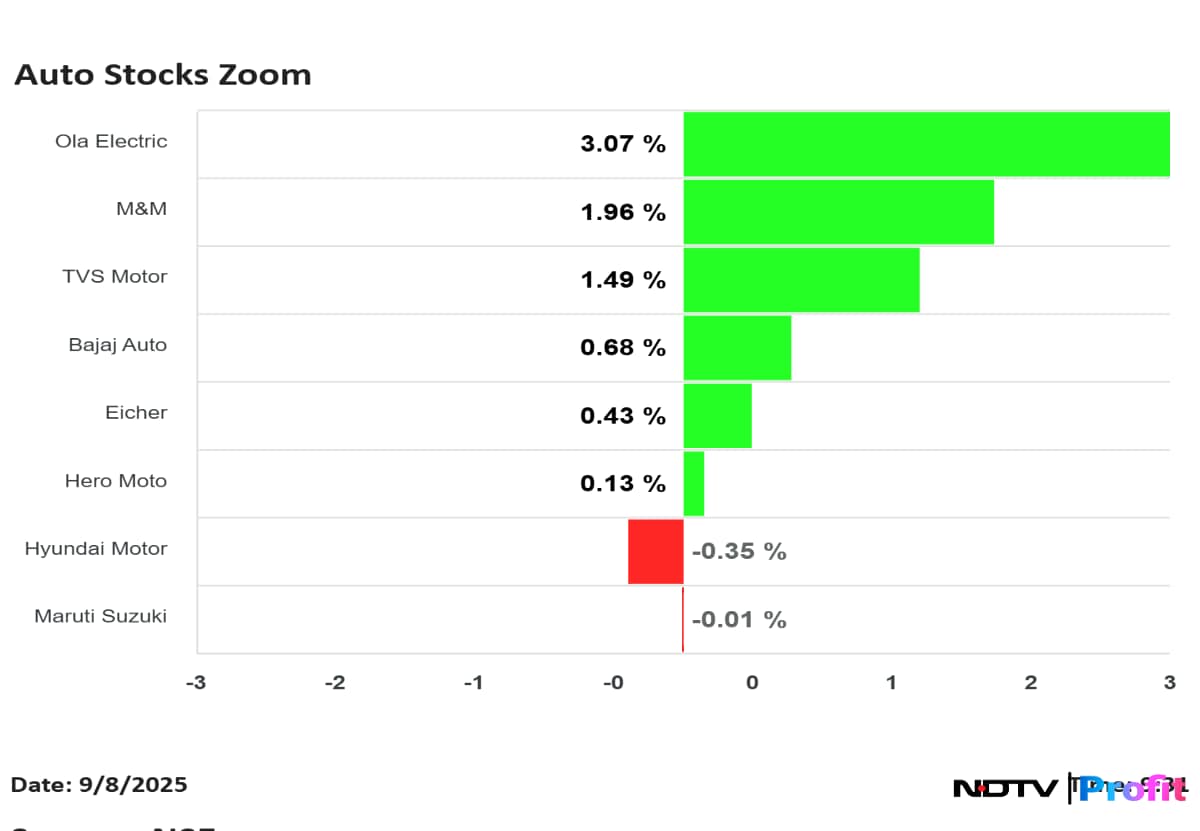

Auto Stocks Share Price

Indian auto stocks like Mahindra & Mahindra, TVS Motors, Bajaj Auto, Eicher and Hero Moto are trading with over 1% gains on the back of the auto cycle.

Interestingly, the one counter that BofA has an 'underperform' on is leading gains in the pack. Ola Electric stock has surged over 3% in trade so far.

Mahindra and Mahindra and TVS Motors have marked gains of nearly 2%. While names like Bajaj Auto, Eicher, and Hero Moto are trading nearly 1% higher as well.

The only counters trading with losses are Hyundai and Maruti Suzuki, logging in less than 1% losses.

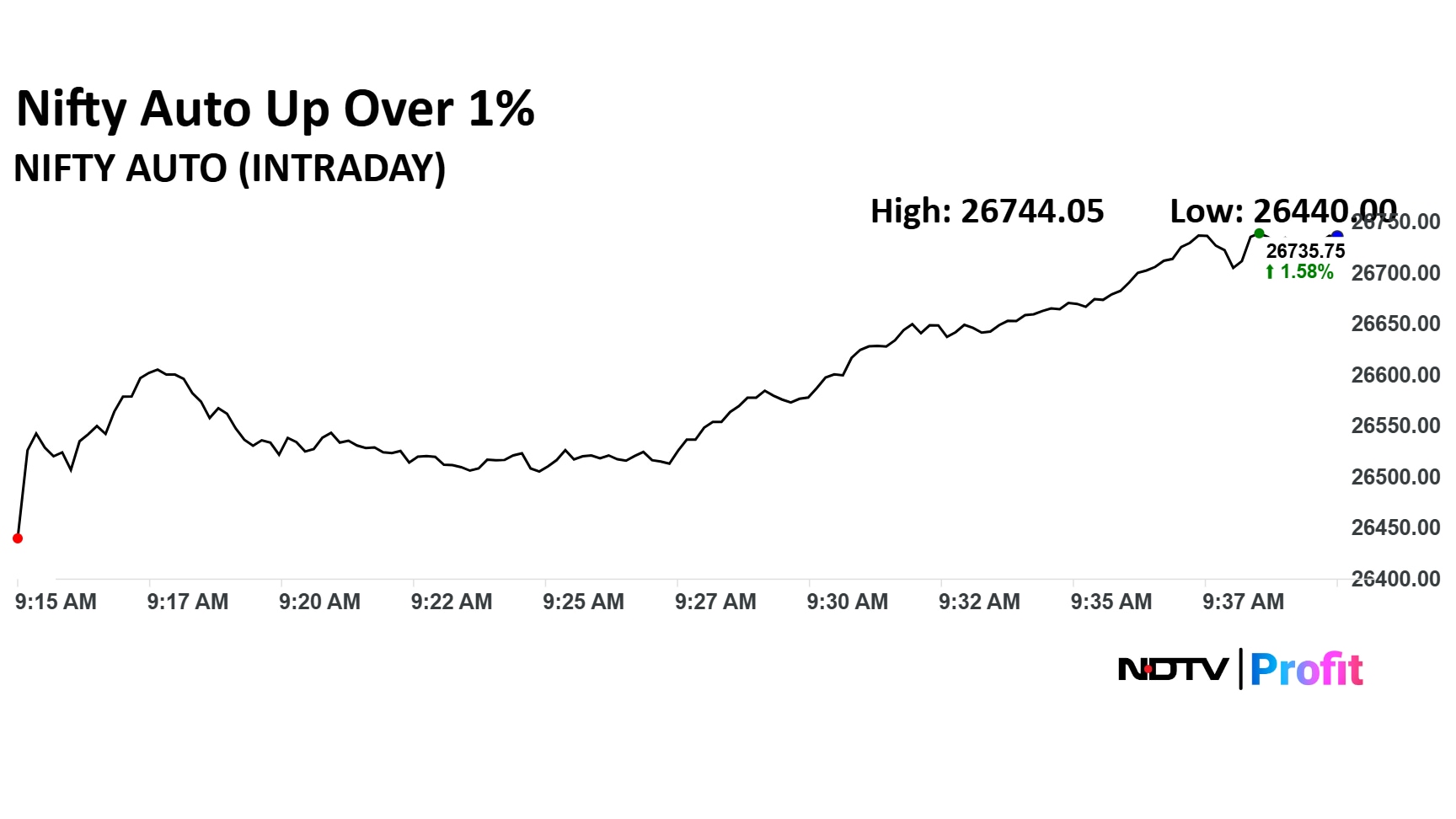

Nifty Auto was also trading over 1% higher. These gains of auto players compared to a 0.40% gains in the benchmark index Nifty 50 as of 9:41 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.