Oil slipped as traders weighed the impact of President Donald Trump's latest wave of tariff threats and fresh attacks on Red Sea shipping.

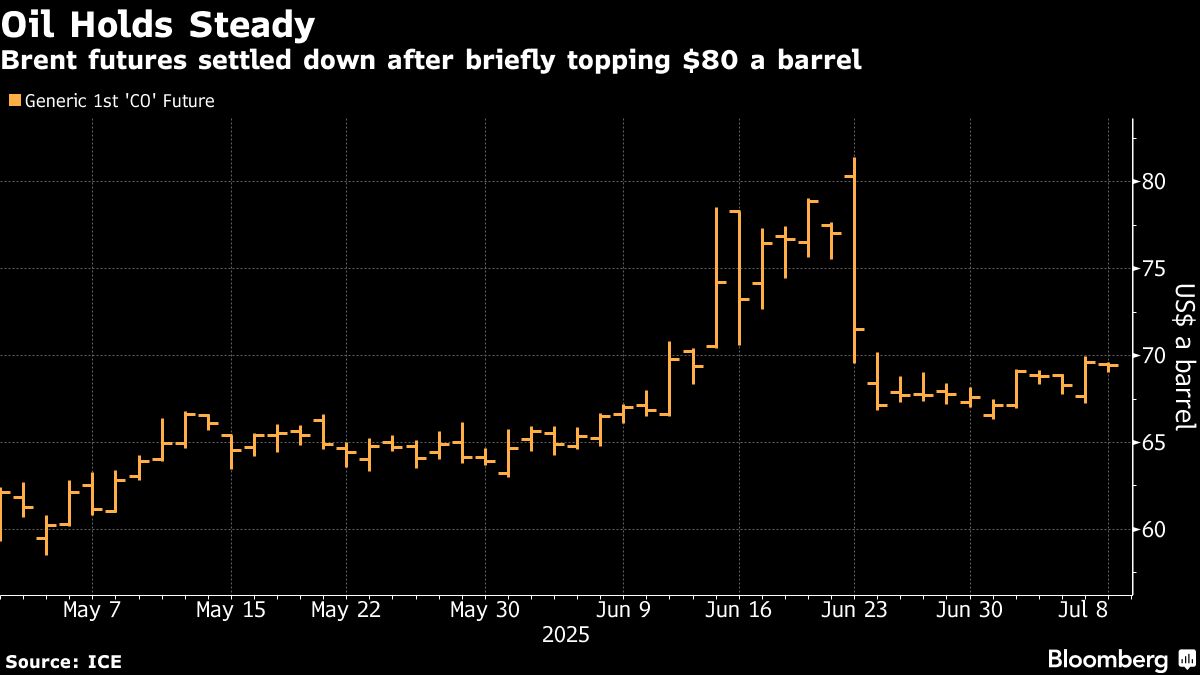

Brent traded near $69 a barrel, after jumping almost 2% on Monday. The US unveiled a slew of letters warning key trading partners of high tariff rates. Meanwhile, another ship in the Red Sea was under attack.

“Traders are watching Trump's new tariff threats and global growth risks, which could soften demand,” said Haris Khurshid, chief investment officer at Karobaar Capital LP. “Looking ahead, we should be paying attention to any new OPEC+ signals about extending or adjusting supply cuts.”

Oil settled higher on Monday even after a decision by OPEC+ to increase production more rapidly than expected in August. Saudi Arabia raised the cost of crude for buyers in Asia by more than they were expecting — a sign Riyadh is confident the market is strong enough to absorb extra supplies.

Trump posted letters to various nations on social media on Monday, starting with his intent to impose 25% levies on goods from Japan and South Korea. The US president said the Aug. 1 deadline was “not 100% firm” and signaled he might tweak rates further.

In the Red Sea, the MV Eternity C vessel “sustained significant damage and lost all propulsion” after being attacked near Al-Hodeidah, Yemen, and is “surrounded by small craft and is under continuous attack,” according to UK Maritime Trade Operations.

The number of tankers passing through the Bab el-Mandeb Strait has remained low after falling sharply in late 2023 amid Houthi attacks.

Prices:

Brent for September delivery was 0.2% lower at $69.41 a barrel as of 11:10 a.m in London.

WTI for August delivery fell 0.4% to $67.63 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.