Oil held a drop on signs Saudi Arabia is seeking another big production increase at next month's OPEC+ meeting, in a bid for market share that could worsen a glut expected later this year.

Brent traded below $65 a barrel after losing 1.2% in the previous session, while West Texas Intermediate was under $63. The kingdom wants the Organization of the Petroleum Exporting Countries and its allies to continue to add at least 411,000 barrels a day of output in August and potentially September, according to people familiar with the matter.

“Once Saudi Arabia takes the lead in accelerating output increases, historical experience suggests that the market could face the risk of a price war, which would be highly unfavorable for oil prices,” said Gao Jian, an analyst at Qisheng Futures Co.

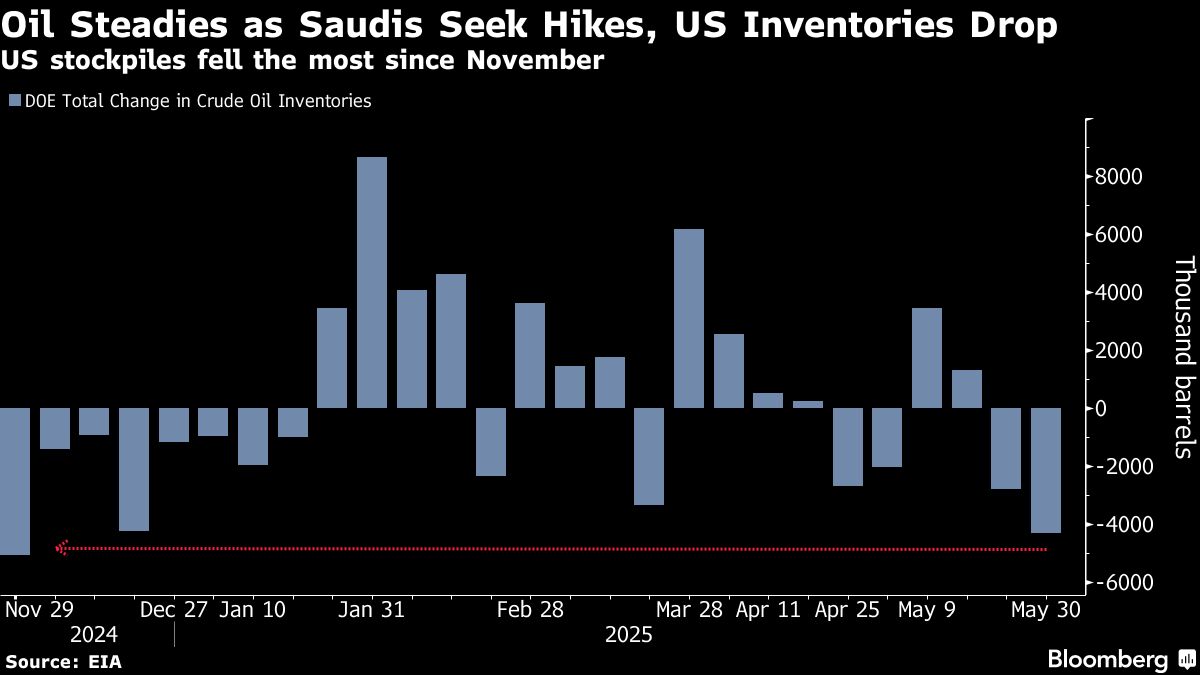

In the US, crude inventories fell by 4.3 million barrels last week, the most since November, data from the Energy Information Administration showed. The drawdown was bigger than an earlier estimate by an industry body.

Crude has fallen about 13% this year on fears trade wars will sap economic growth and energy demand. President Donald Trump has been calling for talks on tariffs with his Chinese counterpart Xi Jinping, who seems to be reluctant to go ahead with high-level negotiations at this stage.

Still, oil is up for the week on relief that OPEC+ didn't go ahead with a bigger-than-expected output increase for July, and some metrics are pointing to near-term strength in the market. The prompt spread for Brent has widened compared with a month ago in a bullish backwardation structure, signaling tight supply.

Meanwhile, Saudi Aramco cut the price of its main oil grade to buyers in Asia for loading next month, but by less than the reduction signaled in a Bloomberg survey.

Prices:

Brent for August settlement slipped 0.1% to $64.81 a barrel at 7:34 a.m. in London.

WTI for July delivery fell 0.2% to $62.70 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.