Activity at US service providers unexpectedly contracted last month for the first time in nearly a year and companies throttled back hiring, indicating the grip on the economy from higher tariffs is getting tighter.

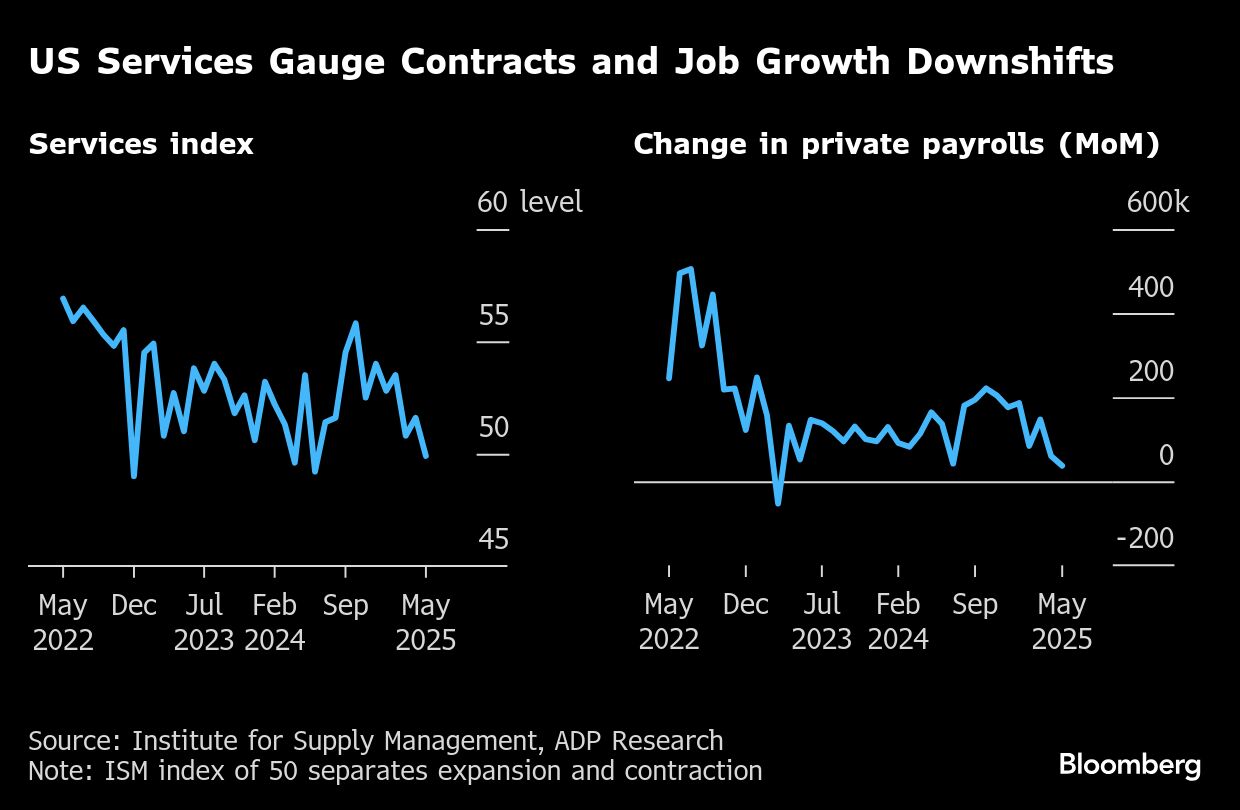

The Institute for Supply Management's index of services dropped 1.7 points in May to 49.9 — a touch below the 50 level that separates expansion and contraction. A separate report from ADP Research showed private-sector payrolls rose just 37,000 last month, the least in two years.

Treasuries rallied after both reports fueled more speculation the Federal Reserve will lower interest rates later this year. While the combined data were far weaker than economists had expected, officials will likely take their cues from more highly regarded government statistics on economic activity and employment — including Friday's jobs report — in determining the course for monetary policy.

There are some signs, such as weaker May auto sales, that consumers are becoming more discerning in their spending. Meanwhile, the upcoming employment data is projected to show a more moderate deceleration in job growth that would indicate the labor market is still holding up.

Nonetheless, Wednesday's ISM and ADP figures underscore an elevated level of anxiety around the Trump administration's frequently changing trade policy. The services survey showed both the steepest contraction in new orders and the highest prices-paid index since late 2022, denoting a more pronounced impact on demand and inflation as a result of higher US duties on imports.

“The overall report was a bleak read on service-sector activity, but the details mostly reflect the dynamics of a pull-forward in demand ahead of tariffs,” Wells Fargo economists Tim Quinlan and Shannon Grein said in a note. “The plunge in demand does not bode well for coming activity, but it's too soon to know if cost pressure will be sustained and its influence on hiring.”

Uncertainty is filtering down into hiring decisions as well, based on the ADP data that showed business services, education and health, manufacturing and trade, transportation and manufacturing lost jobs in May. At the same time, leisure and hospitality, as well financial activities, increased hiring.

ADP offers a supplementary view of labor-market conditions ahead of the government's monthly employment figures — it's not designed to help predict them.

“As usual, we suggest ignoring the message from the ADP employment report, mostly because it has had a very poor track record in recent years,” Oliver Allen, senior US economist at Pantheon Macroeconomics, wrote in a note.

“Payrolls always have scope to surprise,” but Pantheon is sticking to its forecast that private payrolls rose by 110,000 in the May employment report, which would represent a more gradual softening from the average growth of the past six years.

On social media, though, Trump reiterated that Fed Chair Jerome Powell should lower interest rates, following the ADP report. Last week, the president had called Powell to the White House and pressed him to cut rates.

The US economy has held up this year and inflation remains above Fed officials' 2% goal — reasons policymakers cite for leaving rates unchanged while they wait for more clarity on how Trump's tariffs and other policies will affect the economy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.