Nifty Metal extended its decline for the third straight session on Monday. It was the worst performing sector with an over 8% decline following the market crash.

The Nifty Metal index fell 8.61% to 7,690.2 with Tata Steel Ltd. and Welspun Corp. Ltd. leading the decline. This is the highest percentage drop in a day since June 2024, when the index fell over 15.06%.

Nifty 50 fell as much as 5.07% to 21,743.65 and Sensex was down 3,939.68 points to 71,425.01 on Monday. This comes after the Asian markets plunged most in 14 years on Monday following the Wall Street's decline.

The index was pulled down by Tata Steel that hit a lower circuit of 10% following a block deal. Tata Steel has 5.10 million shares traded in multiple block deals.

Welspun Corp. has fallen the most in the index with a 17.83% decline at Rs 664.30 apiece.

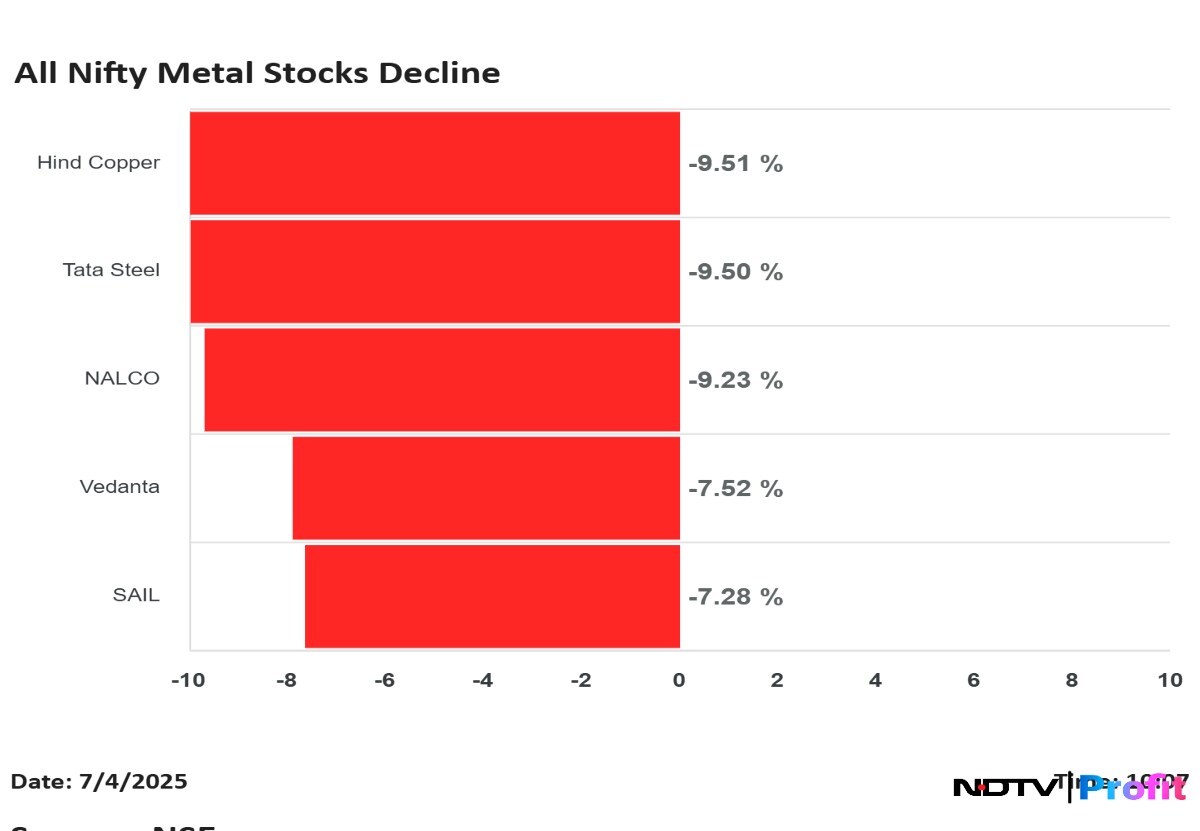

Hindustan Copper Ltd., JSW Steel Ltd., Jindal Stainless Steel Ltd. and Steel Authority of India Ltd. were also trading 10% lower on Monday.

Vedanta Ltd. and National Aluminum Co. were trading over 9% lower, whereas Adani Enterprises Ltd., Hindalco Industries Ltd., Jindal Steel and Power Ltd. and NMDC Ltd. were trading over 8% lower. The other metal stocks like Ratnamani Metals and Tubes Ltd., APL Apollo Tubes Ltd. were also trading lower.

The index extended its decline after it fell nearly 6.56% on Friday. This was on the back of reports that the US is considering tariffs on copper, a key commodity that was excluded from the recent round of reciprocal duties.

Other metals like zinc, nickel and tin were also exempt from the country-specific tariff. However, they could be subject to tariffs in the future.

In addition, there is a 25% tariff imposed by the US on steel imports. However, it would have a limited direct impact as the export exposure is minimal. The US' higher tariffs on Europe and other steel producing countries in Asia may mean the global trade float can make its way to India, making the country more vulnerable to steel imports, according to SAIL Chairperson Amarendu Prakash.

"Steel has been travelling from Asian countries to the US and Europe. Some steel was being exported to the US from Europe. Once the reciprocal tariffs take effect, such exports would become unviable," he said.

"The EU might see tightening of tariff rate quotas amid US tariffs... That will mean Asian countries like China, South Korea and Japan that are exporting to Europe, that steel becomes free and will be floating around in the world. This floating trade might come to India," Prakash added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.