Indian stock markets tanked on Monday, following a wave of global panic that saw trading temporarily halted in Japan and Taiwan earlier in the day due to sharp losses.

With Asia reeling from the fallout of escalating trade tensions, the Nifty 50 dropped as much as 5.07% to 21,743.65 and the Sensex plunged 5.23% to 71,425.01, raising the risk of a market-wide circuit breaker being triggered.

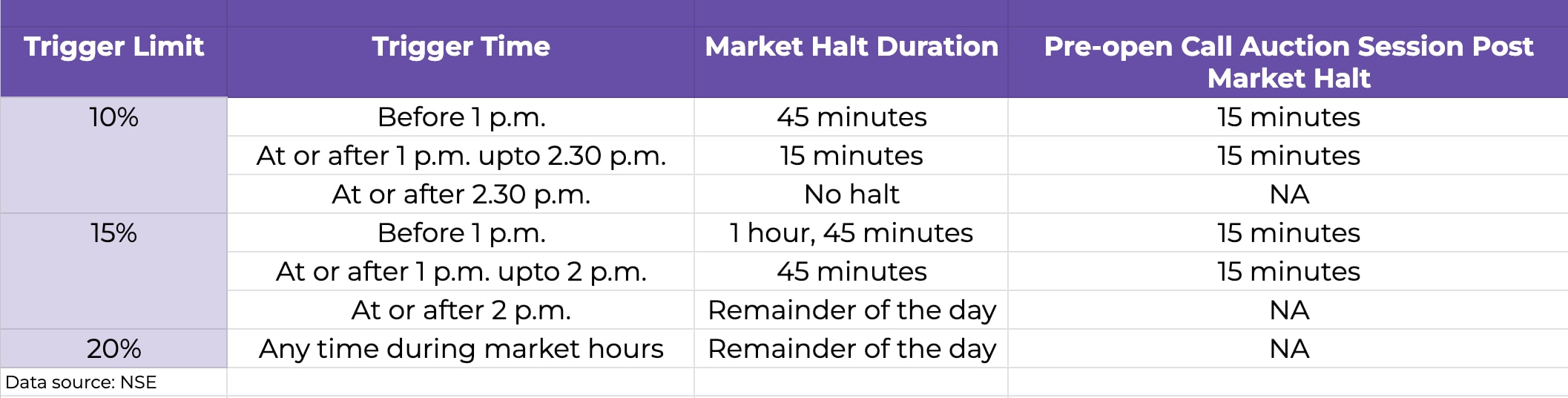

According to NSE rules, trading halts kick in if either the Nifty or the Sensex falls 10%, 15%, or 20% in a session — whichever index breaches the level first. The extent of the halt depends on the time of the breach. A 10% fall before 1 pm triggers a 45-minute halt, while a 15% drop after 2 pm halts trading for the rest of the day. A 20% plunge stops trading entirely, regardless of when it occurs.

The selloff mirrored a rout in global markets, sparked by deepening concerns over US President Donald Trump's “reciprocal” tariffs.

The NSE Volatility Index — India's 'fear gauge' — spiked to its highest level since August. The slide came just as local benchmarks were finding some stability, only to be thrown off balance again by escalating trade tensions and renewed fears about the fallout from US tariff moves.

Asian markets were slammed Monday, with Japan and Taiwan temporarily halting trading to curb panic selling. In Tokyo, the Nikkei 225 futures plunged over 8%, triggering a 10-minute circuit breaker at 8:45 am local time. Taiwan's benchmark tumbled nearly 10%, prompting local regulators to pull the plug and promise further stabilization measures if needed.

Markets globally are now pricing in an increased risk of recession, with expectations that US interest rates may be cut as early as May.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.