The NSE Nifty fell nearly 2% and the BSE Sensex declined by over 1,400 points on Friday as US President Donald Trump's tariffs, incessant foreign-capital outflows and weakness in global markets hit investor sentiment.

The decline marked the eighth consecutive session of losses for the Nifty, which slipped into the negative territory for financial year ending March 2025 with an over 5.3% decline in February alone. This is the biggest monthly fall since October 2024.

The index fell to the June 2024 levels and recorded its longest monthly losing streak in 28 years, falling for the fifth consecutive month, a trend not seen since November 1996.

The Nifty and Sensex have fallen over 14.99% and over 13.89% respectively from their September 2024 peak and lodged deep in correction territory.

Trump Tariffs

Markets dislike uncertainty and ever since Trump has been elected, uncertainty has been on the rise. The Friday fall was triggered by global factors surrounding fresh tariff announcements by the US.

Trump has said that the tariffs on Mexico and Canada will take effect from March 4. In addition, he has imposed a 10% duty on import of Chinese goods on the same day. This follows a 10% tariff implemented by the US on China.

Global Weakness

Indian stocks are mirroring their Asian peers, which fell after Wall Street closed in the red as investors digested underwhelming Nvidia Corp. results, mixed economic data and further details on US tariffs.

Shares declined in Hong Kong fell Friday in line with the US drop a day before, trimming their gains this month to 15%, according to Bloomberg.

On Thursday, both the S&P 500 slipped 1.6% to erase its gains for the year and the Dow Jones Industrial Average fell 0.45%. The Nasdaq Composite slid 2.78% after Nvidia Corp.'s earnings weighed on the 'Magnificent Seven Group' pulling the index lower.

"The sell-off on Wall Street also came as President Donald Trump clarified that previously paused 25% tariffs on imports from Mexico and Canada will go into effect on March 4," said Ameya Ranadive, senior technical analyst at StoxBox.

FPI Selling

In February so far, the foreign portfolio investors have net offloaded equities worth Rs 35,694 crore, according to data from the National Securities Depository Ltd. This was preceded by net selling of Rs 78,027 crore in January.

In 2025 so far, they have sold equities worth Rs 1.13 lakh crore, the NSDL data showed.

On Thursday, FPIs stayed net sellers for the sixth straight session as they net offloaded stocks worth approximately Rs 19,014.4 crore, according to data collected by NDTV Profit.

"Global markets traded negatively, while concerns persisted as foreign institutional investors (FIIs) continued to be net sellers," said Hardik Matalia, derivative analyst, Choice Broking.

Among the reasons for the outflows are global tariff uncertainty, capital pivot towards China and a strong dollar making Indian equities less appealing.

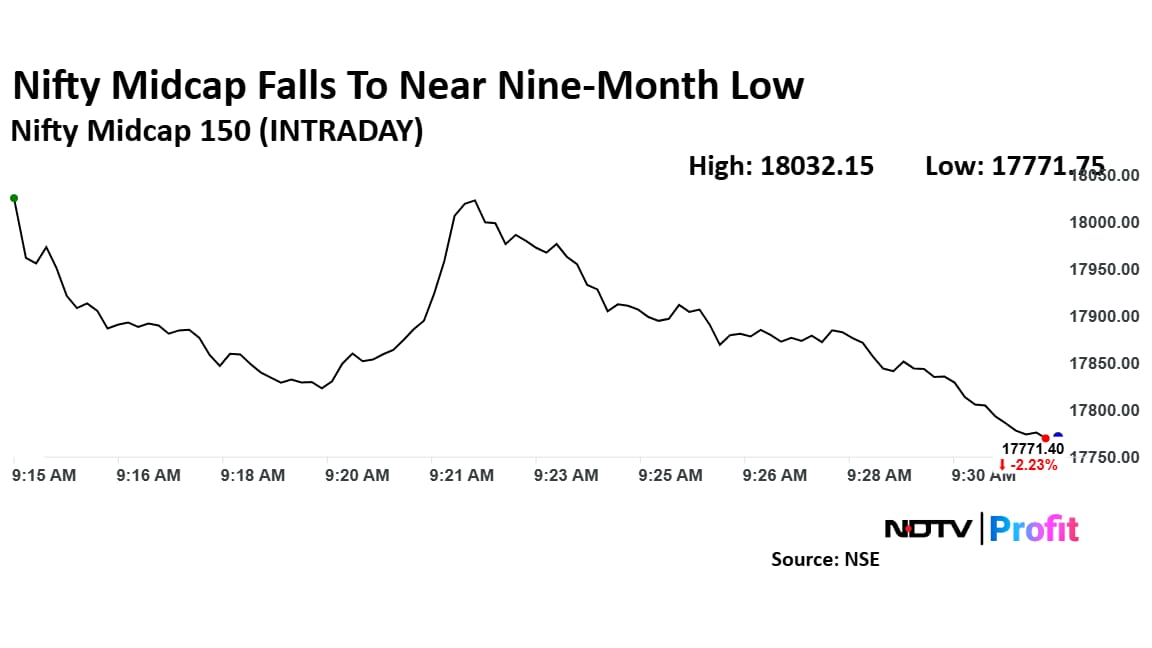

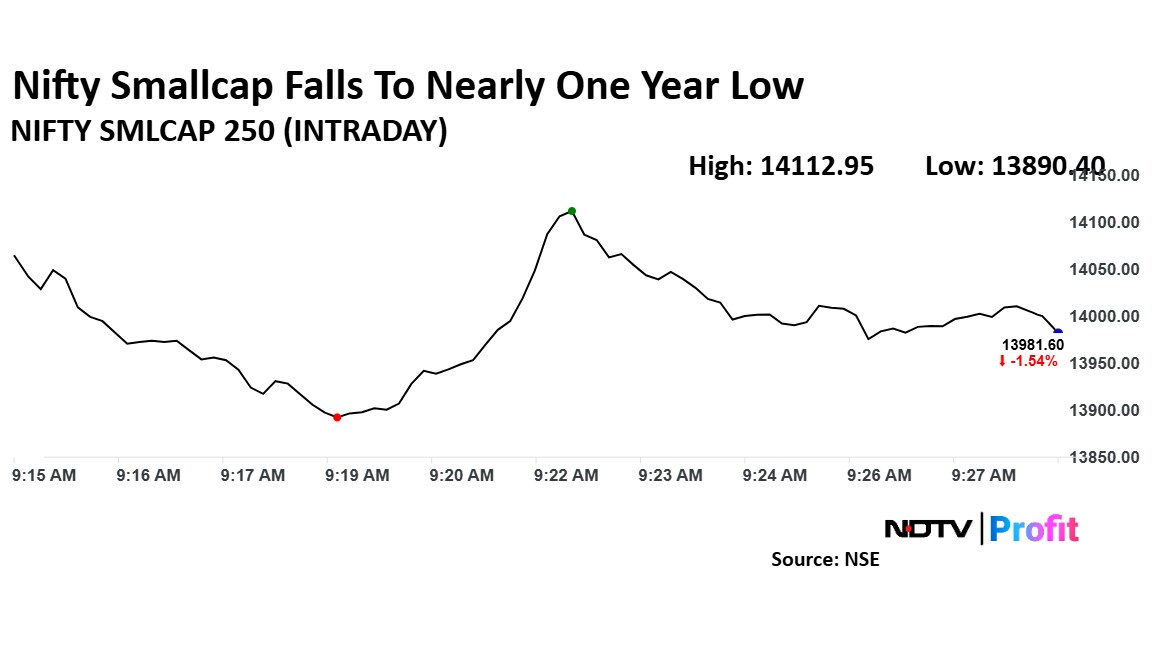

Small, Mid-Cap Rout

The Nifty Smallcap 250 lost over 2%,while the Nifty Midcap 150 fell 1.9% intraday on Friday, faring worse than the benchmarks. The Nifty Midcap 150 and Nifty Smallcap 250 fell for the fifth consecutive session. While Nifty Smallcap 250 Index has fallen to a nearly one-year low, Nifty Midcap 150 Index has fallen to nearly nine-month low.

While the smallcap index is down 22.33% so far this year, midcaps have shed 16.12%.

Christopher Wood, global head of equity strategy at Jefferies, said in his latest Greed & Fear report that for the recent market correction to be considered truly over, mid-cap stock valuations need to align more closely with those of blue-chip companies.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.