Stocks climbed in the final stretch of a rough February, with the latest economic readings reinforing bets the Federal Reserve will be able to cut interest rates at least twice this year.

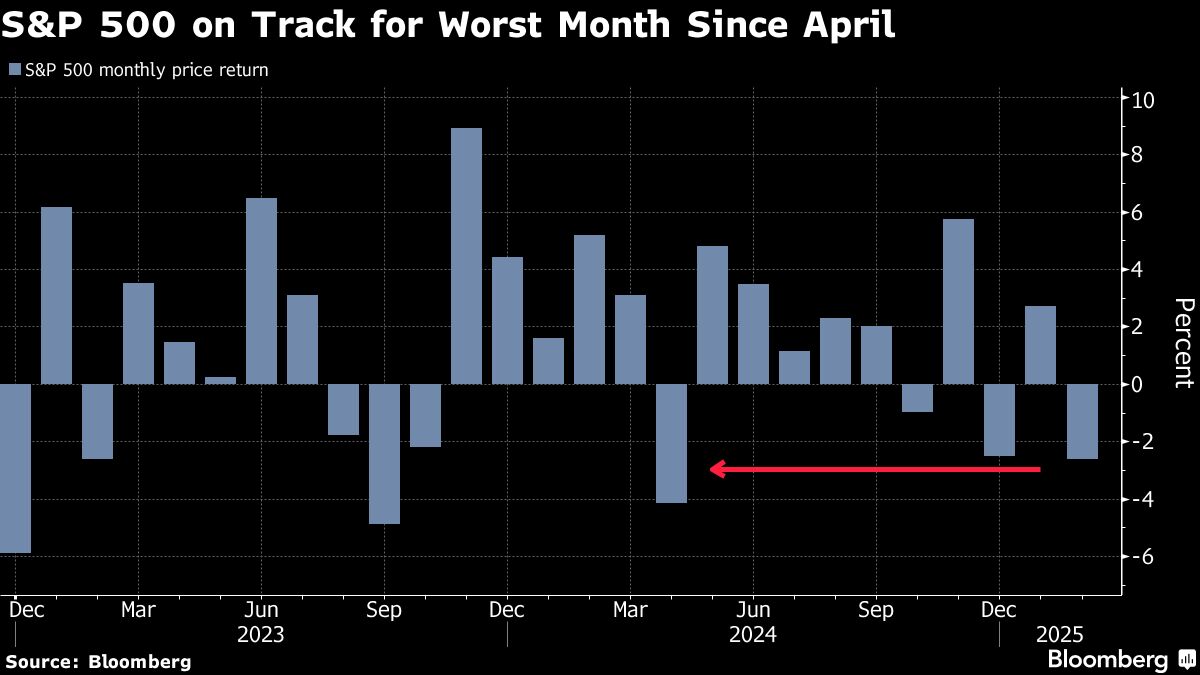

Wall Street got a degree of relief after data showed inflation isn't heating up — with traders looking past a worrisome decline in consumer spending to focus on prospects for Fed policy easing. About 350 shares in the S&P 500 advanced, following a selloff that unsettled investors. Most big techs gained, though the group still headed toward its worst month since December 2022. Treasury two-year yields briefly declined below 4%.

The so-called core personal consumption expenditures price index, which excludes food and energy items, rose 0.3% from December. From a year ago, it increased 2.6%, matching the smallest annual increase since early 2021. Inflation-adjusted consumer spending fell 0.5%, marking the biggest monthly decline in almost four years.

“While additional rate cuts are still probably many months away, we believe this report helps to keep one or two rate cuts on the table for 2025,” said Robert Ruggirello at Brave Eagle Wealth Management. “We believe that inflation is yesterday's problem and that the data will continue to improve going forward.”

Equity buyers emerged after a rout driven by a set of risks ranging from an economic slowdown, a trade war and artificial-intelligence valuations.

“We think the bull market is intact,” said David Lefkowitz at UBS Global Wealth Management. “But we have also cautioned that volatility would likely be higher this year due to policy uncertainty and trade frictions. Therefore, we have been highlighting that short-term hedges may be worth considering.”

The S&P 500 rose 0.2%. The Nasdaq 100 added 0.4%. The Dow Jones Industrial Average gained 0.3%.

Among corporate highlights, Nvidia Corp. and Tesla Inc. led gains in megacaps. While Dell Technologies Inc. gave a strong AI server sales outlook, investors remained concerned about the profitability of these products. HP Inc. sank on a disappointing profit forecast.

The yield on 10-year Treasuries fell two basis points to 4.24%. Swap contracts fully priced in a quarter-point Fed cut by July and a total of more than 60 basis points by year-end. The Bloomberg Dollar Spot Index rose 0.2%.

To David Russell at TradeStation, the PCE report provides a “little comfort” after the worrisome print on consumer prices.

“The drop in personal spending confirms the negative retail sales data we got earlier, suggesting the economy started 2025 on a soft footing,” he said. “Combined with the weak data so far in February, growth is becoming more of a concern for Wall Street. The consumer may finally be throwing in the towel.”

Chris Zaccarelli at Northlight Asset Management says he's very cautious on the market given the high current valuations, the high policy uncertainty companies are forced to navigate and a consensus belief that recession risk is non-existent (or extremely low).

“Softer consumer spending and slower income growth should catch the Fed's attention,” said Jeff Roach at LPL Financial. “Despite the deceleration in the annual pace of inflation, the monthly rate is still running hotter than the Fed would like.”

Roach says investors will continue to focus on the uncertain growth trajectory as real spending unexpectedly fall in January from weaker consumer demand.

“The odds are rising that the Fed's next rate cut will be in June,” he said. “Whether the next cut happens then or in July is less relevant than the number of cuts by end of year. The current macro backdrop suggests only two cuts in total this year but more in 2026.”

Corporate Highlights:

Microsoft Corp. is signaling the end of the line for Skype, the iconic internet calling and chat service it bought almost 14 years ago.

Bath & Body Works Inc., a retailer of personal care products, was upgraded at Citigroup Inc. in the wake of the company's results.

Redfin Corp., an online real estate company, reported fourth-quarter results that were weaker than expected on key metrics and gave an outlook that is seen as disappointing.

Rocket Lab USA Inc. delayed the launch of its Neutron rocket to the second half of the year and issued a revenue forecast for the first quarter which fell short of estimates. This prompted analysts to either lower or place their price targets under review.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.3% as of 12:39 p.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average rose 0.3%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index rose 0.7%

The Russell 2000 Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro was little changed at $1.0403

The British pound was little changed at $1.2600

The Japanese yen fell 0.5% to 150.53 per dollar

Cryptocurrencies

Bitcoin fell 0.5% to $83,876.48

Ether fell 2.4% to $2,224.98

Bonds

The yield on 10-year Treasuries declined two basis points to 4.24%

Germany's 10-year yield was little changed at 2.41%

Britain's 10-year yield declined three basis points to 4.48%

Commodities

West Texas Intermediate crude fell 0.5% to $70.01 a barrel

Spot gold fell 1.1% to $2,846.99 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.