Maruti Suzuki's share price declined 2.25% after the company released its new mid-term management plan. The plan, which outlines growth targets and significant investments in electric vehicles and other alternative fuel technologies, appeared to have a mixed reception from investors.

The company's new five-year plan aims to achieve sales of 25.4 lakh cars by fiscal 2030. A key component of this strategy is a significant shift towards environmentally friendly vehicles, with the company projecting that EVs, hybrids, and CNG vehicles will account for 75% of its total sales volume by FY30.

To support these goals, Suzuki plans to invest 1,200 billion yen (approximately Rs 7,000 crore) in India by FY30. This investment will be allocated across various areas, including:

Production: 550 billion yen.

New models: 400 billion yen.

Carbon neutrality: 100 billion yen.

Quality measures: 150 billion yen.

Maruti Suzuki intends to expand its production capacity by establishing four operational plants by 2030, aiming for a total production capacity of 4 million cars annually. The company also aims to reclaim a 50% market share by FY30 and become the leading producer, seller, and exporter of EVs in India.

A notable aspect of the plan is Maruti Suzuki's commitment to the EV market, with plans to introduce six electric cars by FY30, including two in FY25. While the plan details large investment into future technologies, it is possible that some investors are reacting to the cost of those investments, or to the time scale of the goals.

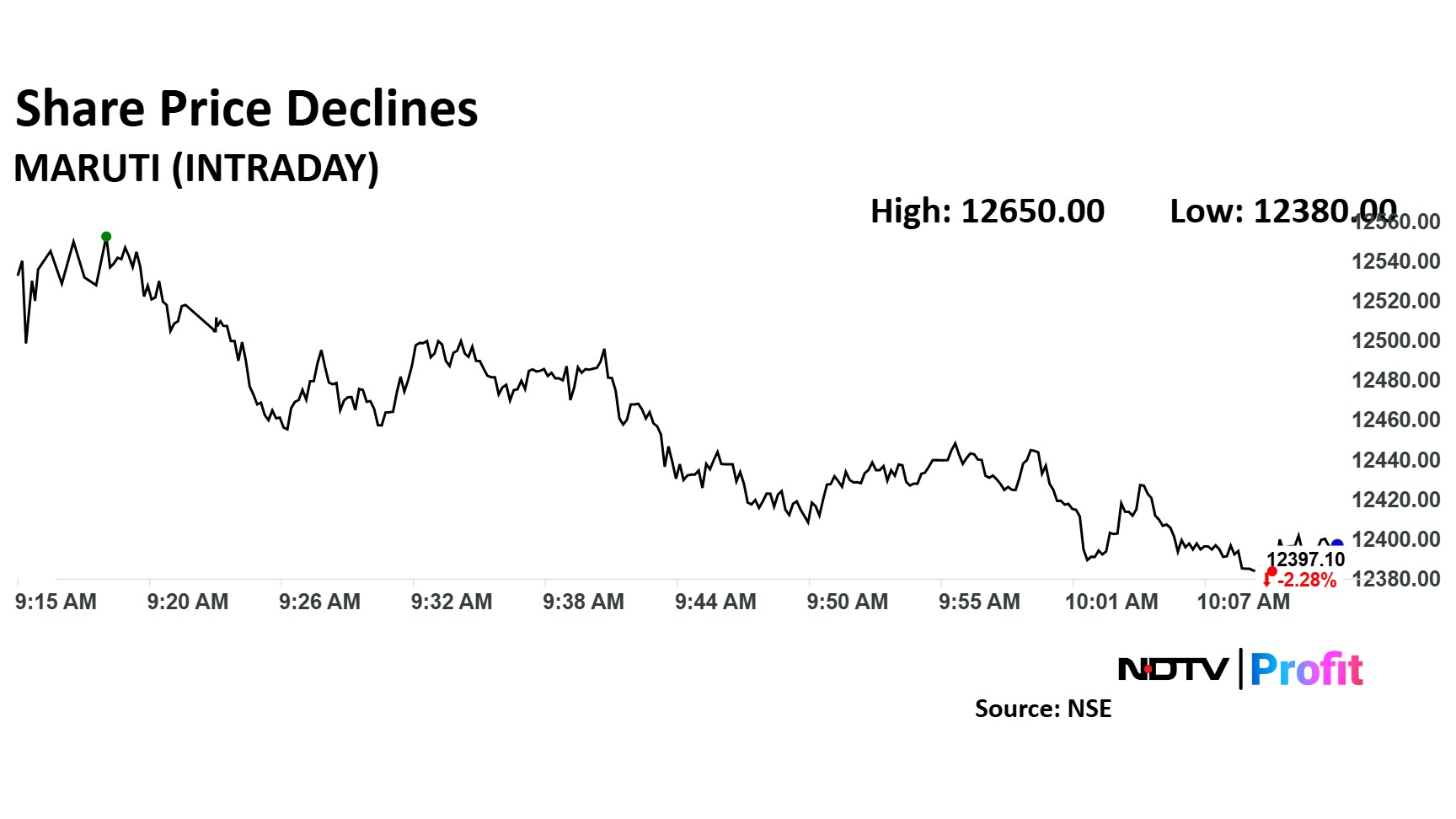

Maruti Suzuki India Share Price Today

Shares of Maruti Suzuki fell as much as 2.41% to Rs 12,380 apiece. They pared losses to trade 2.37% lower at Rs 12,385.30 apiece, as of 10:10 a.m. This compares to a 0.28% advance in the NSE Nifty 50.

The stock has risen 8.20% in the last 12 months. The relative strength index was at 47.

Out of 47 analysts tracking the company, 39 maintain a 'buy' rating, five recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.