Macquarie downgraded Mankind Pharma Ltd. to 'underperform' and lowered its target price on the stock as well, as the brokerage sees risks to the execution of the Bharat Serum and Vaccines acquisition, even as positives are baked in.

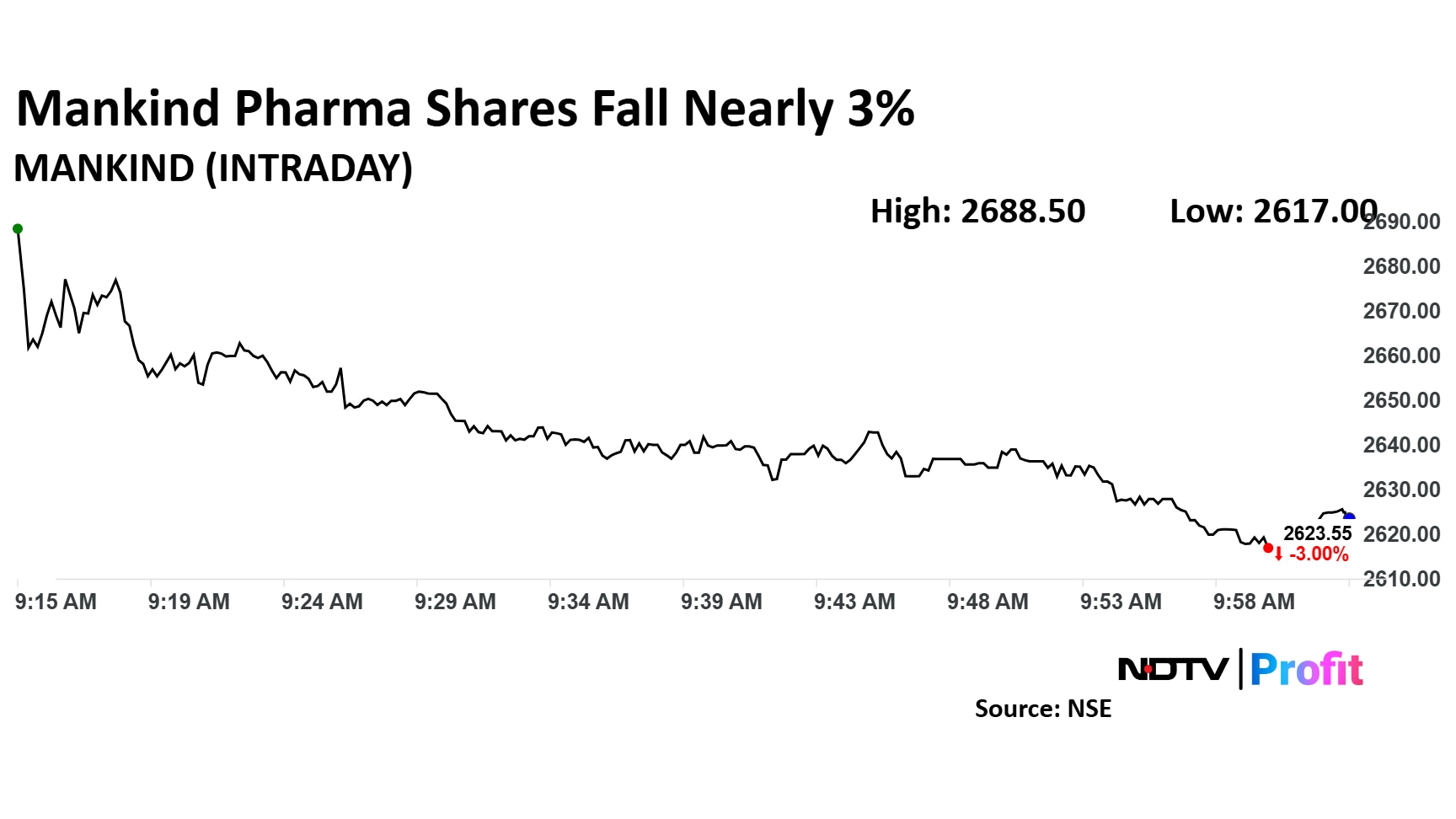

Share price of Mankind Pharma fell nearly 3% after receiving the downgrade.

The brokerage cut the target price to Rs 2,150 per share.

Mankind's own domestic formulations business has been weak due to slower growth in acute therapies, which accounts for up to 65% of its revenue, Macquarie said. It has included the BSV acquisition in its forecast, which adds to top-line growth, but would drag down bottom-line growth.

Domestic Formulations Business Remains Weak

The company's domestic formulations business reported a 10% growth in the first half of the financial year 2025.

Additionally, the third quarter is expected to see slower growth, with IMS IQVIA data indicating a 5% year-on-year increase. The weakness in the domestic formulations business, is attributed to the sluggish growth in acute therapies, representing up to 65% of the business.

Consequently, it has revised down the domestic formulation revenue growth CAGR to 10% from 11%.

BSV Acquisition Execution Awaited

The management anticipates strong growth and improved profitability for the BSV business in the coming years, which is reflected in the brokerage's consensus estimates as well.

However, secondary sales data from IMS IQVIA suggests BSV's sales growth is much slower, according to Macquarie.

Significant margin expansion may also be challenging due to lower gross margins and different selling channel for BSV products. It projects up to 18% revenue CAGR for BSV business in the estimates.

Exports Business Might Be Topping Out

The company's exports revenue delivered over 80% CAGR, accelerating overall top-line growth and offering operating leverage benefits.

However, recent exports data from ports suggests plateauing with Q3 exports. Hence, operating leverage benefit will be limited from hereon, according to Macquarie.

It lowered earnings estimates, primarily due to earnings dilution from the BSV acquisition. Our earnings estimates are 10% lower than Bloomberg consensus, according to the brokerage. It has cut target price by 7% to Rs 2,150 per share, based on 30 times price to earnings ratio.

"We use cash EPS to adjust for meaningful amortisation drag on reported earnings from the recent acquisition of BSV. Mankind's revenue is projected to deliver an 18% CAGR, mainly due to the BSV acquisition, while its core business slows. Acquisition-related debt and amortisation will limit net profit CAGR to 14%. At a 38 times PER on FY27 earnings, stock price reflects potential gains but overlooks risks," according to the brokerage.

Mankind Pharma Share Price

Mankind Pharma Ltd. stock fell as much as 3.31% during the day to Rs 2,615 apiece on the NSE. It was trading 2.97% lower at Rs 2,624.3 apiece, compared to a 0.78% decline in the benchmark Nifty 50 as of 10:34 a.m.

It has risen 22.32% in the last 12 months. The total traded volume so far in the day stood at 0.8 times its 30-day average. The relative strength index was at 43.27.

Of the 16 analysts tracking the company, 12 have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,883, implying an upside of 9.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.