.png?downsize=773:435)

Lupin Ltd. shares rose on Wednesday, after Citi gave the stock a double upgrade to 'buy' rating, driven by expectations of sustained margin strength. This is set to be fueled by good momentum from US launch and positive traction in non-US markets.

The brokerage has hiked the target price to Rs 2,260 from Rs 1,900, citing the potential for gJynarque to exceed expectations and contribute significantly to US sales.

Despite potential risks from tariffs, which could initially impact Ebitda by up to 4 to 6%, Citi expects a price-led recovery. It highlighted Lupin's base business margin expansion, driven by loss reduction in adjacencies and complex generic launches.

Valuations are currently at an attractive entry point, according to the brokerage. While there are risks like US market competition and tariff impact, Citi remains positive about Lupin's growth trajectory.

Base Business Margin Expansion May Sustain

The brokerage expects the base-line Ebitda margins to improve, broadly based on two factors — loss reduction in adjacencies and complex generic launches.

It also expects Lupin's US sales to remain strong over financial year 2026-27, driven by gJynarque. This may have a longer tail and has the potential to surprise positively, Citi said. Products in complex injectables and biosimilars are expected to help Lupin achieve over $1 billion sales in financial year 2027.

Tariffs And Key Risks

Although tariffs are unlikely, an imposition of 10% tariffs may hit Lupin's US business Ebitda by around 500 bps, according to Citi. However, it expects generic prices in the US to start moving up in the event of tariffs. This may mean the net impact could be relatively lower than the initial hit.

Key risks include adverse competition, pricing dynamics in the US, higher impact of tariffs, and approval delays, Citi said.

Lupin Share Price

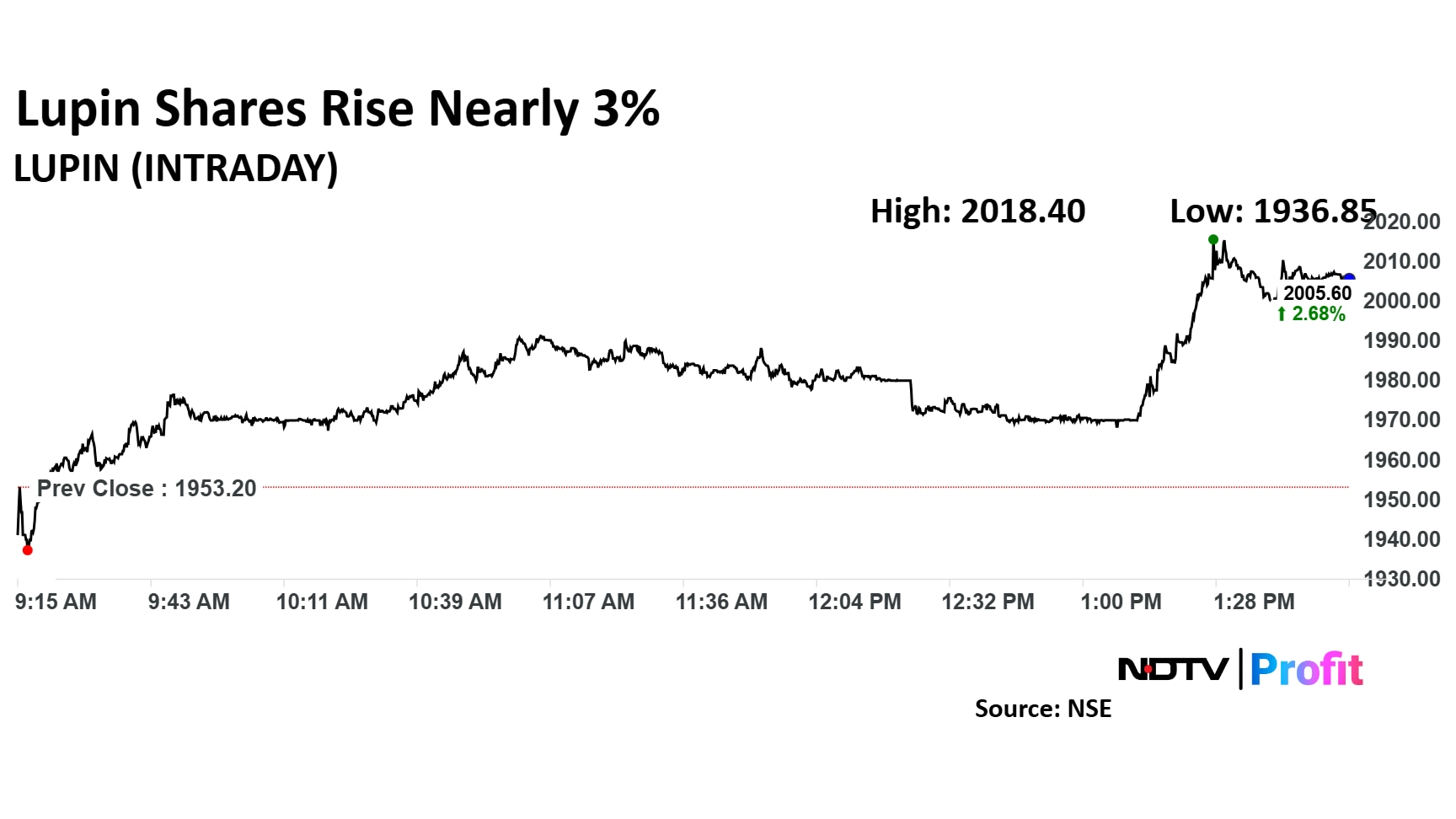

Lupin share price rose as much as 3.34% during the day to Rs 2,018.4 apiece on the NSE. It was trading 2.67% higher at Rs 2,005.3 apiece, compared to a 1.12% advance in the benchmark Nifty 50 as of 1:56 p.m.

The stock has risen 19.52% in the last 12 months. The relative strength index was at 48.9.

Twenty two of the 37 analysts tracking the company have a 'buy' rating on the stock, 10 recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,306.4, implying a potential upside of 15.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.