Shares of Larsen and Toubro Ltd. hit an all-time high on Tuesday after its target price was raised by Citi Research, citing the ongoing capex upcycle and potential rerating in the sector.

The infrastructure company's order inflows continue to witness very strong traction due to infrastructure capex upcycles and strong oil & gas and civil infrastructure capex in the Middle East, Citi said in a note on April 1.

This, combined with strong operating performance, is leading to the rerating of the stock's trading multiple, the brokerage said. "We think these are multi-year trends, and as a result, L&T remains our top pick in the India Infrastructure and Industrials space."

Citi has raised its target price for the multinational conglomerate to Rs 4,373 per share from an earlier Rs 4,082 per share. The revised target price implies a potential upside of 14% from Monday's closing on the BSE.

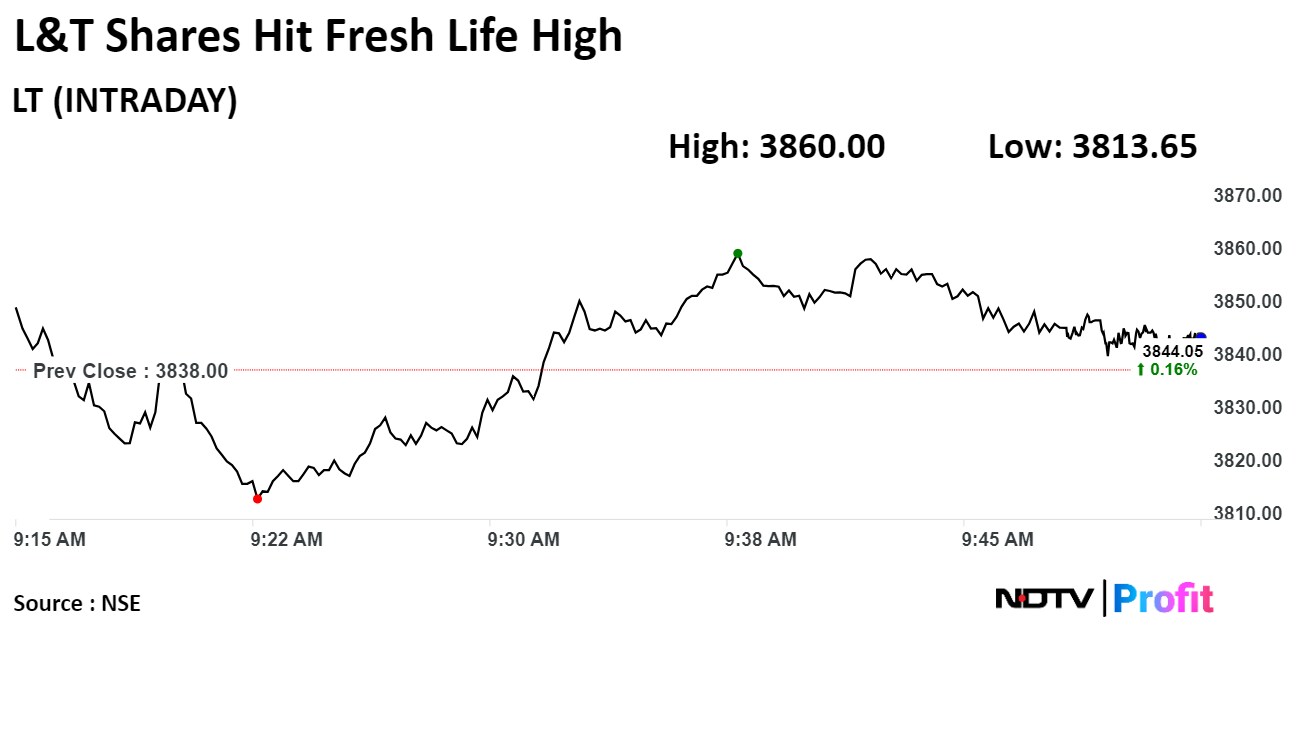

Shares of L&T rose as much as 0.57% to hit an all-time high of Rs 3,860 apiece on the NSE. It was trading 0.19% higher at Rs 3,845.4 apiece, compared to a 0.02% deline in the benchmark Nifty 50 as of 9:52 a.m.

The stock has risen 77.09% in the past 12 months. The relative strength index was at 70.

Thirty out of the 35 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.