Laurus Labs Ltd. shares declined over 3% on Friday, a day after the company reported strong second-quarter earnings. The decline comes despite the pharmaceutical firm posting a robust performance for the July–September period, with consolidated revenue rising 35.1% year-on-year to Rs 1,653.47 crore and net profit surging 883% to Rs 194.97 crore.

Laurus Labs is a research-driven pharmaceutical manufacturing organisation established in 2005. The company is involved in developing and manufacturing Active Pharmaceutical Ingredients (APIs) and Intermediates. The company says its position was strengthened by their backward-integration capability while remaining highly regulatory compliant across all operations.

Laurus Labs Q2 Highlights (Cons, YoY)

Revenue up 35.1% to Rs 1,653.47 crore versus Rs 1,223.70 crore.

Net Profit up 883% to Rs 194.97 crore versus Rs 19.84 crore.

Ebitda up 126% to Rs 403.26 crore versus Rs 178.33 crore.

Margin at 24.4% versus 14.6%.

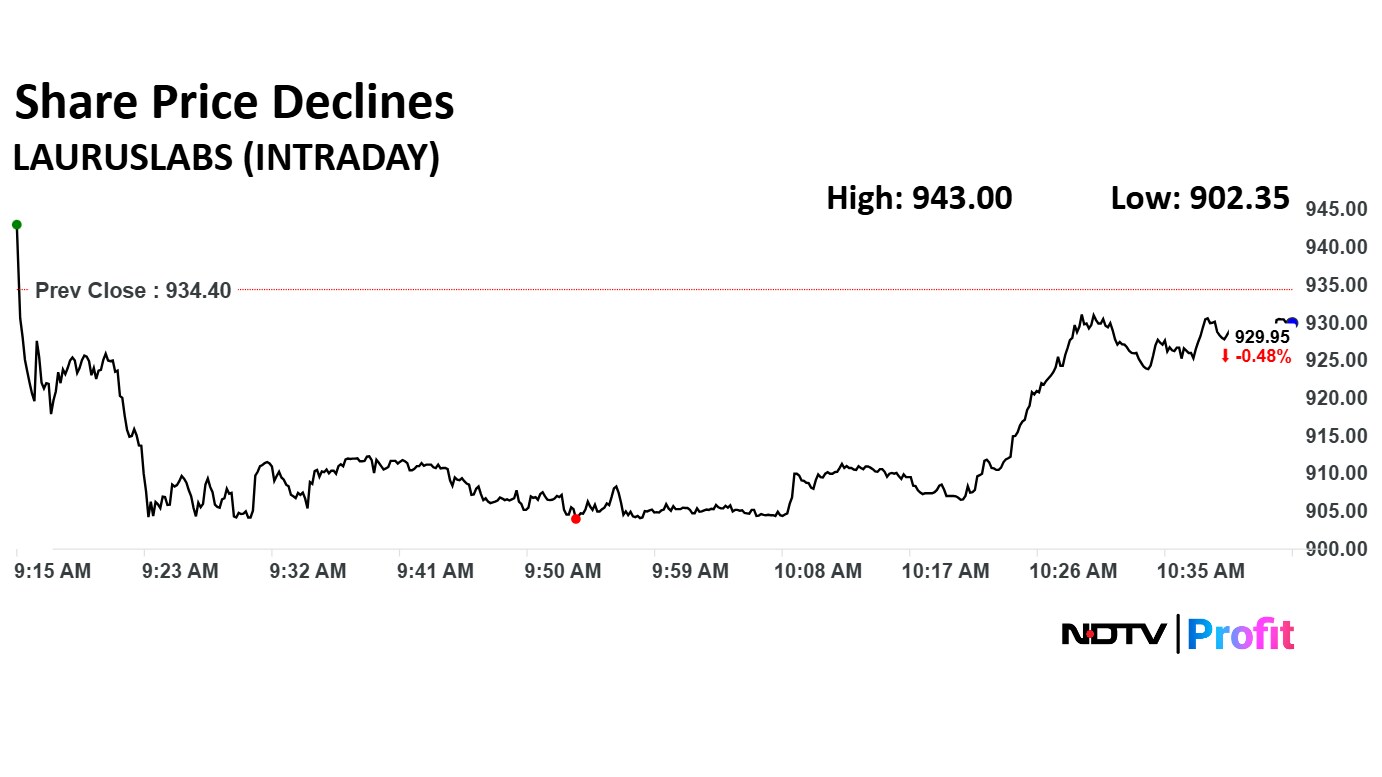

The scrip fell as much as 3.43% to Rs 902.35 apiece. It pared losses to trade 0.88% lower at Rs 926.20 apiece, as of 10:30 a.m. This compares to a 0.27% decline in the NSE Nifty 50 Index.

It has risen 107.98% in the last 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 71.

Out of 17 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.