JPMorgan has reiterated its Overweight stance on India's pipe makers despite near-term PVC price risks, citing favorable risk-reward after recent corrections and strong market share gains.

The brokerage cut its target price on Astral Ltd. to Rs 1,700 from Rs 1,800 and on Supreme Industries Ltd. to Rs 4,200 from Rs 4,760, while continuing to prefer Astra, expecting industry demand recovery in the second half and pricing support.

JPMorgan On India Pipes

Astral: Maintain Overweight; Cut target price to Rs 1,700 from Rs 1,800

Supreme Industries: Maintain Overweight; Cut target price to Rs 4,200 from Rs 4,760

PVC risk impacting stocks

Risk/reward favorable post recent correction

See sustained market share gains, industry demand recovering in H2, and some pricing support

Market share gains have surprised to the upside

Continue to prefer Astral over Supreme

Astral started operations in 1998 with manufacturing polymer piping systems for domestic and industrial applications. The company is known for introducing CPVC piping for the first time in India, as mentioned on its website.

Astral introduced a wide range of products in the Pipes category and further expanded within the Building Materials industry.

Meanwhile, the Supreme Industries was founded in 1942. The company produces a wide range of products including plastic piping systems, moulded furniture, protective and performance packaging, and industrial moulded components

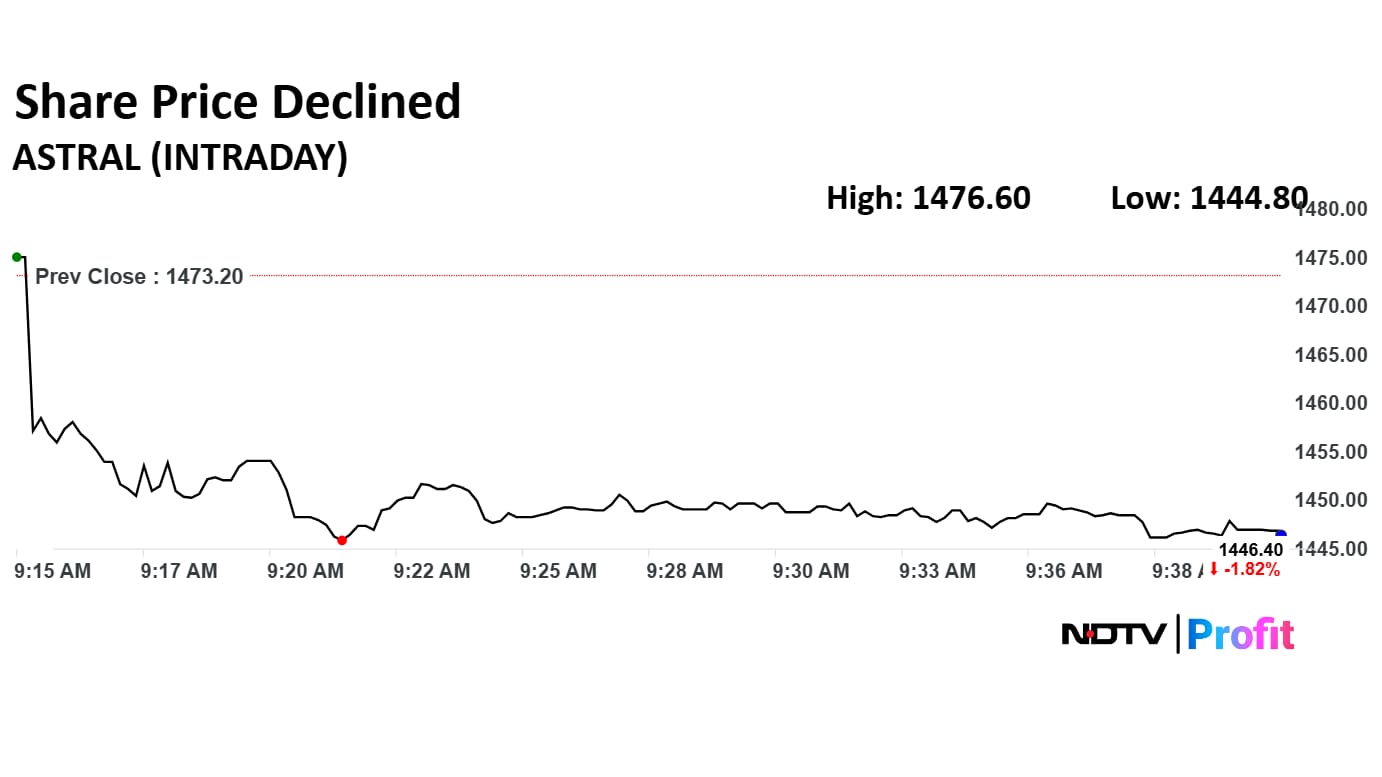

The scrip fell as much as 1.93% to Rs 1,444 apiece. It pared losses to trade 1.75% lower at Rs 1,447 apiece, as of 09:40 a.m. This compares to a flat NSE Nifty 50 Index.

It has declined 12.31% in the last 12 months. Total traded volume so far in the day stood at 0.14 times its 30-day average. The relative strength index was at 63.31.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.