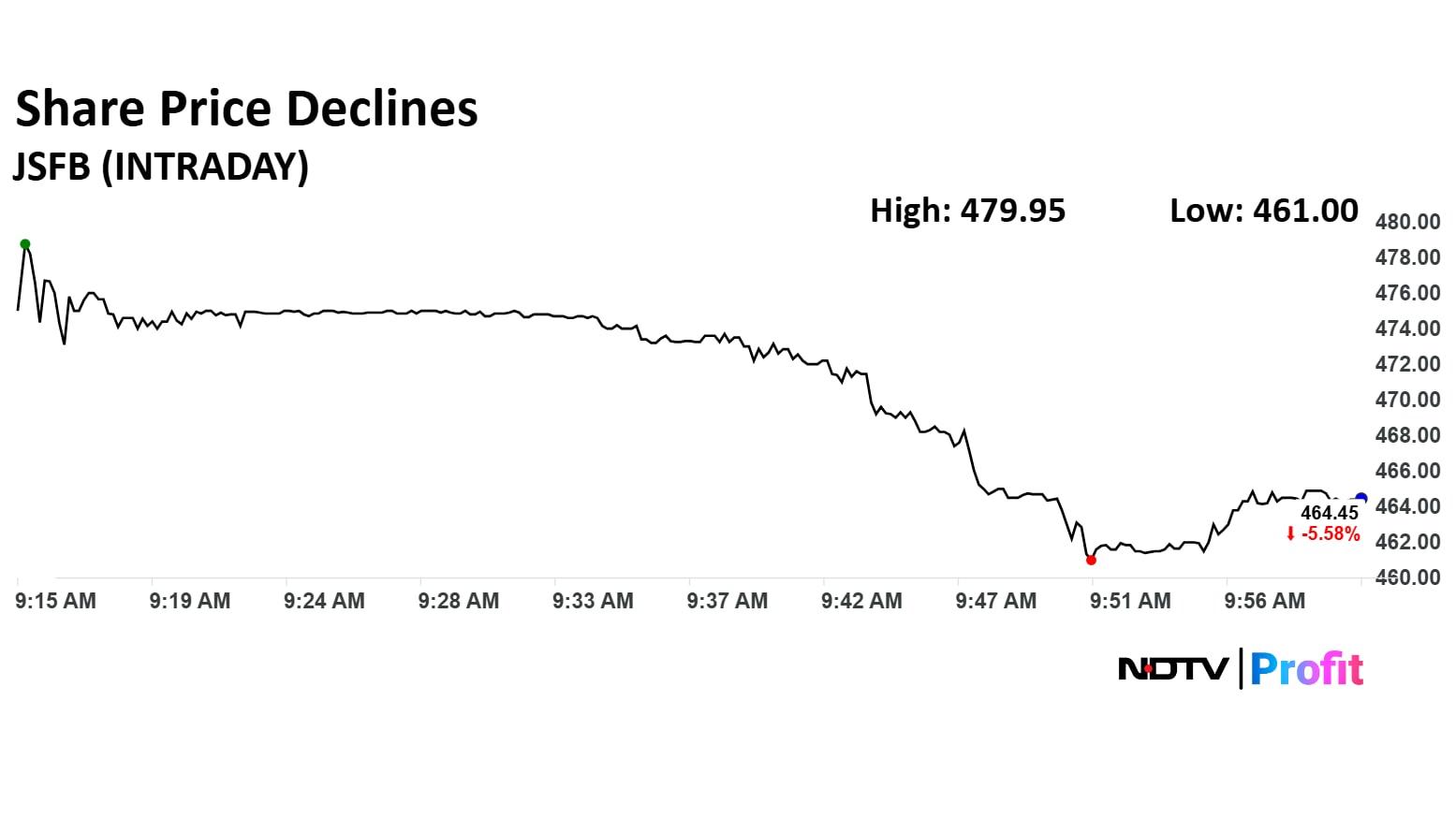

Shares of Jana Small Finance Bank fell by over 6.28% on Wednesday, reacting sharply to the lender's weaker-than-expected earnings for the first quarter of FY26.

The Bengaluru-based bank reported a net profit of Rs 101.9 crore for the April–June period, down 40.2% from Rs 170.5 crore in the same quarter last year. The decline was largely attributed to higher operating costs and a less favourable revenue mix, according to the company's disclosures. Net interest income (NII), a key measure of a bank's core earnings, also dipped 2.4% year-on-year to Rs 595 crore.

Asset quality showed mild deterioration, with gross non-performing assets (NPAs) rising to 2.91% from 2.71% in the previous quarter. Net NPAs, however, remained flat at 0.94%, indicating some stability in recoveries and provisioning.

Jana Small Finance Bank, which began operations in 2018 after transitioning from a microfinance institution, focuses on serving underserved and financially excluded segments across India.

It operates a network of branches and digital channels, offering retail banking, MSME lending, and financial inclusion products. The bank has steadily expanded its footprint, but continues to face challenges typical of small finance banks, including cost pressures and asset quality volatility.

The scrip fell as much as 6.28% to Rs 461 apiece. It pared losses to trade 5.63% lower at Rs 464.20 apiece, as of 09:58 a.m. This compares to a 0.22% decline in the NSE Nifty 50 Index.

It has risen fallen 29.10% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 34.

Out of four analysts tracking the company, three maintain a 'buy' rating and one recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.