ITC Shares Plunge To Nearly Three-Year Low Amid Block Deal, Upcoming Tobacco Cess

A large trade was also recorded in ITC earlier in the day, with over 4 crore shares changing hands.

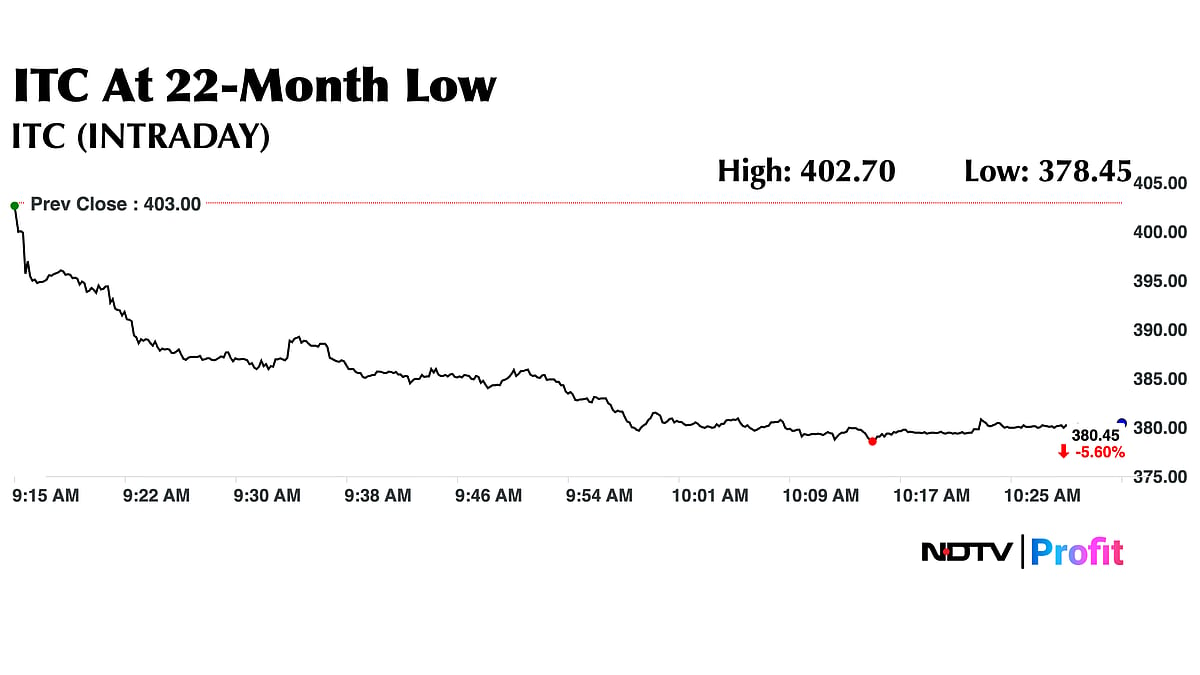

Shares of ITC Ltd. declined to their lowest level in nearly three years on Thursday after the government notified an increase in excise duty on cigarettes and other products, along with a block deal in the stock. The shares dropped over 6% in early trade.

The Finance Ministry notified the levy of 40% GST on tobacco, cigarettes and bidis, effective February 1, 2026. This comprises a 28% tax, along with the subsuming of excise and NCCD.

Key clarity awaited is whether any additional cess or duty has been imposed and what the overall tax incidence will be after implementation.

A large trade was also recorded in ITC earlier in the day, with over 4 crore shares changing hands. The number of shares traded amounted to 0.3% of the company’s outstanding equity.

The shares were exchanged at an average price of Rs 400 per share, taking the total deal value to Rs 1,614.5 crore.

In the September quarter, ITC’s cigarette business accounted for 48% of its overall revenue. Revenue from the cigarette segment rose 6.7% year-on-year to Rs 8,722 crore, while volumes increased 6%.

ITC Share Price Today

The scrip fell as much as 6.09% to Rs 378.45 apiece, paring losses to trade 5.63% lower at Rs 380.30 apiece, as of 10:34 a.m. This compares to a 0.14% advance in the NSE Nifty 50 Index.

It has fallen 21.45% in the last 12 months. Total traded volume so far in the day stood at 9.4 times its 30-day average. The relative strength index was at 56.83.

Out of 38 analysts tracking the company, 36 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 30.4%.