Shares of Indian Renewable Energy Development Agency Ltd. fell over 7% on Friday, as the stock entered the Futures & Options segment with the start of the March series. This decline comes as investors adjust to the new trading dynamics introduced by the stock's inclusion in the F&O segment.

IREDA, a government-owned financial institution dedicated to promoting renewable energy projects, has been a key player in financing green energy initiatives across India. The company's entry into the F&O segment allows investors to trade in futures and options contracts based on IREDA's stock. This inclusion is expected to enhance liquidity and provide more trading opportunities for investors.

The F&O segment allows traders to hedge their positions and speculate on the future price movements of stocks. It includes contracts that obligate the buyer to purchase, or the seller to sell, the underlying asset at a predetermined price on a specified date. This can lead to increased volatility as traders react to market expectations and news.

Alongside IREDA, four other stocks—Tata Technologies Ltd., IIFL Finance Ltd., Patanjali Foods Ltd., and Titagarh Rail Systems Ltd.—also began trading with F&O contracts at the start of the March series.

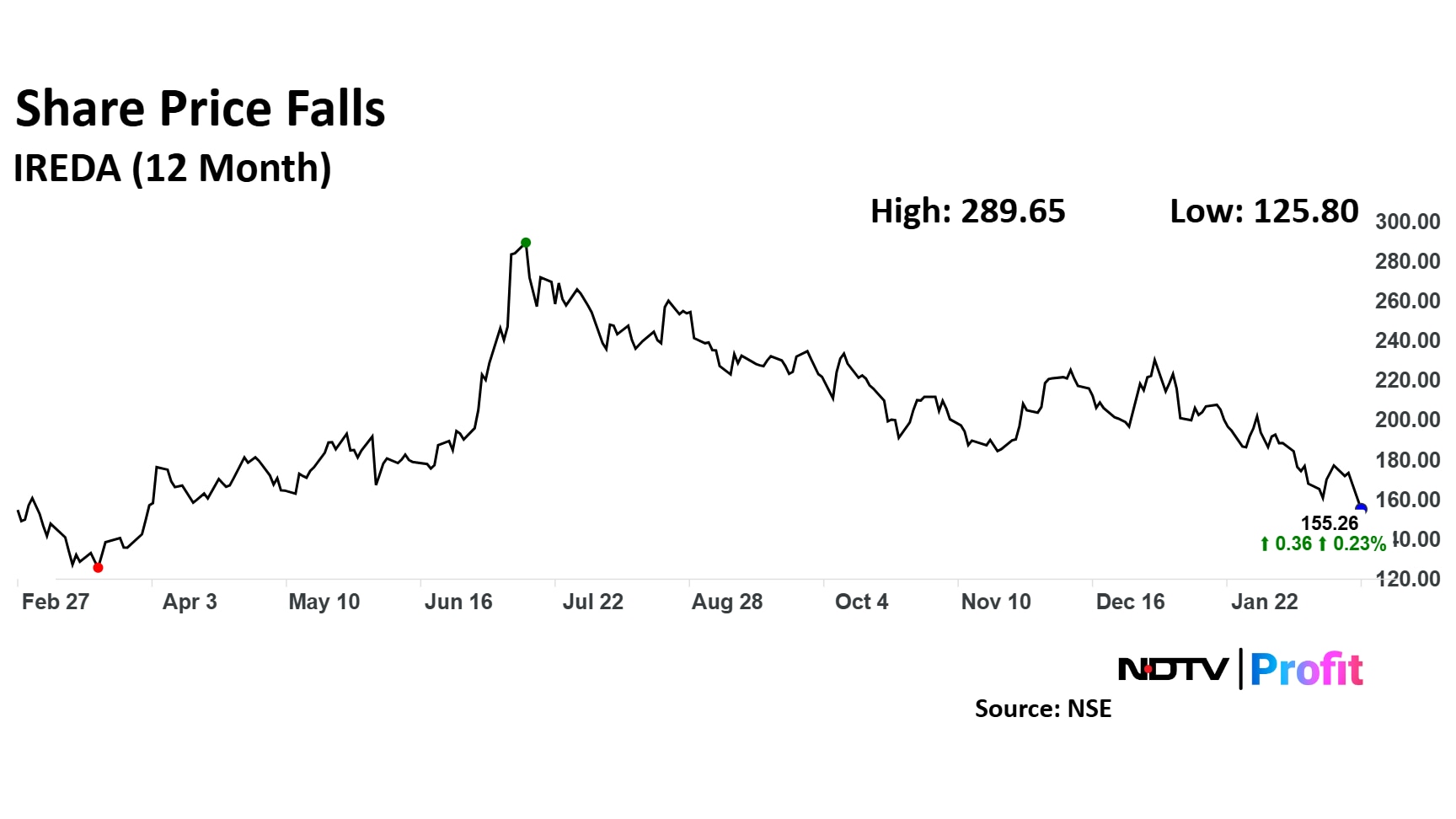

Ireda Share Price

The scrip fell as much as 7.54% to Rs 153.96 apiece. It pared losses to trade 6.04% lower at Rs 156.45 apiece, as of 11:29 a.m. This compares to a 1.20% decline in the NSE Nifty 50.

It has risen 18.65% in the last 12 months. Total traded volume so far in the day stood at 1.85 times its 30-day average. The relative strength index was at 39.

Out of two analysts tracking the company, one maintains a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.