- Infosys received SEC exemptive relief for its Rs 18,000 crore buyback plan

- The buyback price is Rs 1,800 per share, a 19.28% premium to last close

- Shareholders must approve the buyback via special resolution and postal ballot

Infosys Ltd. has received exemptive relief from the US Securities and Exchange Commission for its 18,000-crore buyback, according to its notification to the exchanges. The company announced its first share buyback in three years, since October 2022.

Now, the buyback is awaiting approval from existing shareholders via a special resolution and postal ballot.

This marks the fifth time the IT giant is repurchasing its shares. The decision came amid macroeconomic volatility weighing on stock price.

The price for the share buyback is set at Rs 1,800 per share, which represents a premium of 19.28% from its last closing price on the BSE

The share repurchase process may take three to four months to complete, based on historical data. The stock has over 25.79 lakh owners.

According to NDTV Profit calculations, Infosys spends an average of 30% of its cash on buybacks. It buys back 14-15% of net worth. Its first-quarter cash and cash equivalents are at Rs 45,200 crore, while its net worth is at Rs 95,350 crore.

The current buyback is a part of the capital return policy Infosys announced in 2024 of returning 85% of free cash flow over five years through dividends and repurchases.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

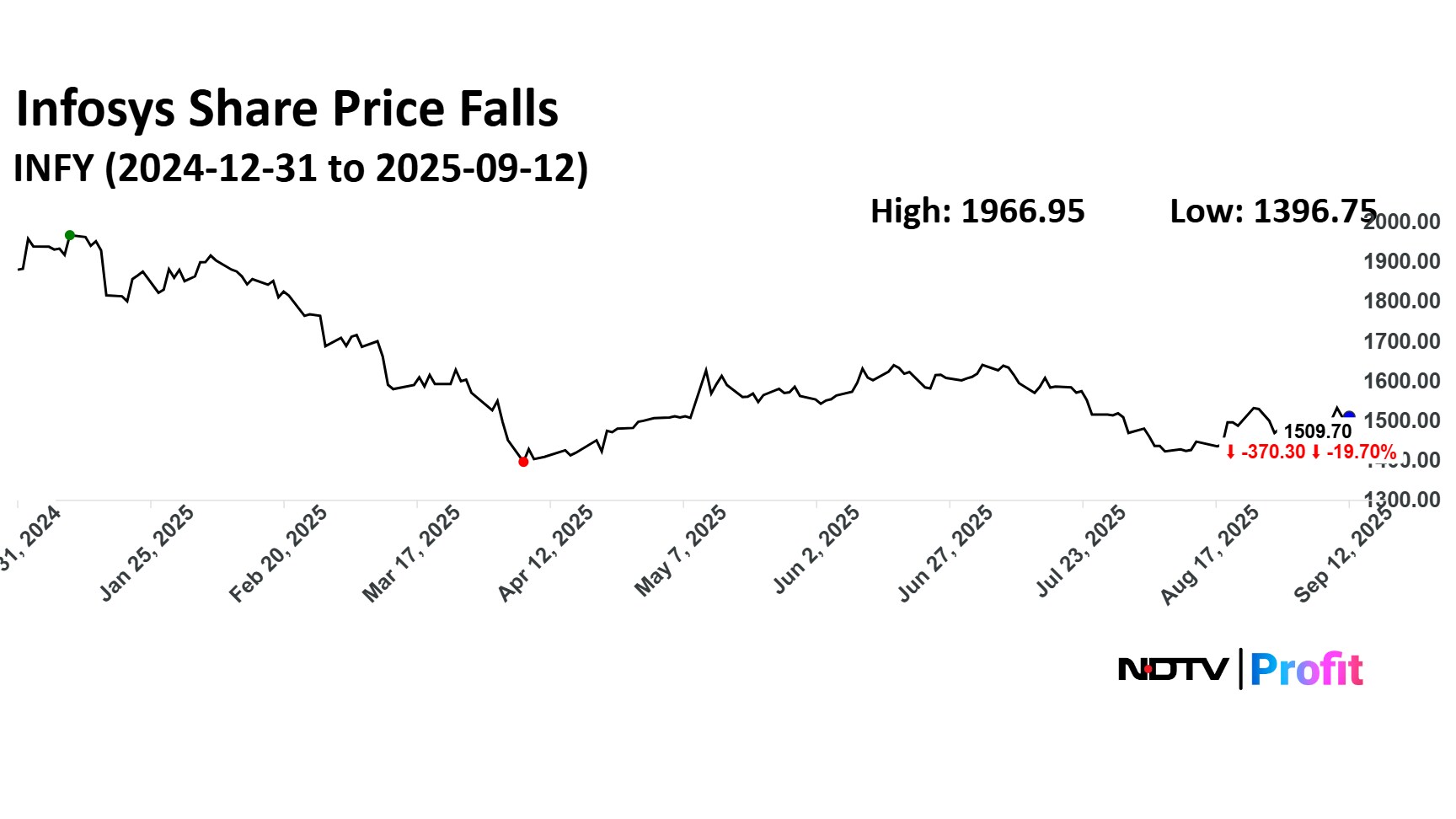

Infosys share price has lost 19.70% of its value on a year-to-date basis. It ended 1.33% down at Rs 1,512 apiece on Thursday. The stock is the fourth worst performer in the NSE Nifty IT index.

IT stocks have come under pressure because of the worsening global macroeconomic situation due to tariff tensions. On a year-to-date basis, the NSE Nifty IT is the worst-performing sector. The index has slumped 16.92%.

Infosys has underperformed most large-cap peers over the past six months. Now with the potential buyback, the stock will likely find support, given the inexpensive valuation, Morgan Stanley said.

Infosys share price may rise relative to the country index over the next 60 days, the brokerage said. The buyback also signals stability and reiteration of its annual revenue and margin guidance in coming results. Morgan Stanley remained equal weight on the stock.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.