The shares of IndusInd Bank Ltd. rose on Monday snapping its two-day declining streak.

This comes after the bank said that it is examining the findings of an audit report by Grant Thornton which hints at likely insider trading.

Clarifying media reports, the lender said the audit report delivered on April 26 identified certain aspects, which may require a determination from an "insider trading perspective."

"The bank is examining these findings in the report and based on the outcome of such examination, the bank will take the necessary steps under applicable law (including the bank's Insider Trading Code)," the bank said in a stock exchange filing.

The Grant Thornton report identifies that the incorrect accounting of internal derivative trades, particularly in cases of early termination, led to the recording of notional profits, which is cited as the principal root cause for the accounting discrepancy according to IndusInd's public disclosure last month.

The report also examined the roles and actions of key employees in this context.

The board is taking the necessary steps to fix accountability for the persons responsible for these lapses and realign the roles and responsibilities of senior management, the bank said.

The derivatives trouble has led to exits in the top management following the Grant Thornton report. Other employees of the private lender are also likely to come under scrutiny, three persons aware of the matter told NDTV Profit.

IndusInd Bank Share Price Decline

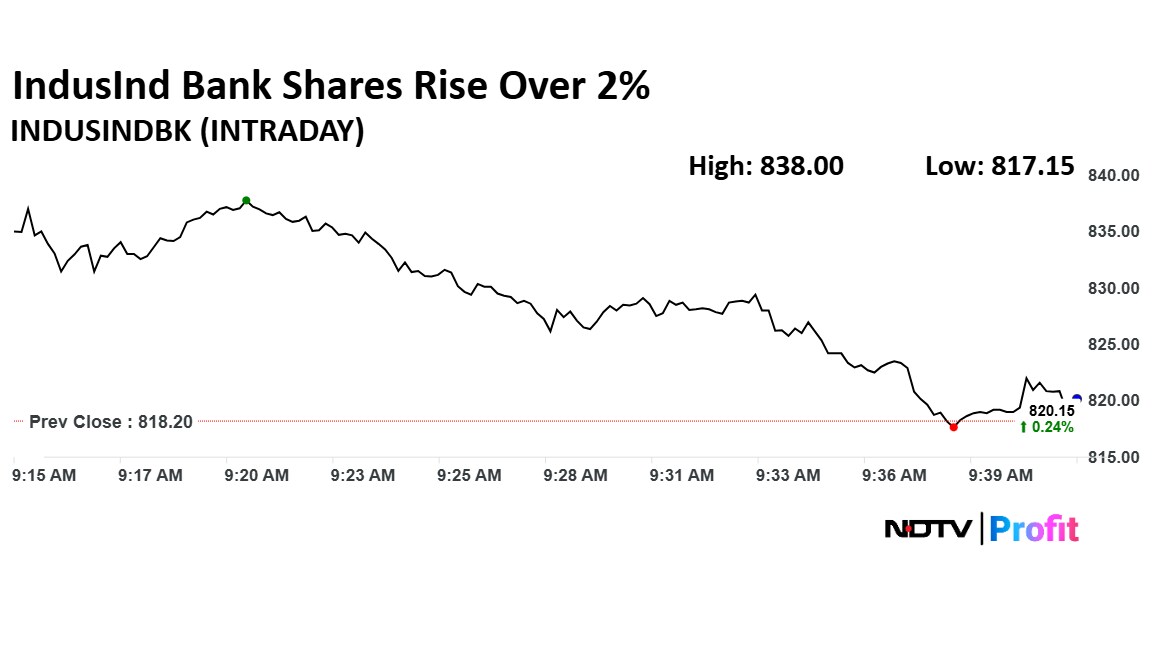

The shares of IndusInd Bank rose as much as 2.42% to Rs 838 apiece, the highest level since May 5. It pared gains to trade 1.02% higher at Rs 826.55 apiece, as of 9:41 a.m. This compares to a 2.53% advance in the NSE Nifty 50 Index.

It has risen 41.01% in the last 12 months and 14.72% year-to-date. Total traded volume so far in the day stood at 13.06 times its 30-day average. The relative strength index was at 42.

Out of 34 analysts tracking the company, 18 maintain a 'buy' rating, 18 recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.