IndusInd Bank Ltd.'s share price traded higher on Wednesday after falling for five days. The counter crashed 27% on Tuesday to the lowest since November 2020. This was after the lender announced it had identified accounting discrepancies in its derivatives portfolio during an internal review in October 2024.

The bank has appointed an external agency to review and validate its internal findings independently on the derivatives portfolio. The disclosure followed the Reserve Bank of India's September 2023 guidelines on bond investment categorisation and valuation.

The discrepancy could have a 2.35% impact on IndusInd Bank's net worth. This translates to a Rs 1,500-2,000 crore hit.

Further, the financial year 2024 annual report of IndusInd Bank on NSE suggests that the chief executive officer sold 80% of holding near the peak.

Sumant Kathpalia held up to 35,000 shares at the start of financial year 2024. About 1.98 lakh shares were vested as ESOPs. Further 1,85,991 shares were sold at an average price of Rs 1,524 per share. Kathpalia currently holds up to 48,000 shares.

Executive Director Arun Khurana also sold 2.14 lakh shares at Rs 1,499 per share and currently holds up to 40,000 shares.

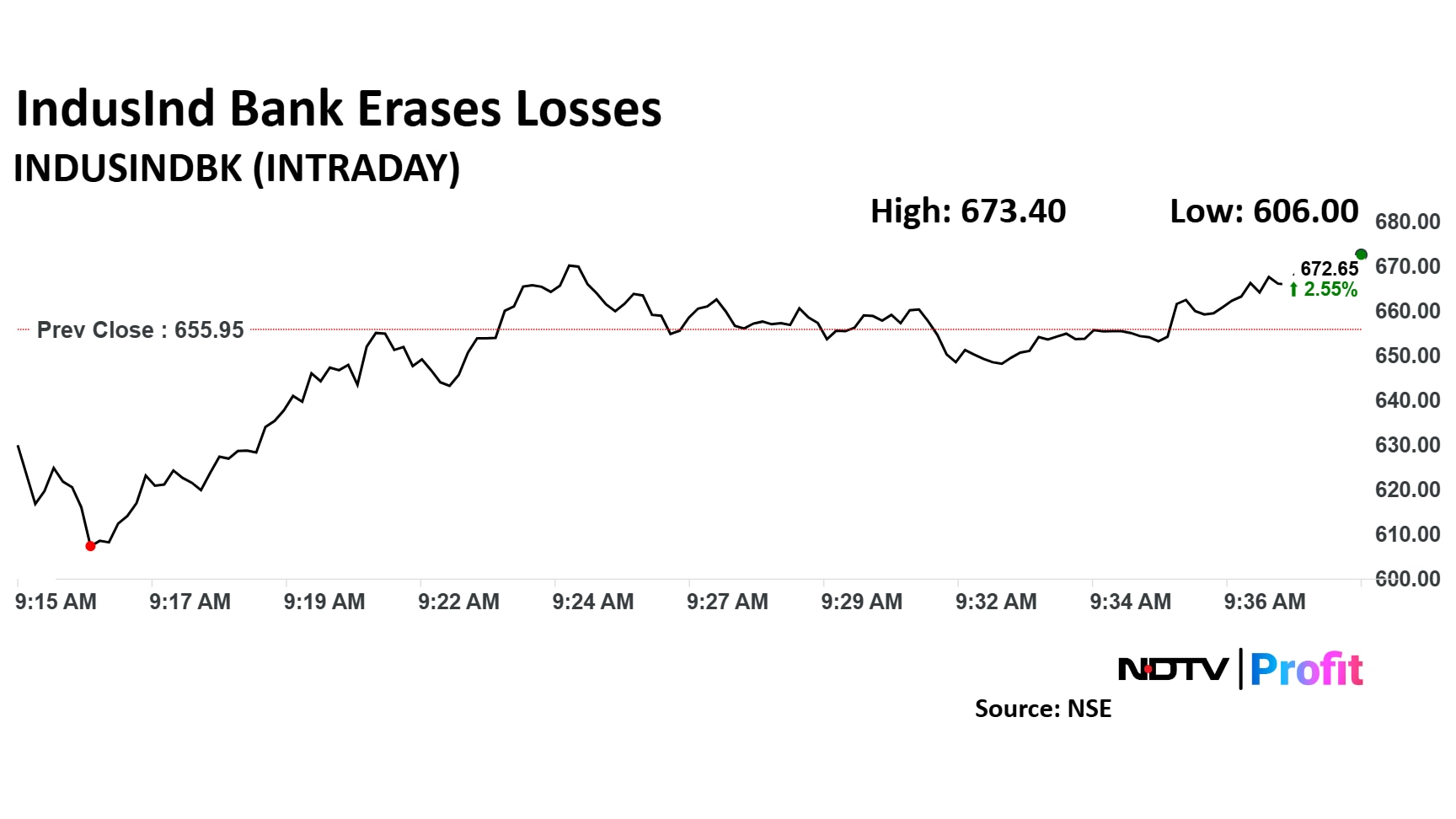

IndusInd Share Price

IndusInd Bank stock fell as much as 7.61% during early trade to Rs 606 apiece on the NSE. The stock then erased losses, trading 0.70% higher as of 9:31 a.m. It was trading 0.83% lower at Rs 650 apiece, compared to a 0.14% decline in the benchmark Nifty 50 as of 9:32 a.m.

The scrip has declined 58.01% in the last 12 months. The total traded volume so far in the day stood at 33 times its 30-day average. The relative strength index was at 13.03.

Of the 48 analysts tracking the lender, 20 have a 'buy' rating on the stock, 18 recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus target price on the stock is Rs 1,033.4, implying an upside of 62.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.