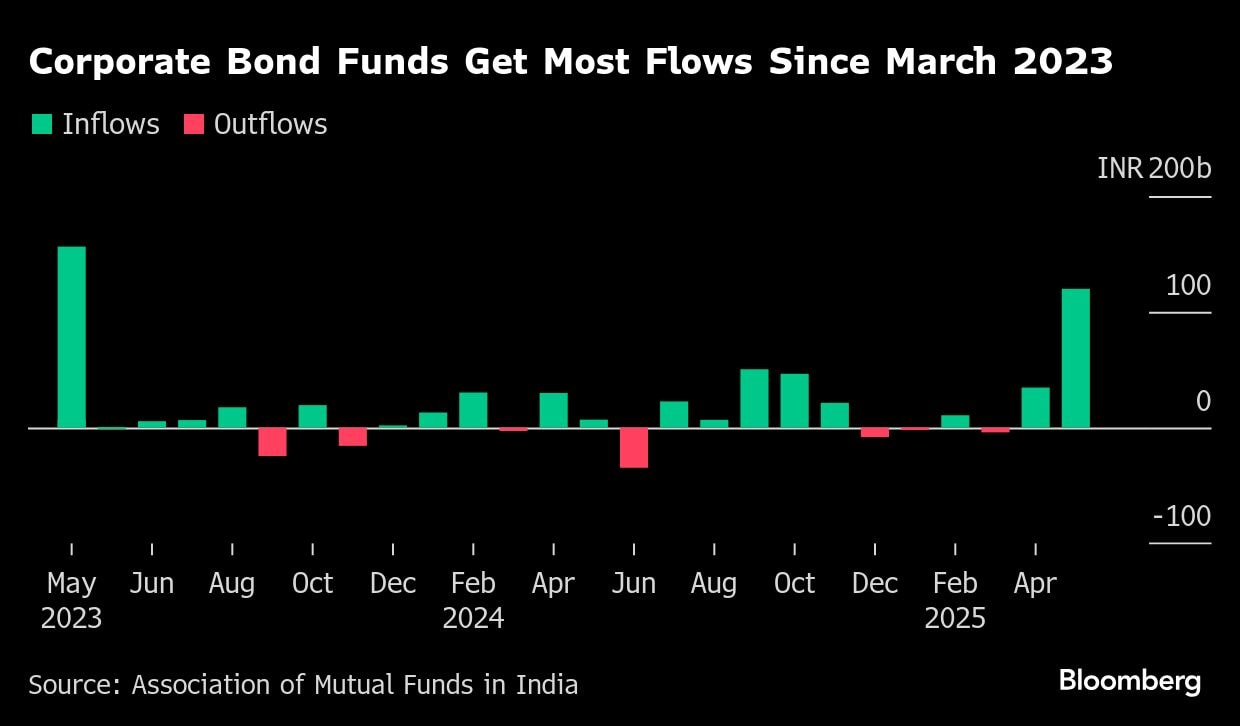

India's corporate bond funds received the highest inflows in over two years as aggressive cash injections by the central bank spurred investments by the nation's lenders.

These funds attracted a net 119.8 billion rupees ($1.4 billion) last month, the highest since March 2023, according to data from the Association of Mutual Funds in India. This marks the second straight month of inflows into funds that invest mainly in company debt rated AA+ and above.

“This inflow could be largely from banks, which may be parking their excess liquidity,” said Dhawal Dalal, chief investment officer for fixed income at Edelweiss Asset Management Ltd. “It may be a tactical call they may have taken and may remain invested for sometime. There is surplus liquidity available.”

Company bonds have emerged as one of the favored trades due to their attractive yields over government debt and shorter tenors. Their appeal intensified after the Reserve Bank of India's unexpected liquidity injection to support growth. The authority also shifted its stance to neutral, tempering expectations for further easing, making longer-duration debt less appealing.

“The inflows might continue but we see it more in shorter end than into longer duration bonds,” said Venkat N Chalasani, chief executive officer of AMFI.

Details on the AMFI data:

Inflows in equity funds stood at 190.1 billion rupees. That's the smallest in a year, and marks a 55% drop from the peak in October

Flows into hybrid funds, which invest in stocks and bonds, surpassed those into equity funds for first time in 13 months

Overnight and liquid funds saw withdrawals, while money market funds took in 112.2 billion rupees

Flows into monthly investment plans surged to a record 266.9 billion rupees, reflecting investors' sustained appetite for long-term investments

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.