Shares of Indian Hotels Co. hit a record high on Thursday following a stellar second quarter, optimistic management commentary, and brokerages from Morgan Stanley to Jefferies weighing in on the company.

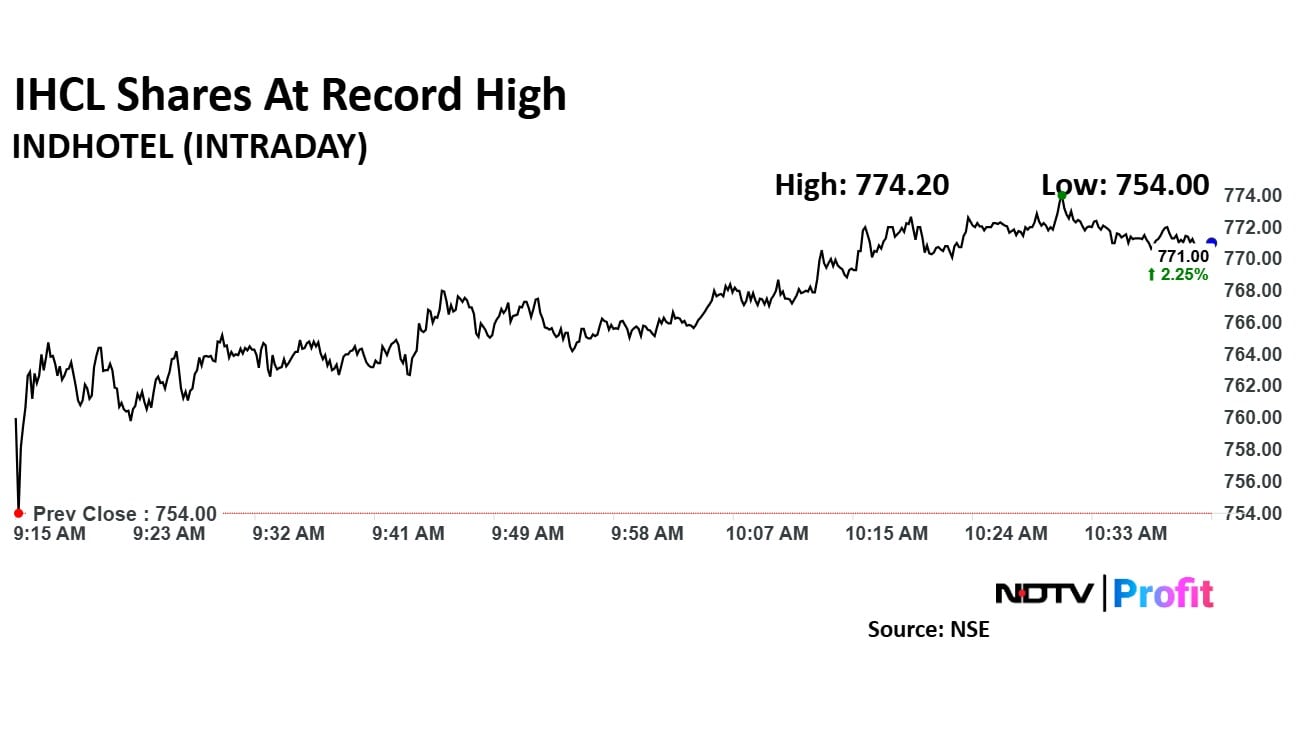

The stock rose as much as 2.68% during the day to Rs 774.20 apiece on the NSE.

Morgan Stanley shared a note on Wednesday maintaining an 'overweight' rating with a target price of Rs 759 per share, implying a 1% upside. As South Asia's most profitable hotel chain, it is 'raising the bar' by aiming for a 20% uptick in Return on Capital Employed by fiscal 2030, the brokerage said.

Although the management refrained from providing a margin target, an RoCE improvement implies margin expansion, said Morgan Stanley. It also noted that the Searock project in Mumbai is moving in a positive direction, and given the location, it would be a skyline defining property. The brokerage also expects new businesses (Qmin, Ama and Ginger) to grow at a 30% compound annual growth rate over fiscals 2023 to 2030.

The company is rapidly expanding its footprint, and is currently on track to open two hotels each month. It is planning to accelerate to 2.5 or even three hotels per month, said Managing Director and Chief Executive Officer, Puneet Chhatwal. With 120 hotels signed and in various stages of development, the company expects to add a total of 25 new properties this year, 30 in the next fiscal, and 36 in fiscal 2027, he told NDTV Profit in an exclusive.

IHCL Stock Price Today

The Indian Hotels Company's stock rose as much as 2.68% during the day to Rs 774.20 apiece on the NSE. It was trading 2.29% higher at Rs 771.25 apiece, compared to a 0.87% decline in the benchmark Nifty 50 as of 10:40 a.m.

It has risen 83.33% in the last 12 months and 75.9% on a year-to-date basis. The relative strength index was at 68.95.

Thirteen of the 28 analysts tracking the Taj hotel operator have a 'buy' rating on the stock, six recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.