The recently listed Hyundai Motor India Ltd. received an 'underperform' rating from Bank of America with a likely marginal downside. It cited muted earnings growth profile and lack of catalysts.

The slowing of the personal vehicles industry, pause in premiumisation theme, and capacity constraints have weighed on the listed Indian unit of Korea's Hyundai Motor Group, BofA said in a note on Dec. 5. "New model launch and market share gain capital missing for now. Risk Reward remains unfavourable."

BofA gave a target price of Rs 1,840 per share against the previous price of Rs 1,872.5 apiece, implying a downside of 1.7%.

The brokerage expects car maker's volume growth to be muted at a CAGR of 5% over fiscal 2024-27 given the "cyclical bump" that the PV industry seems to have hit, the note said. The auto maker is capacity constrained for another year which caps volume growth, it said.

Premiumisation as a theme will likely take a pause given demand weakness in metros and big cities, BofA said. Hyundai has been a proxy to premiumisation and ASP tailwind now seems in base, the brokerage said.

Hyundai Motor is a good franchise but the "risk-reward is unfavourable at current levels" and the relative preference within the sector is for stocks with rural mass segment exposure, it said. Upside risks to the ratings include strong industry demand, margin expansion and high dividends, BofA said.

After raising Rs 27,870 crore in its initial public offering—India's biggest so far—shares of the automaker debuted at a discount of 1.5%.

The maiden IPO of the India unit was subscribed 2.37 times, with bids led by qualified institutional buyers. The company had set a price band of Rs 1,865–1,960 per share for the IPO, which was a pure offer for sale of 14.2 crore shares.

However, the brokerage acknowledged Hyundai as a solid brand in India, being the second largest player with a 14.4% volume market share. Nimble strategy and superior understanding of evolving buyer needs, make Hyundai stand out in India, BofA said.

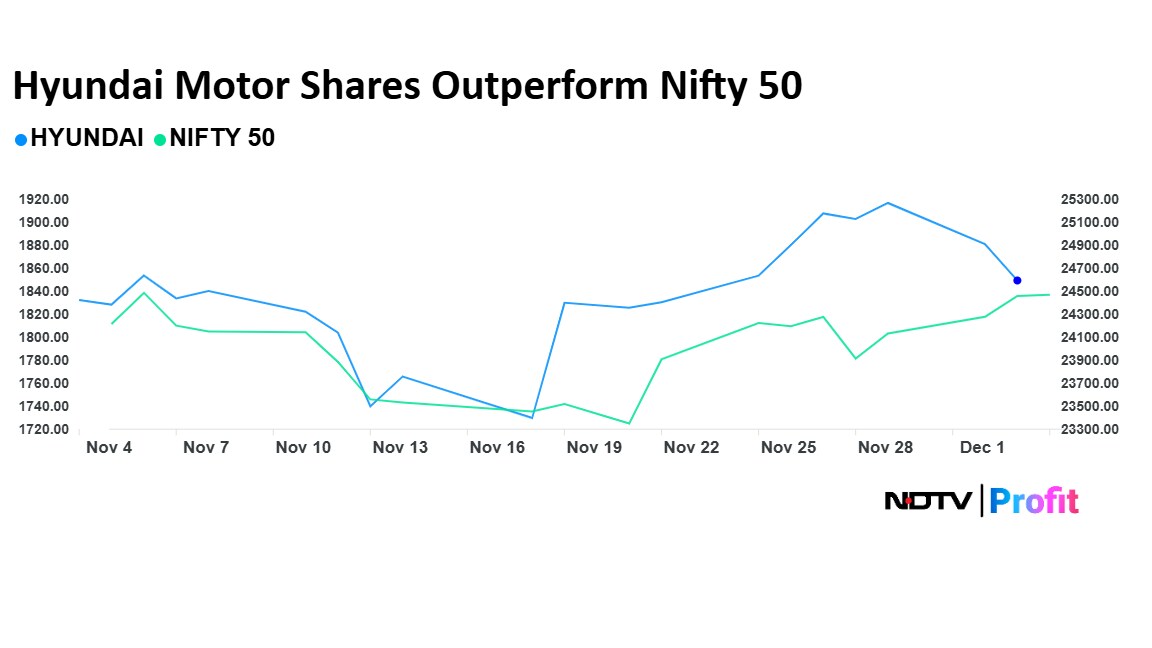

Since its listing on the street on Oct. 22, the stock has risen by 3.3% while the benchmark NSE Nifty 50 has fallen by 0.6% in the same period.

Of the 12 analysts tracking the automaker, nine have a 'buy' rating on the stock, and three have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 13.6 %.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)