- Hindustan Unilever shares fell nearly 5% after posting Q2 results impacted by trade destocking

- Brokerages like Jefferies and Citi maintained buy ratings and raised target prices for HUL

- Jefferies raised its target price to Rs 3,050, Citi to Rs 3,000 amid strategic volume growth focus

Hindustan Uniliever Ltd., shares declined as much as nearly 5% during trade so far. This comes after the company posted its second quarter results early Thursday.

The consensus among top brokerages remains largely positive on Hindustan Unilever Ltd., after the company posted its second quarter results yesterday. Names like Cti, Jefferies, and Goldman Sachs have maintained their 'buy' ratings, driven by the company's clear strategic focus on volume growth.

Jefferies leads with the highest target price hike to Rs 3,050, while Citi also raised its price target to Rs 3,000. Despite this, the market is factoring in short-term pain. Investec maintained a Hold with a marginally cut target price of Rs 2,610, and Morgan Stanley maintained an Equal-weight rating with a target of Rs 2,335, citing a slow recovery timeline.

The quarter two results were significantly impacted by a transitory trade destocking across the supply chain, as distributors held back purchases in anticipation of the Goods and Services Tax rate cuts. Management estimated this led to a substantial 200 basis points drag on growth.

Jefferies noted this Q2 impact, which is expected to continue into quarter three, will likely disappoint investors with a short-term orientation. Goldman Sachs, while maintaining Buy, cut its Earnings Per Share estimates to factor in a slower, more gradual recovery pace anticipated for the second half of the financial year.

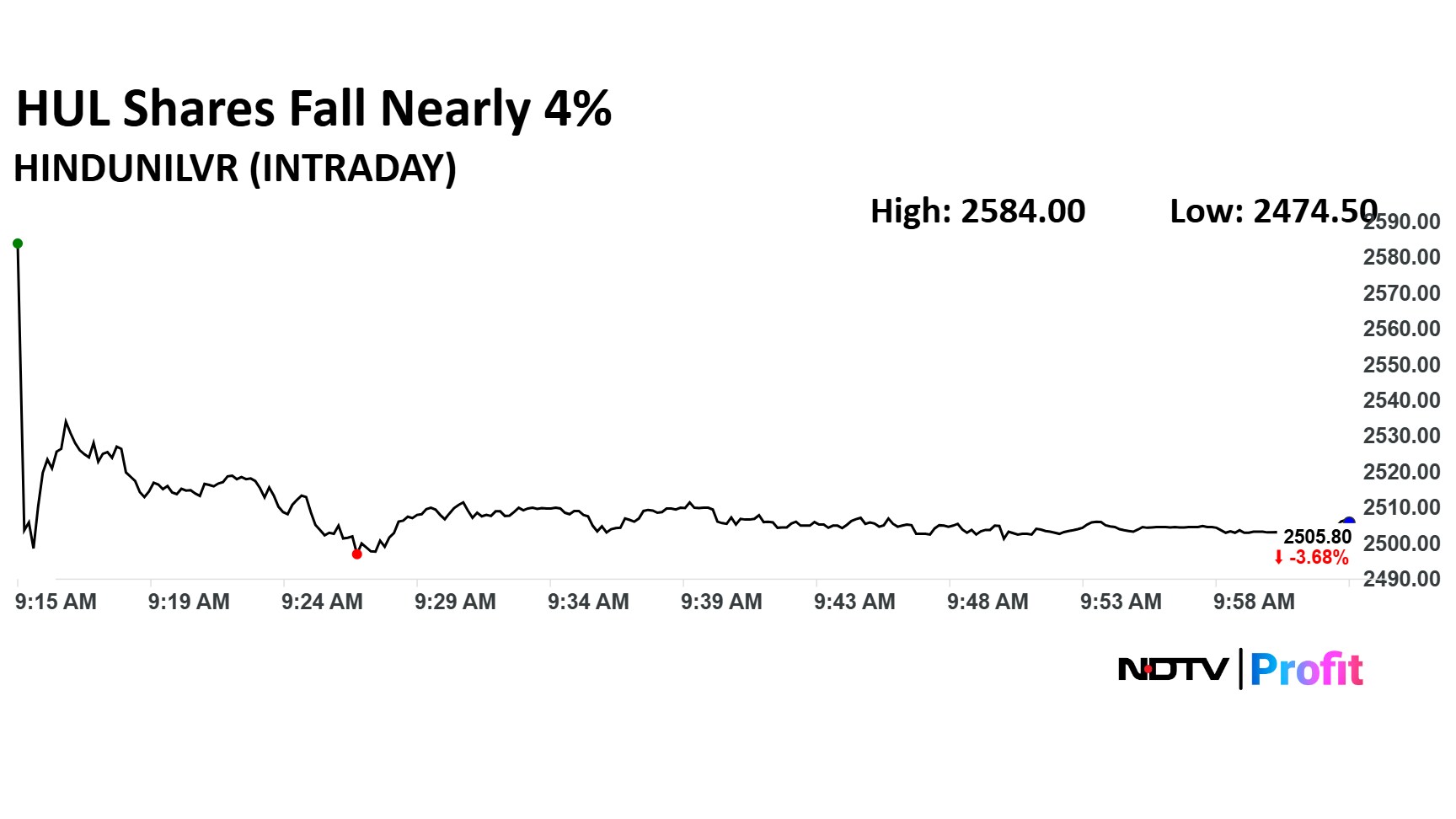

HUL Share Price

HUL stock fell as much as 4.89% during the day to Rs 2,474.5 apiece on the NSE. It was trading 3.66% lower at Rs 2,506.5 apiece, compared to an 0.01% advance in the benchmark Nifty 50 as of 10:04 a.m.

It has risen 0.14% in the last 12 months and 7.82% on a year-to-date basis. The relative strength index was at 56.10.

Thirty three out of the 44 analysts tracking the company have a 'buy' rating on the stock, nine recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,789.6, implying a upside of 11.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.