Shares of HCL Technologies Ltd. dropped over 9% in early trade on Tuesday, as the company's revenue guidance for the current fiscal disappointed. The company did manage an 8% rise in profit growth during the conventionally weak December quarter.

The IT major lifted its revenue growth guidance for the fiscal from 3.5–5.0% on-year to 4.5–5.0% in constant currency terms. To clarify, the revision in the lower band of the guidance factors in the 50-basis-point contribution to revenue from acquisition of Communications Technology Group assets from Hewlett Packard Enterprise acquisition.

HCLTech noted that the ask rate for the fourth quarter is (−)1.3% to +0.6% sequentially in constant currency for the services business. Hence, at mid-point, organic growth guidance at 4.25% is unchanged for this fiscal. In the March quarter, there is a planned ramp-down in a mega deal (to be visible in retail, CPG and telecom verticals) in the services business.

The company's software business (2% decline year-on-year in cc) performed below the company's expectation due to a delay in signing certain large deals and renewals.

The company also pointed to smaller deals replacing larger contracts, which may impact margins, and warned of the impact of currency volatility. Additionally, the disengagement of one of its top clients raised concerns about future growth prospects.

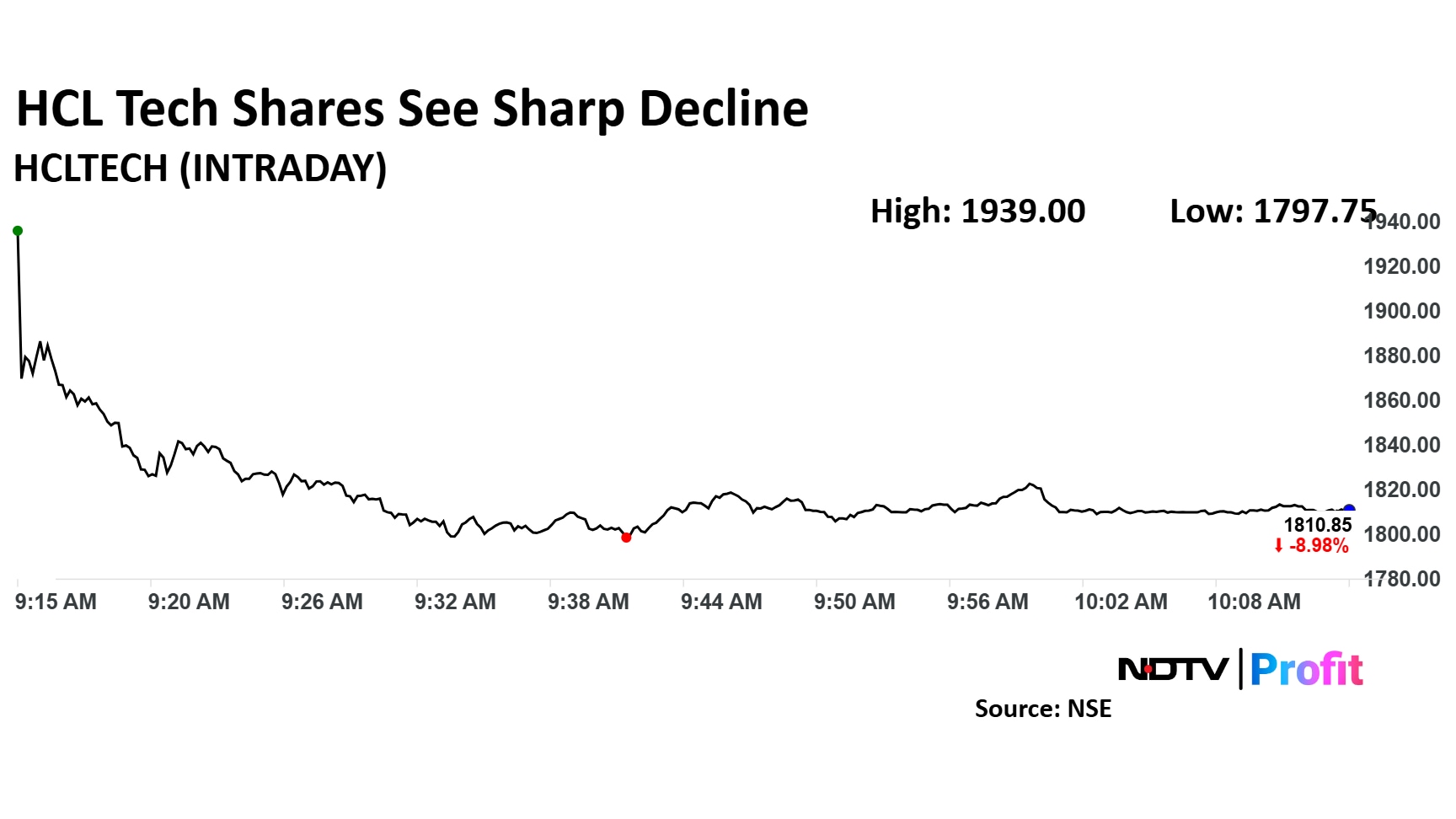

The scrip fell as much as 9.63% to Rs 1,797.75 apiece. It pared losses to trade 9.02% lower at Rs 1,810 apiece, as of 10:07 a.m. This compares to a 0.29% decline in the NSE Nifty 50 Index.

It has risen 13.97% in the last 12 months. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 36.

Out of 44 analysts tracking the company, 18 maintain a 'buy' rating, 16 recommend a 'hold,' and 10 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.