Garden Reach Shipbuilders & Engineers Ltd.'s share price was up over 4% during trade so far, after the company entered an agreement with Carsten Rehder Schiffsmakler Und Reederei GmbH & Co KG for the construction of hybrid multi-purpose vessels worth $62.4 million.

The stock has also being traded in high volumes as the stock is trading nearly 400 times higher than its 30-day average volume according to Bloomberg data.

Garden Reach Shipbuilders and Engineers' net profit surged more than 37% in the quarter ended June 30, 2025. The company's profit surged to Rs 120 crore in the first quarter of fiscal 2025-26 as compared to Rs 87.2 crore in the same period last year.

The company also reported a 29.7% uptick in its revenue to Rs 1,310 crore versus Rs 1,010 crore in the previous year. The Ebitda of the company also rose to 98.9% to Rs 112 crore, versus Rs 56.3 crore. The Ebitda margin also expanded to 8.5%, compared to 5.6% in the previous year.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

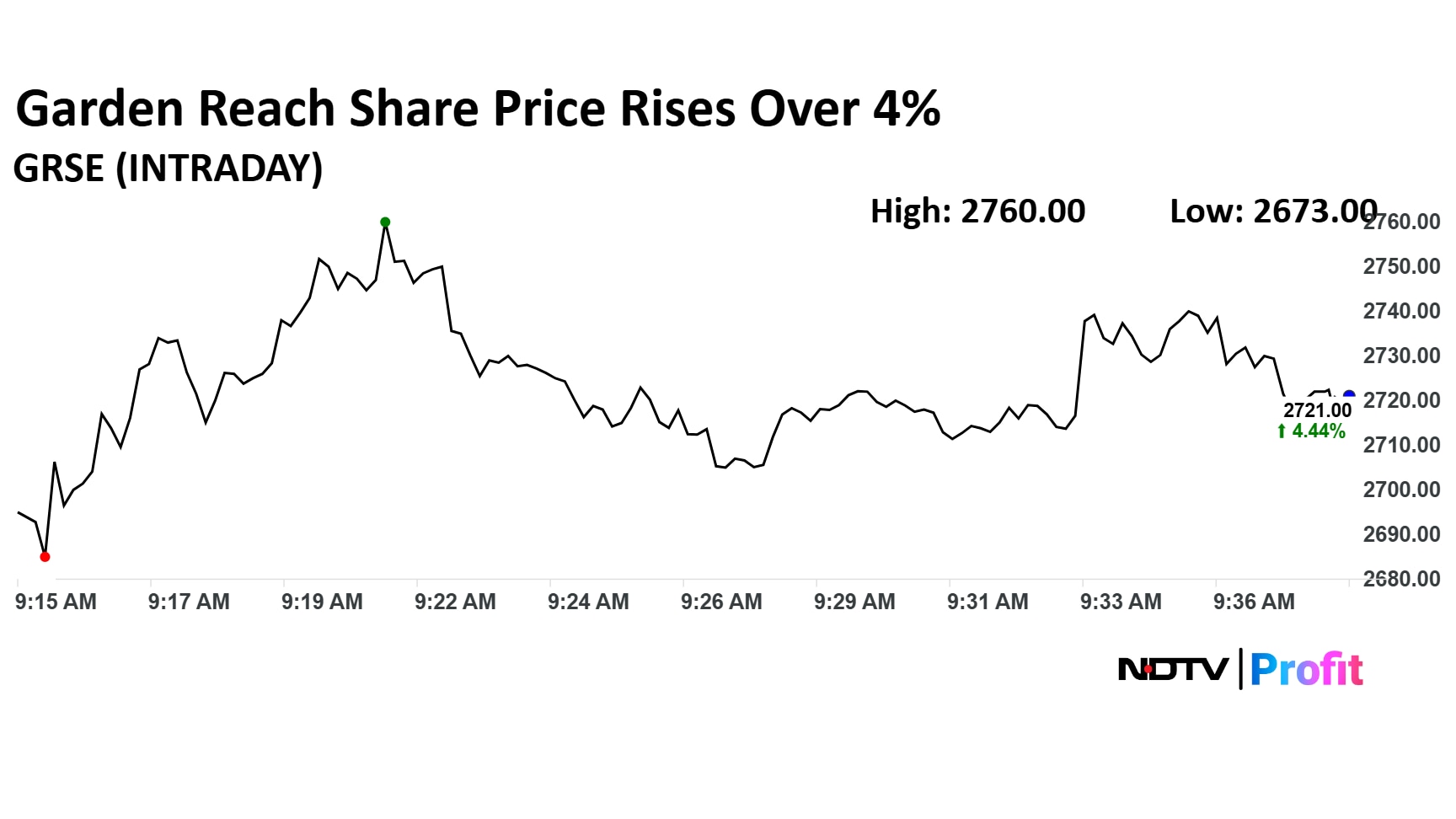

GRSE Share Price

Garden Reach stock rose as much as 5.94% during the day to Rs 2,760 apiece on the NSE. It was trading 4.44% higher at Rs 2,720 apiece, compared to an 0.04% decline in the benchmark Nifty 50 as of 9:43 a.m.

It has risen 46.05% in the last 12 months and 68.15% on a year-to-date basis. The total traded volume so far in the day stood at 396 times its 30-day average. The relative strength index was at 63.28.

Three out of the six analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,933.8, implying a upside of 7.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.