Gold Vs Silver: The yellow metal reversed course to rise in the previous session after the US Federal Reserve's interest rate cut, though uncertainty over next year's policy outlook persisted, while silver hit an all-time peak. Lower interest rates raise the appeal of non-yielding assets to investors.

The initial market reaction to the widely expected interest rate cut was negative, reflecting a lack of consensus about the decision and a lack of clear guidance for next year. The US Fed had also announced a bond-buying programme to smooth stains in the money markets, which provided a boost to gold and silver, according to analysts at Julius Baer.

"With bullion already at record highs, the policy shift adds momentum to the rally, as investors seek safe-haven assets amid economic uncertainty and inflationary pressures," said Hareesh V, Head of Commodity Research, Geojit Investments Ltd.

US Fed's final policy decision for 2025

The US Fed cut interest rates by a quarter of a percentage point in yet another divided vote, but signalled a pause on further easing as officials look ahead to assess the direction of the job market and inflation that still "remains somewhat elevated." Projections issued after the two-day meeting showed most policymakers see just one rate cut in 2026.

US Fed Chair Jerome Powell offered no indication of when another cut might occur. However, Powell said the central bank rate policy is well positioned to respond to what lies ahead for the economy. US President Donald Trump said that the Fed's rate cut could have been larger.

Gold Vs Silver prices after US Fed's rate cut verdict

Spot gold rose 0.7% at $4,236.57 per ounce. US gold futures for February delivery settled 0.3% lower at $4,224.70. Spot silver rose to a record peak of $61.85 on Wednesday, Dec. 10. The white metal's prices have surged 113% so far this year, supported by rising industrial demand, declining inventories, and its designation as a critical mineral by the US.

However, on Thursday spot silver rose 0.6% to $62.16 per ounce, after hitting a record high of $62.88 earlier in the session, bringing its year-to-date gain to 115%. Gold edged lower today as traders weighed the US Fed's divided vote on the rate cut. Spot gold fell 0.3% to $4,216.49 per ounce.

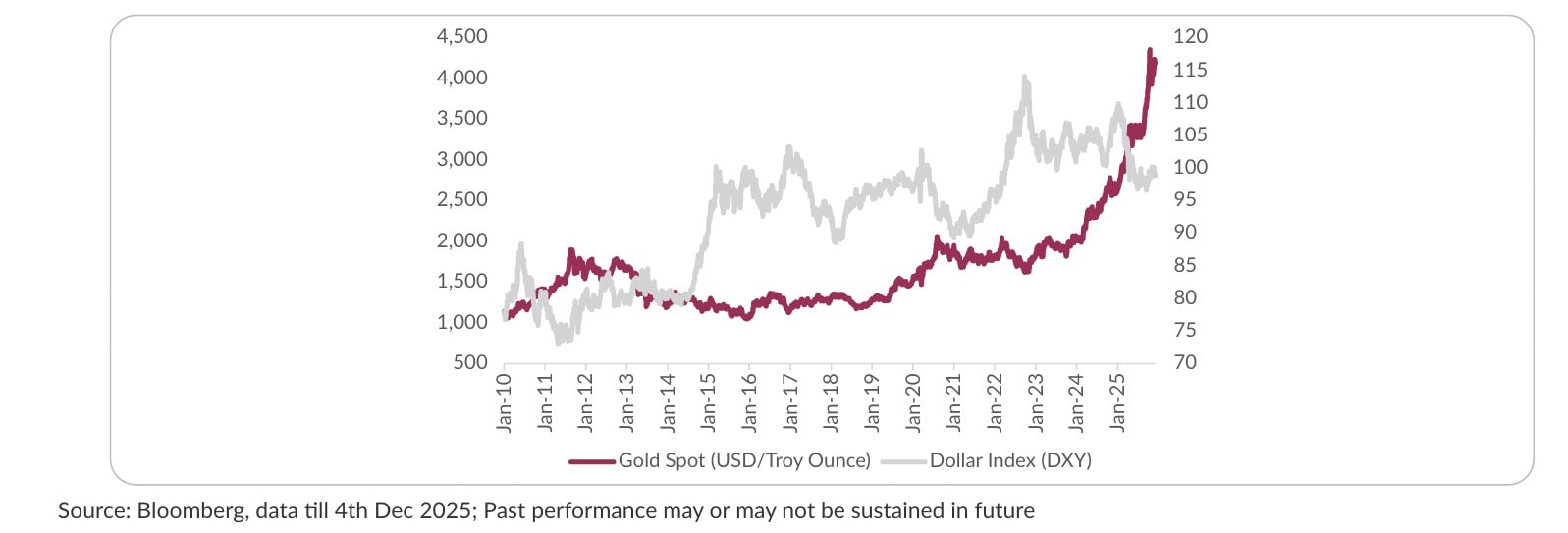

"The post-cut weakening of the US dollar further supports gold and silver prices, as a softer greenback makes these metals more affordable for global buyers," added Hareesh V of Geojit Investments. Analysts believe precious metals shine when real returns on cash drop.

Gold Vs Silver: What should you bet on?

Silver's reaction to the US Fed's announcement was outsized, increasing its outperformance over gold since the resumption of the rally in early November to more than 20 percentage points. Considering a fairly similar fundamental backdrop for both gold and silver, analysts at Julius Baer believe that such a stark outperformance is not fully justified.

"Rather than fundamentals, we believe this reflects the momentum of speculative traders and trend followers in silver, which is reflected in our technical assessment," said said Carsten Menke, Head Next Generation Research, Julius Baer.

"While short-term risks are skewed to the upside because of the market momentum, our view is that prices have moved too fast. We therefore, remain Neutral. We reiterate our 'Constructive' view on gold, supported by the ongoing strength of investment demand and central-bank buying," said Menke.

According to Hareesh V of Geojit, the sharp rally in bullion is underpinned by structural supply deficits, industrial demand for silver, and sustained ETF inflows. "Technical breakouts above long-standing resistance levels have amplified buying interest, while geopolitical risks and inflation hedging continue to fuel long-term bullish outlooks despite short-term volatility."

A softer USD, combined with lower interest rates, supports gold and silver by reducing the opportunity cost of holding non-yielding assets. According to Ross Maxwell, Global Strategy Operations Lead, VT Markets, investors tend to look toward safe-haven assets, strengthening demand for precious metals. "Silver benefits from this dynamic as well, though its industrial exposure adds an additional layer of volatility and upside potential."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.