- Brent crude traded above $68 per barrel after a 1% gain in the previous session

- OPEC+ will meet this weekend to decide October oil output, with uncertain outcomes

- US targets India over Russian oil imports amid Ukraine conflict, India rejects pressure

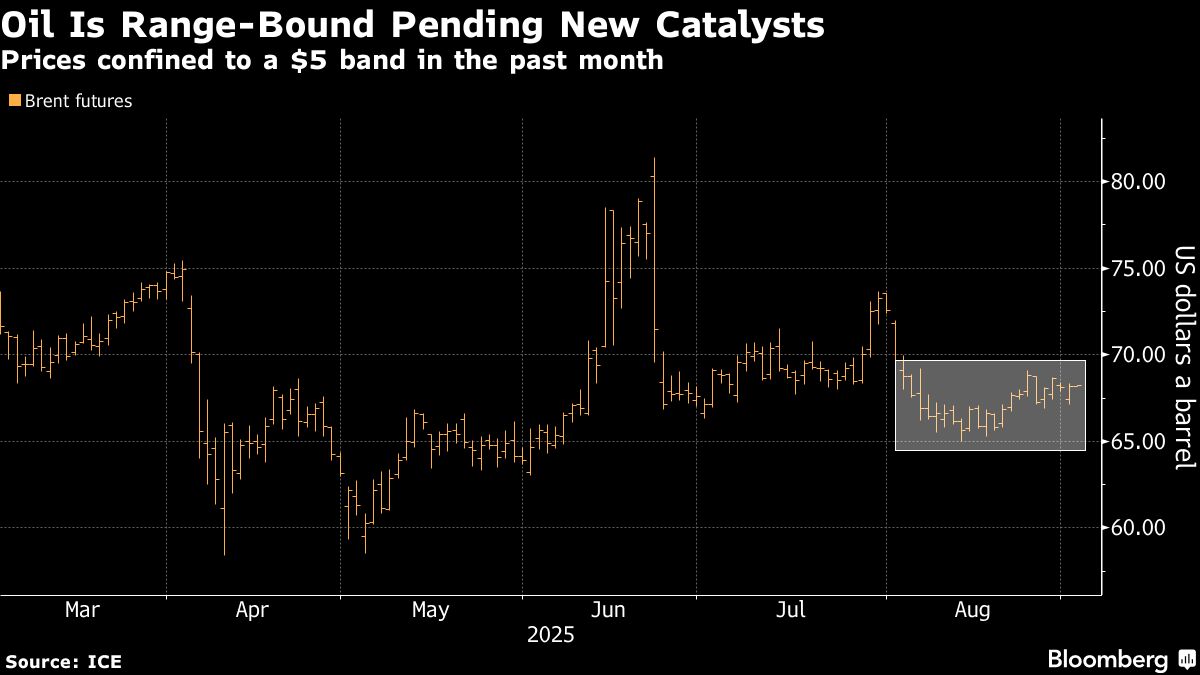

Oil drifted as traders waited for fresh catalysts to move prices out of what's been a relatively narrow band, with attention on an upcoming OPEC+ meeting and US moves on Russian supplies.

Brent traded above $68 a barrel after the November contract gained 1% in the previous session, while West Texas Intermediate was near $65. OPEC+ will hold a meeting this weekend to decide on output for October, and market watchers are divided over the likely outcome between no change and a modest rise.

Supplies are also in focus amid US efforts to pressure Moscow to make peace in Ukraine by targeting India, a top importer of its crude. New Delhi has rejected that initiative, with a cordial meeting between Prime Minister Narendra Modi and President Vladimir Putin on Monday. Separately, Treasury Secretary Scott Bessent said Washington would look at Russian sanctions this week.

Global crude benchmark Brent has largely been confined between $65 and $70 a barrel in recent weeks, with prices about 8% lower this year. Among traders, there are widespread concerns about a looming surplus after OPEC+ opted at earlier meetings to relax supply curbs in a bid to reclaim market share, and as the US-led trade war risks crimping energy demand.

“Crude is likely to remain rangebound,” said Vandana Hari, founder of market analysis firm Vanda Insights, adding that Ukranian attacks on Russian oil facilities were providing a floor for prices, while chances of tighter US sanctions had receded. “Expectations of a looming glut are capping gains,” she said.

On the Indian standoff, President Donald Trump said New Delhi had offered to cut its tariff rates to zero following the US imposition last week of 50% levies as punishment for the purchases of Moscow's oil. Still, it wasn't clear when the offer was made, or whether the White House plans to reopen talks.

Prices:

Brent for November settlement gained 0.2% to $68.31 a barrel at 8:44 a.m. in Singapore

WTI for October delivery traded at $64.78 a barrel, up 1.2% from Friday's close. There was no settlement on Monday due to a US holiday

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.