- Analysts say the bull run is being driven by a ‘fear of missing out’

- OpenAI reached a $500 billion valuation following an employee share sale

- Any setback in earnings from tech firms may spark a selloff given their stretched valuations

Global chipmakers saw their market value soar as investors rushed to get exposure to artificial intelligence, the latest sign of a frenetic bull run that is pushing tech stocks to all-time highs.

The sector is being swept up by a wave of good news from AI companies, including ChatGPT-owner OpenAI's record $500 billion valuation on an employee share sale and its pacts with a group of South Korean chipmakers, as well as a report that Intel Corp. is in talks to add Advanced Micro Devices Inc. as a customer.

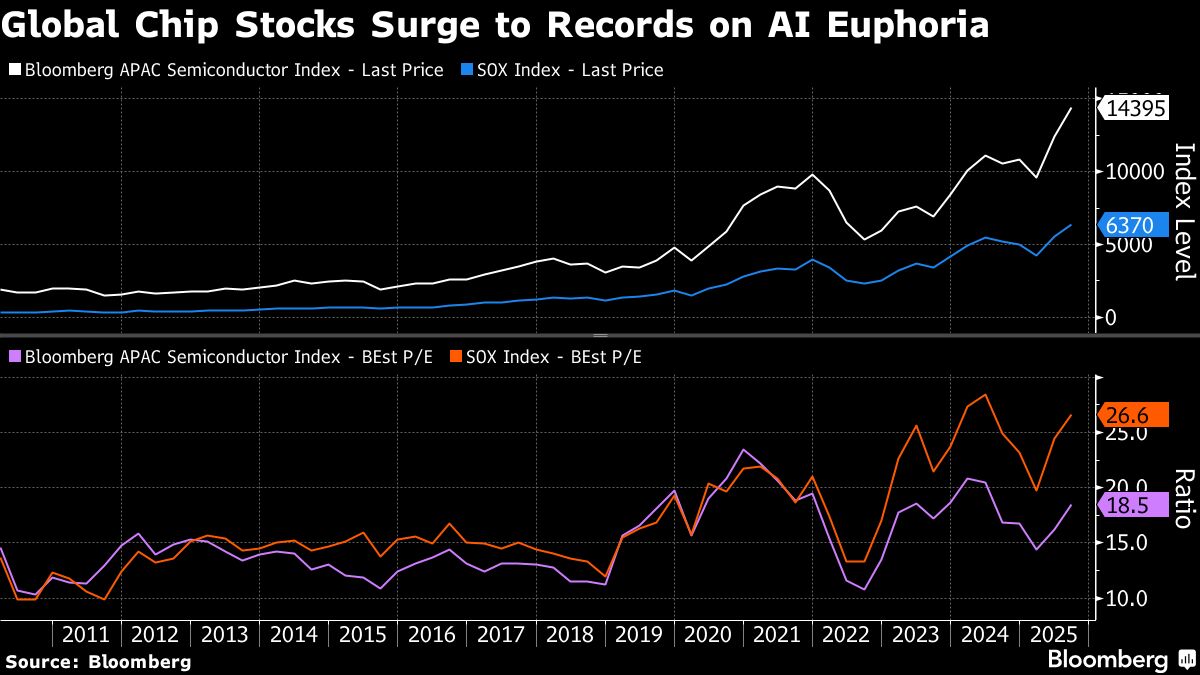

The bullishness has pushed the combined market capitalization of the Philadelphia Stock Exchange Semiconductor Index and a gauge tracking Asia chip stocks up by just over $200 billion in the latest session, according to Bloomberg calculations.

Korean chip stocks were among the biggest gainers on Thursday, surging on the OpenAI deal and sending the Kospi Index to a record high. Shares of SK Hynix Inc. jumped 10%, while Samsung Electronics Co. advanced 3.5%.

Analysts say the bull run is being driven by a ‘fear of missing out', with investors largely dismissing concerns about a bubble developing in the AI sector.

“Tech momentum shows no sign of fading — as if gravity doesn't exist — with headwinds brushed aside and every AI headline sparking bursts of euphoria,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “Bubble talk lingers, but it's FOMO that's clearly running the show. Momentum looks self-sustaining until upcoming fourth quarter earnings may force the reality check.”

The recent rally has caused a spike in chipmakers' valuations: Bloomberg's Asia chip gauge is trading at around 19 times forward earnings estimates while the SOX Index is now trading at 27 times earnings, approaching record highs from 2024.

Investor Scramble

Since ChatGPT launched the modern AI era, investors have scrambled to get exposure to technology that has the potential to shake-up the global economy. They've piled into big infrastructure providers such as chip linchpins Nvidia Corp. and SK Hynix Inc., pushed up valuations of startups like OpenAI and Anthropic, and poured capital into all manner of gear suppliers to the AI boom.

After striking a non-binding framework agreement with Korean chipmakers, OpenAI's Sam Altman is next scheduled for Taipei, where he's reportedly slated to meet with Taiwan Semiconductor Manufacturing Co. and Hon Hai Precision Industry Co. The shares of both companies rose on Thursday.

Chinese technology companies have also been on a strong upward trajectory, driven by investor enthusiasm for the country's grassroot AI advancements. Fresh impetus came from the government's announcement for increased support for the sector, alongside Alibaba's plans to ramp up AI spending and Huawei's unusual step of publicly unveiling its three-year vision for eroding Nvidia's dominance. These developments helped push the Hang Seng Tech Index's year-to-date gain to around 50%.

The surge in valuations worldwide has worried some market observers who argue that, while datacenter spending and construction is accelerating, AI services have yet to go mainstream and earn the revenues needed to justify the near-unprecedented rally.

It remains uncertain if there will be eventual demand for all the computing power now under construction. Any setback in earnings from mega tech firms may spark a selloff given their stretched valuations, as seen during the meltdown in April, according to JPMorgan Asset Management.

For now, though, investors see more upside for tech shares despite the lofty valuations.

“Tech stocks continue to defy gravity,” Peter Kim, managing director at KB Securities, said in a Bloomberg TV interview. “I don't see significant headwinds against Asian tech, possibly extending into next year.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.