Fortis Healthcare Ltd. received a 'buy' rating initiation from multinational investment firm UBS that sees earnings acceleration in the coming years due to the rapid growth in India's organised hospital sector.

Analysts have placed a 12-month price target of Rs 1,000 on the stock, indicating a potential upside of 18% over the previous close. Fortis Health is valued at 28 times the EV/Ebitda — a financial ratio used to assess a company's value relative to its operating profitability. The stock has re-rated over the past year.

UBS expects Fortis to deliver over 16% annual revenue growth over three years and an average 24% Ebitda margin, with scope for a positive surprise.

Analyst Observation

Fortis is entering a strong growth momentum phase, with a rising margin trajectory, according to UBS.

The hospital segment's growth drivers include new bed additions, occupancy, ARPOB and patient mix improvement. The management is focused on revamping the infrastructure and hiring doctors to aid its operating metrics.

"We think management's guidance of around 200 basis points Ebitda margin expansion in FY26 is achievable," a note said.

Besides, the diagnostics segment Agilus will transform due to network expansion, higher home collections, and wellness packages. "We believe Agilus can deliver peer-average growth in low to double digits, with meaningful scope for margin expansion over the medium to long term," UBS said.

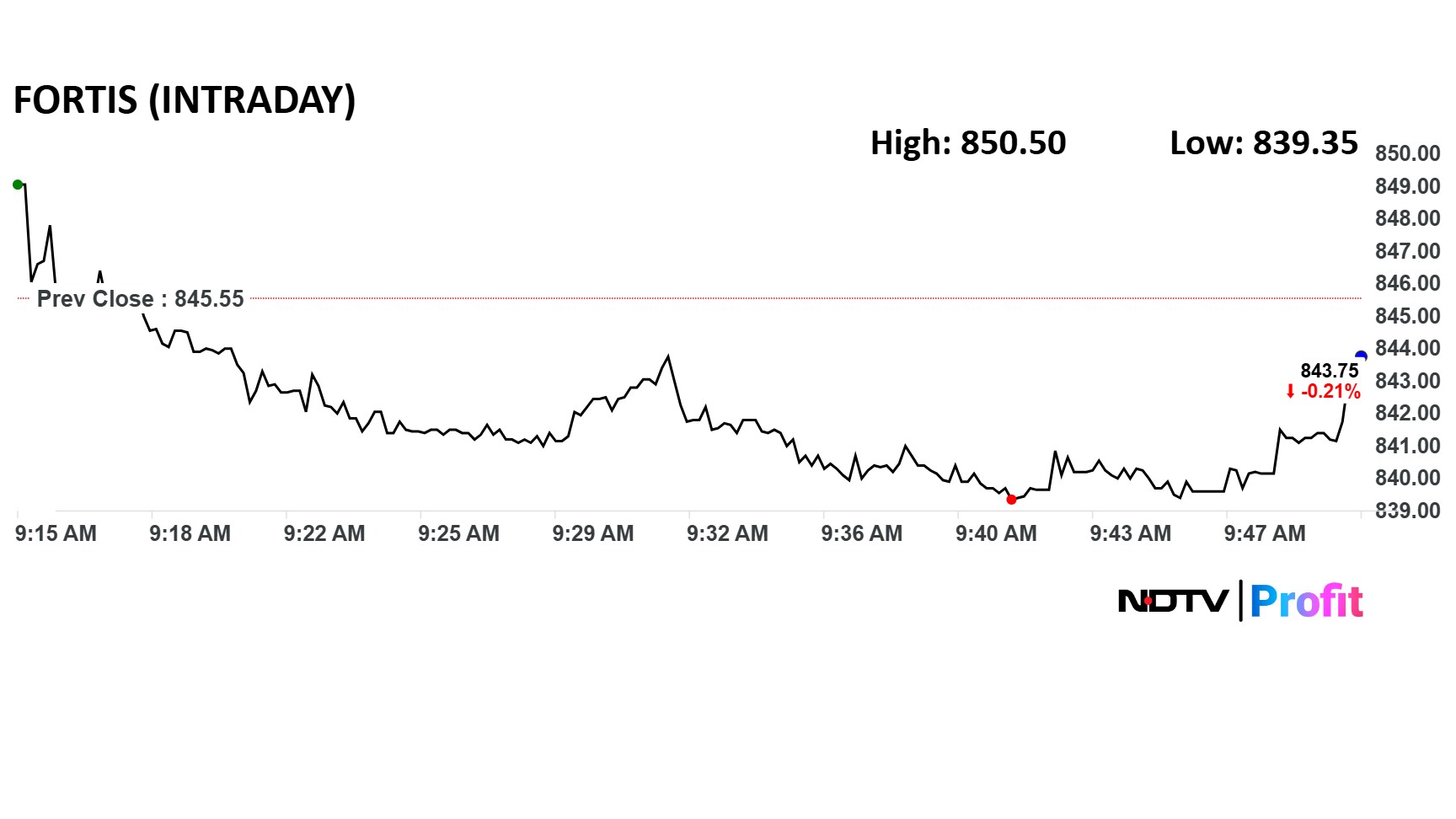

Fortis Health Share Price Movement

Shares of Fortis Health were unchanged during early trade on Monday.

Shares of Fortis Health were unchanged during early trade on Monday. The relative strength index was 63. The stock has risen 65% in the last 12 months and 17% so far this year.

Fifteen out of the 16 analysts tracking Fortis Health have a 'buy' rating on the stock, and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 824.8 implies a potential downside of 2%.

The company is due to announce its first quarter financial results on Aug. 14.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.