Stocks of fast-moving consumer good companies tanked on Monday after Godrej Consumer Products Ltd., a key industry player, flagged the continued slowdown in demand which could affect the performance in the October-December quarter.

"The demand conditions in India have been subdued for the past few months which is evident in FMCG market growth," Godrej Consumer said in its quarterly update, released post-market hours on Friday.

Since the concern expressed by the company covered the overall demand conditions, the stocks of other FMCG firms, including industry bellwether Hindustan Unilever Ltd. were also hit.

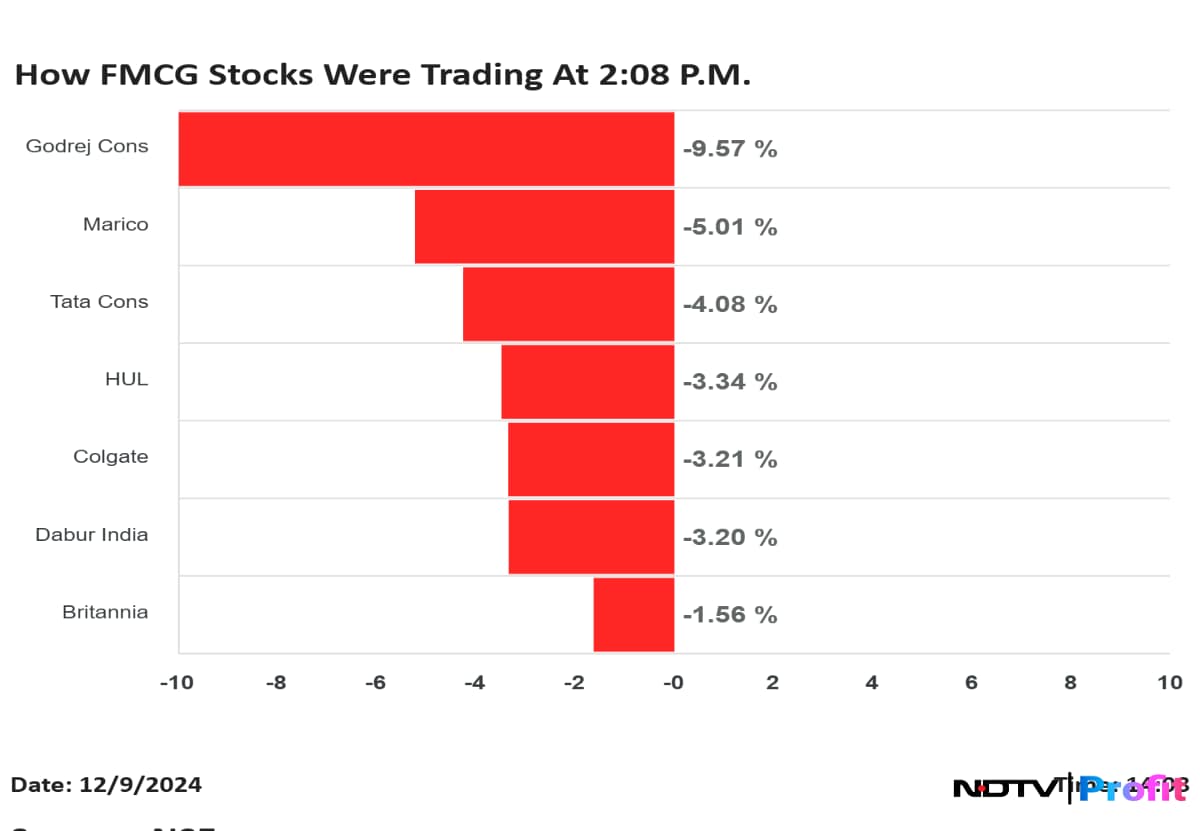

HUL dropped up to 4% to a low of Rs 2,383.3 apiece on the NSE, whereas Marico Ltd. slipped up to 5.3% to Rs 600.55 per share. Dabur India Ltd. tanked up to 3.9% to a low of Rs 503.2.

Britannia Industries Ltd. declined up to 2.5% to Rs 4,750.05 per share earlier in the day, Tata Consumer Products Ltd. was down up to 4.4% to

Rs 931.5 apiece, and Colgate-Palmolive (India) Ltd. slipped up to 3.85 to Rs 2,777.5.

The sharpest decline was recorded by Godrej Consumer, whose stock was hammered by over 10% to Rs 1,101.65.

The FMCG stocks recovered to some extent from their day's lows, but were still significantly trading in the red till the latter half of the session.

Consumption Downturn

FMCG companies reported a subdued second quarter, as urban demand remained tepid despite a slight uptick in rural consumption. The trend could hold true for the third quarter as well, with Godrej Consumer flagging the "subdued" demand conditions in its quarterly update.

"The current inflationary environment has created pressure on the margins. The company maintains its commitment to strategic investments in media and other areas like rural van distribution etc. despite these challenging conditions," it added.

HUL has also flagged concerns about growth in big cities trending down. At its Capital Markets Day held on Nov. 29, Chief Executive Officer Rohit Jawa told investors that there were "no major changes" in demand trends, presenting a "cautious near-term" growth outlook.

Parle Products Pvt. echoed similar sentiments. The festive months of October and November did not turn out as expected, the company's Vice President Mayank Shah had stated.

"Urban stress is very much palpable," he said, hoping to close the quarter with 4-5% growth versus expectations of 8-9%. "We expect sales in the second half to be better than the first, but double-digit growth is still some time away."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.