Shares of Godrej Consumer Products Ltd. slumped nearly 10% in early trade on Monday to hit an 11-month low, as mixed brokerage views and concerns over demand pressures weighed heavily on investor sentiment.

A mid-quarter update from the company flagged challenging conditions in its key segments—soaps and household insecticides—triggering fresh doubts about near-term growth prospects.

Emkay Downgrade

Emkay Global led the bearish wave, downgrading GCPL from 'add' to 'reduce' with a revised target price of Rs 1,225, down from Rs 1,375, indicating a 9% potential upside. The brokerage cited demand stress in two-third of the company's India business, driven by:

Sharp inflation in palm oil, impacting the soaps portfolio and necessitating price hikes.

Weakness in the HI segment due to a delayed winter in North India and floods in the South, which disrupted demand.

Emkay cut its fiscal 2025 earnings estimates by 4-7%, forecasting a high-teen Ebitda decline for the third quarter, primarily due to raw material cost pressures and a high base.

Jefferies Flags Investor Concerns

Jefferies pointed out that GCPL's mid-quarter update—released unusually early—has amplified investor concerns about the FMCG sector's slowdown. The brokerage echoed worries about the HI segment's ongoing volatility, exacerbated by unfavourable weather conditions like a delayed winter and a cyclone.

While management views these challenges as transitory, Jefferies emphasised that the next few quarters will be critical in proving the success of GCPL's recent innovations, such as its new LV insecticide product.

Motilal Oswal Notes Pressure On Margins

Motilal Oswal Financial Services Ltd. noted the subdued demand environment in India's FMCG sector, but praised GCPL's resilience with an average 7% organic volume growth over six quarters. However, the brokerage expects the third quarter to reflect flattish volumes and mid-single-digit sales growth due to persistent weakness in soaps and HI.

Margins, which hit an exceptional 29.7% in the third quarter thanks to favourable commodity prices, are now expected to dip below the normative range of 24-27% as inflation bites, said Motilal Oswal.

Citi Stays Bullish

On the other hand, Citi maintained a 'buy' rating with a target price of Rs 1,550 per share, signaling potential upside of 25%. While Citi acknowledged short-term challenges, it highlighted growth drivers such as:

Growth momentum in newer categories in India.

Simplification of international operations.

Despite these positives, Citi expects GCPL's standalone business to report flat volume growth in the third quarter, with mid-single-digit revenue growth and pressure in the soaps and HI categories.

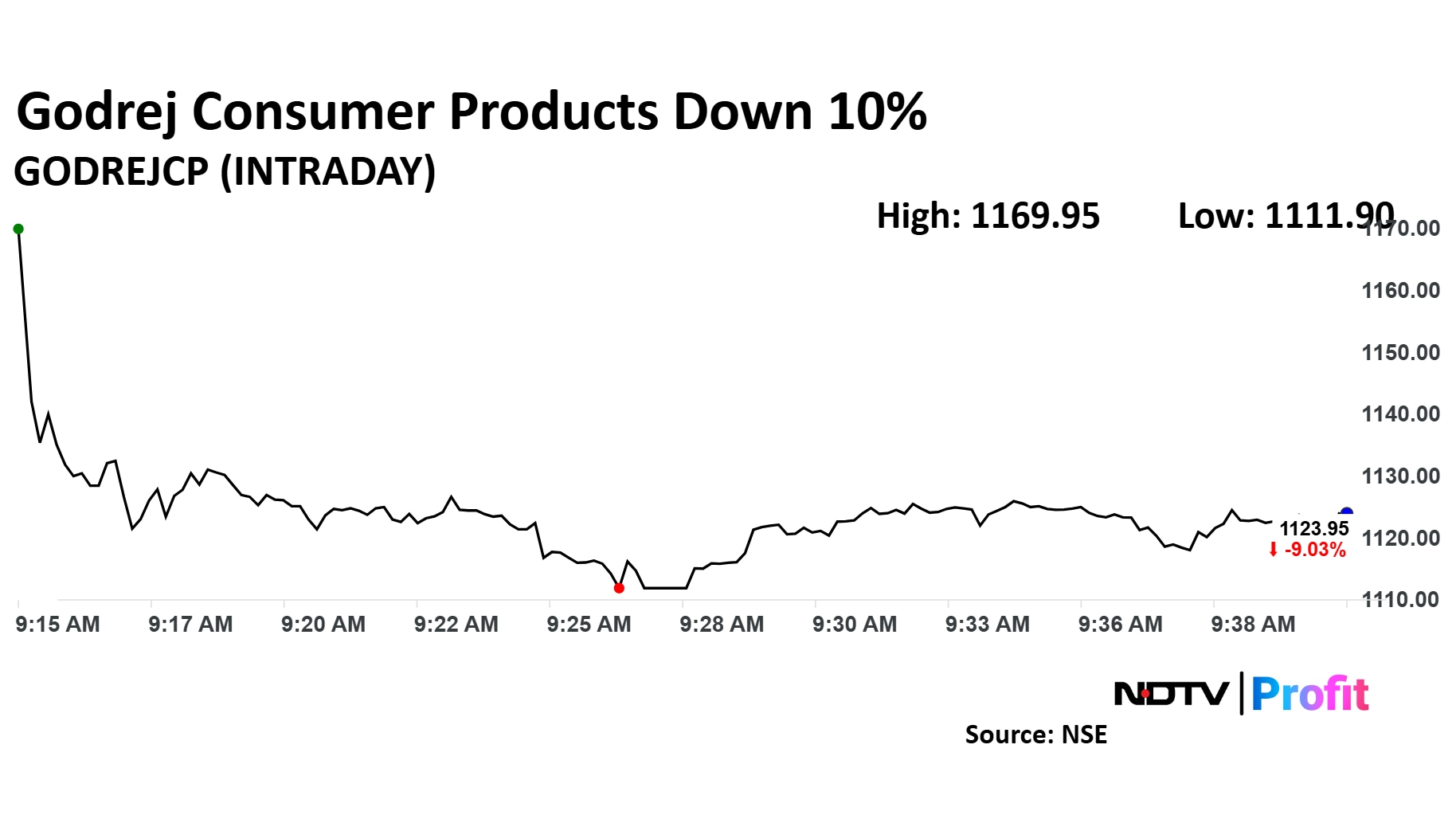

Godrej Consumer Products Share Price Today

The scrip fell as much as 10% to Rs 1,111.90 apiece, the lowest level since Jan. 18, 2024. It pared losses to trade 8.96% lower at Rs 1,124.80 apiece, as of 09:37 a.m. This compares to a 0.08% decline in the NSE Nifty 50.

It has fallen 3.36% on a year-to-date basis. Total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 28.63.

Out of 36 analysts tracking the company, 25 maintain a 'buy' rating, eight recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 25.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.