Shares of Emami Realty Ltd. hit the 5% upper circuit on Thursday after the company displayed a development plan with a mix of residential and commercial projects, targeting a revenue potential of Rs 15,000 crore, through a press release on Thursday.

The Kolkata-based real estate developer aims to solidify its footprint across India, with significant investments planned in West Bengal and other key states.

The company has outlined a total estimated investment of Rs 10,000 crore for its upcoming projects, including residential projects worth Rs 9,000 crore and commercial projects worth the remaining Rs 1,000 crore.

The investment will be divided as follows:

West Bengal: Rs 4,500 crore allocated for multiple residential and commercial developments.

Other States: Rs 5,500 crore earmarked for projects in Uttar Pradesh, Jharkhand, Odisha, and Tamil Nadu.

This development comes on the heels of Kolkata's recent status as the most affordable major city in India, according to JLL's Home Purchase Affordability Index. Home affordability in India is expected to improve over the next 12 months, as per the report.

An anticipated 50-basis-point interest rate cut by the Reserve Bank of India is expected to enhance affordability across key residential markets. Residential sales are forecast to reach a record 305,000–310,000 units in 2024, with further growth in 2025, projected to hit 340,000–350,000 units, as per JLL's analysis.

Mumbai and Pune are predicted to approach peak affordability levels, driven by steady income growth and moderating price increases. Kolkata is set to achieve new affordability milestones, solidifying its status as India's most affordable real estate market.

Meanwhile, cities like Bengaluru, Hyderabad, and Delhi NCR will experience gradual improvements in affordability, though they will remain below peak levels.

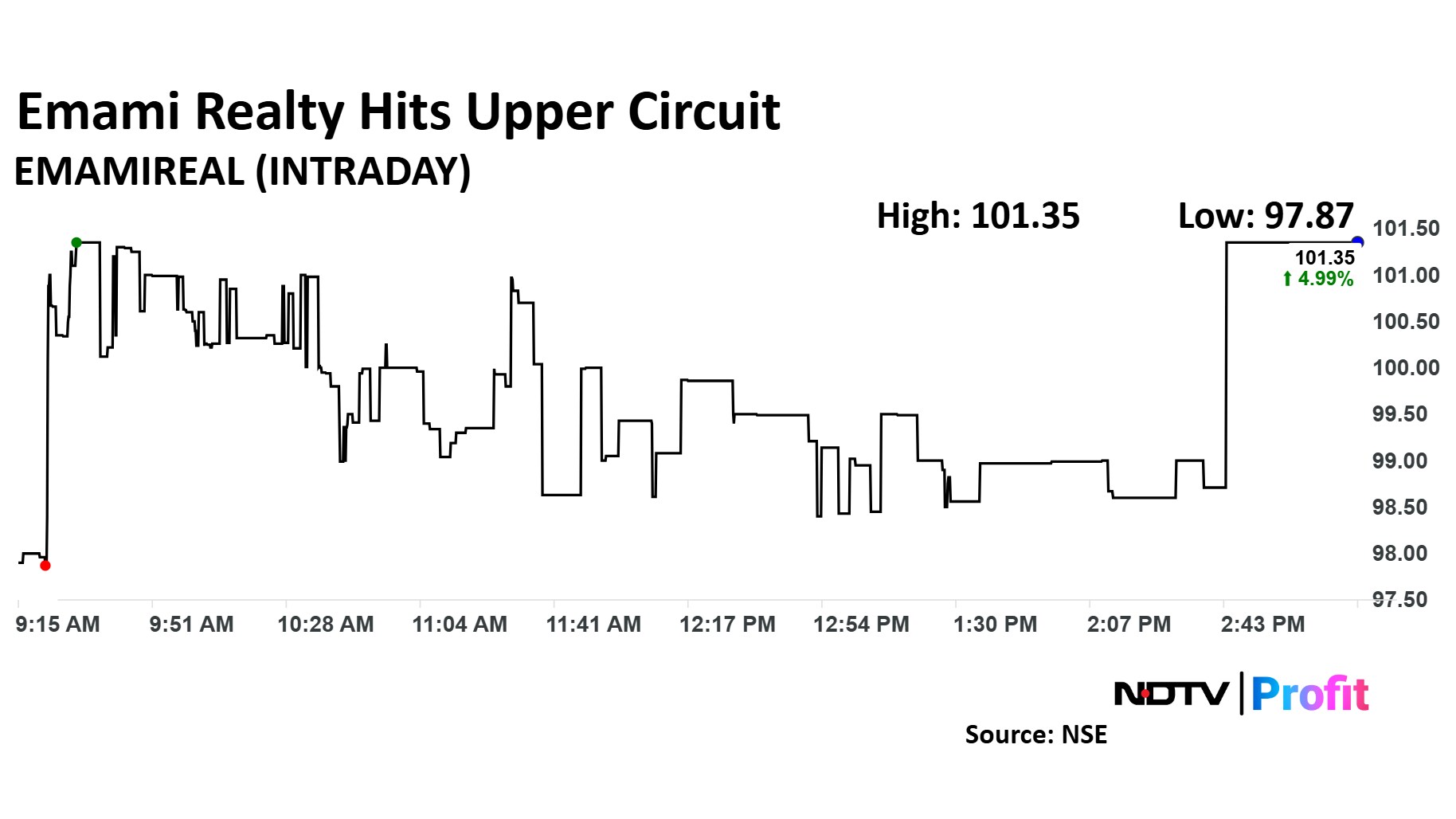

The scrip rose as much as 4.99% to Rs 101.35 apiece intraday and hit its upper circuit. This compares to a 1.42% decline in the NSE Nifty 50 Index.

It has fallen 15.79% on a year-to-date basis. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 53.11.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.