Dabur's share price jumped over 4% on Monday after the company reported a sequential recovery in demand during the first quarter of the current fiscal.

Dabur noted an uptick in volume growth, particularly in urban markets. The home and personal care division is expected to perform strongly, driven by significant growth in the oral, home, and skincare categories.

Organised trade channels, including e-commerce, quick commerce, and modern trade, continued to exhibit strong momentum during the quarter. Dabur's international business is also expected to grow in double digits in constant-currency terms, driven by markets such as MENA, Turkey, Bangladesh, and the US-based Namaste business.

However, the company's beverage portfolio faced challenges due to unseasonal rain and a shorter summer.

As a result of the decline in the beverage segment, Dabur's consolidated revenue is expected to grow in low single digits, with operating profit growth slightly lagging behind revenue.

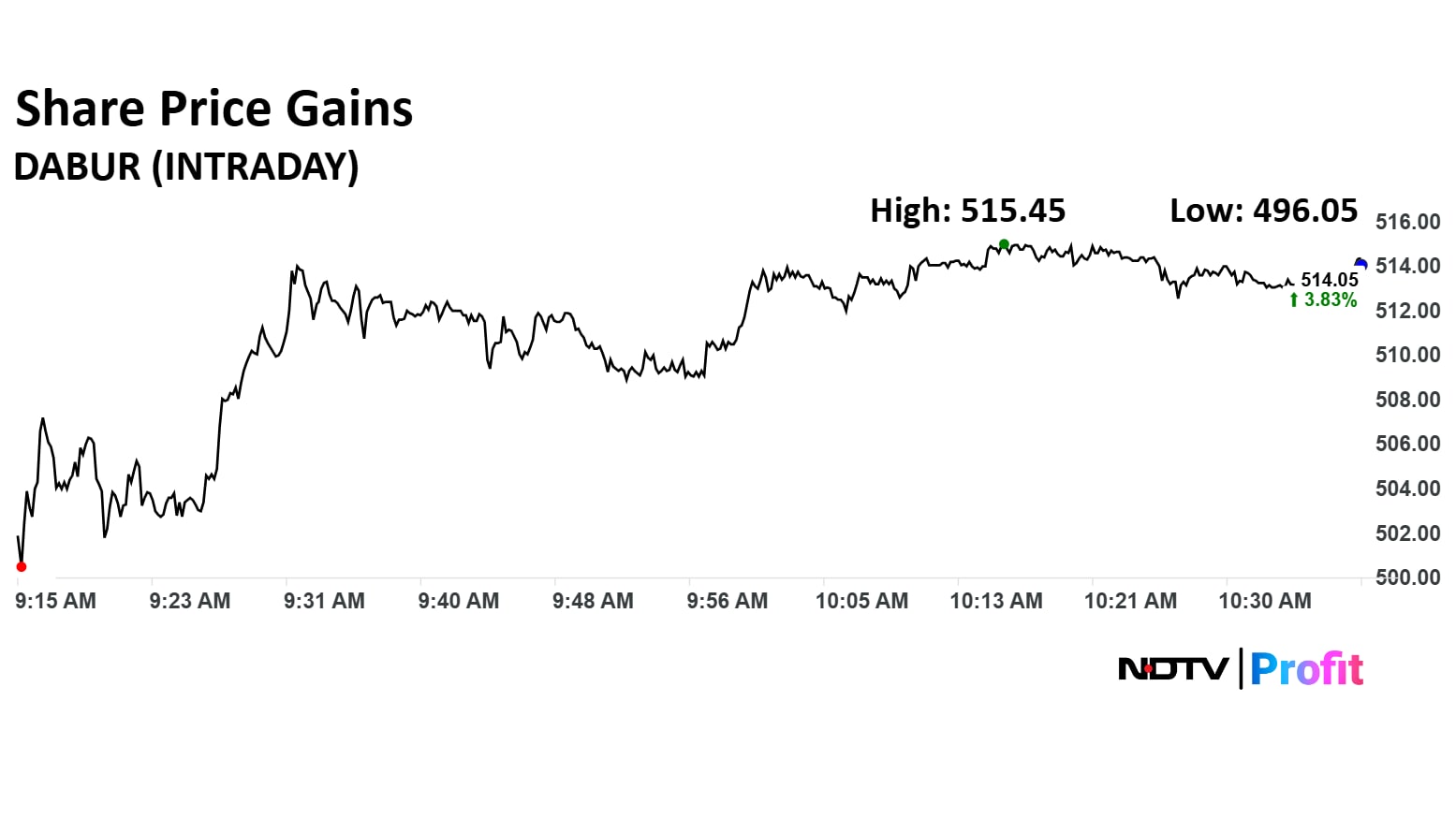

Dabur India Share Price Today

The scrip rose as much as 4.11% to Rs 515.45 apiece. It pared gains to trade 3.81% higher at Rs 513.95 apiece, as of 10:40 a.m. This compares to a flat NSE Nifty 50.

It has fallen 17% in the last 12 months. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 73.

Out of 32 analysts tracking the company, 15 maintain a 'buy' rating, 19 recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.