- Coal India received official licence to explore Ontillu–Chandragiri rare earth area

- The exploration block covers 209.62 square kilometres

- Coal India must start exploration within one year of letter of intent

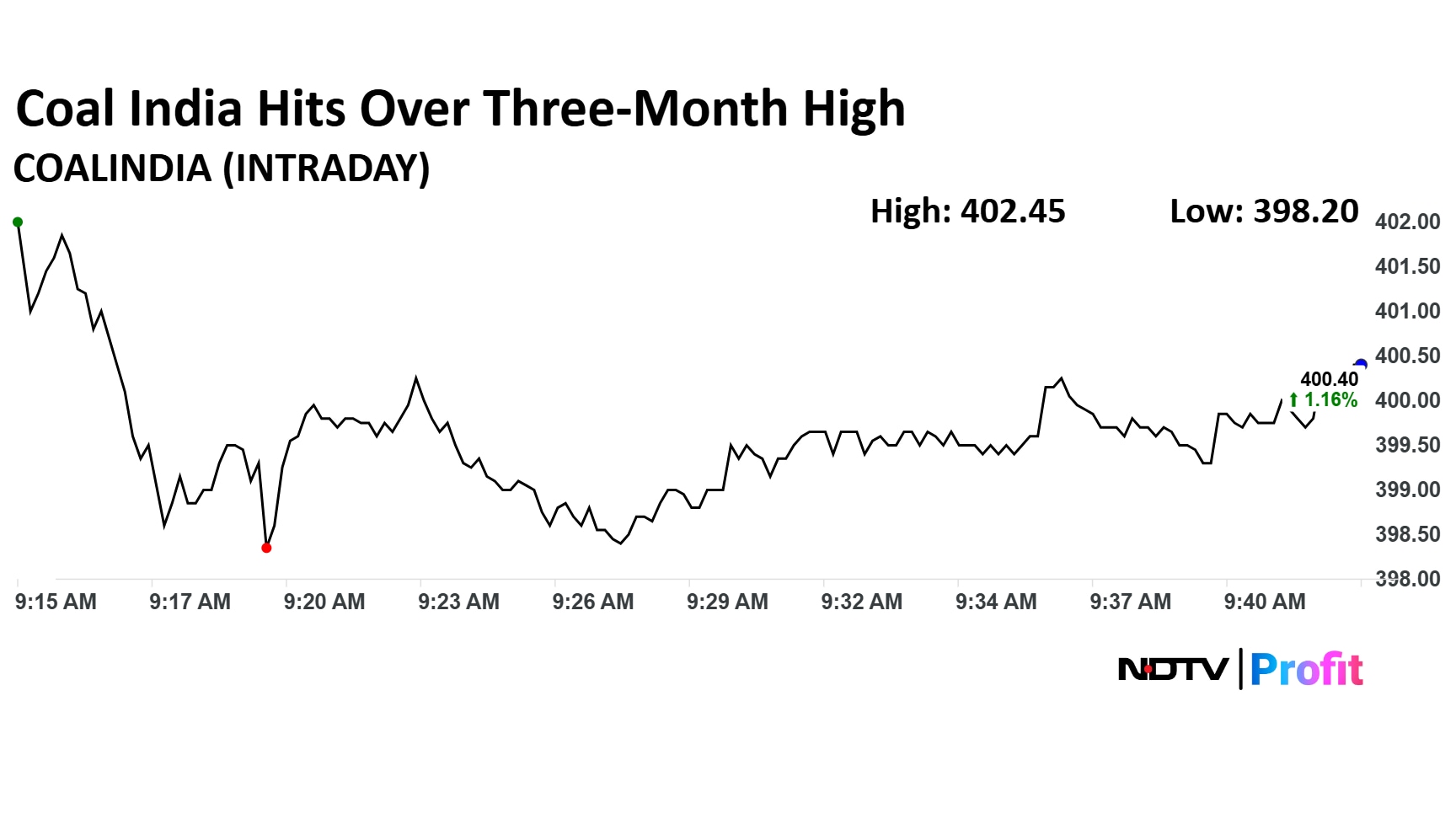

Coal India Ltd. share price hit four-month high in Wednesday's session as the company received official license to explore Ontillu – Chandragiri rare earth exploration area. The Maharatna company has emerged as the preferred bidder for the exploration area in a bid by the Ministry of Mines.

Ontillu–Chandragiri rare earth element exploration block is spread across 209.62 square kilometres. Coal India has to execute licensed exploration project within one year of receiving the letter of intent from the governement, the company revealed in the exchange filing.

In a separate filing Tuesday, Coal India has said that Crisil Ratings and Analytics Ltd. has assigned CRISIL Environmental, Social, and Governance (ESG) 53 rating to the company.

Coal India clarified in the exchange filing that it has not engaged CRISIL ESG Ratings & Analytics for the rating.

Track live market updates with NDTV Profit here.

Coal India share price advanced 1.68% to Rs 402.45 apiece, the highest level since June 11. It was trading 0.76% higher at Rs 398 apiece as of 10:16 a.m. compared to 0.27% advance in the NSE Nifty 50 index.

Coal India share price has been rallying for seven days in a row and gained 3.44%. The stock hit a 52-week high of Rs 517.85 apiece on Sept 27, 2024. It hit a 52-week low of Rs 349.25 apiece on Feb 17.

The stock declined 18.23% in 12 months, and 3.94% on year-to-date basis. Total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 66.59.

Out of 25 analysts tracking the company, 16 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.