India's bond rally, which has defied a global debt market meltdown amid US tariffs, has room to extend, according to Citigroup Inc.'s local markets chief.

Softening inflation, signs of more interest-rate cuts and improved liquidity are all pointing at gains for bonds going forward, Aditya Bagree, managing director and head of markets at Citi India, said in an interview in Mumbai.

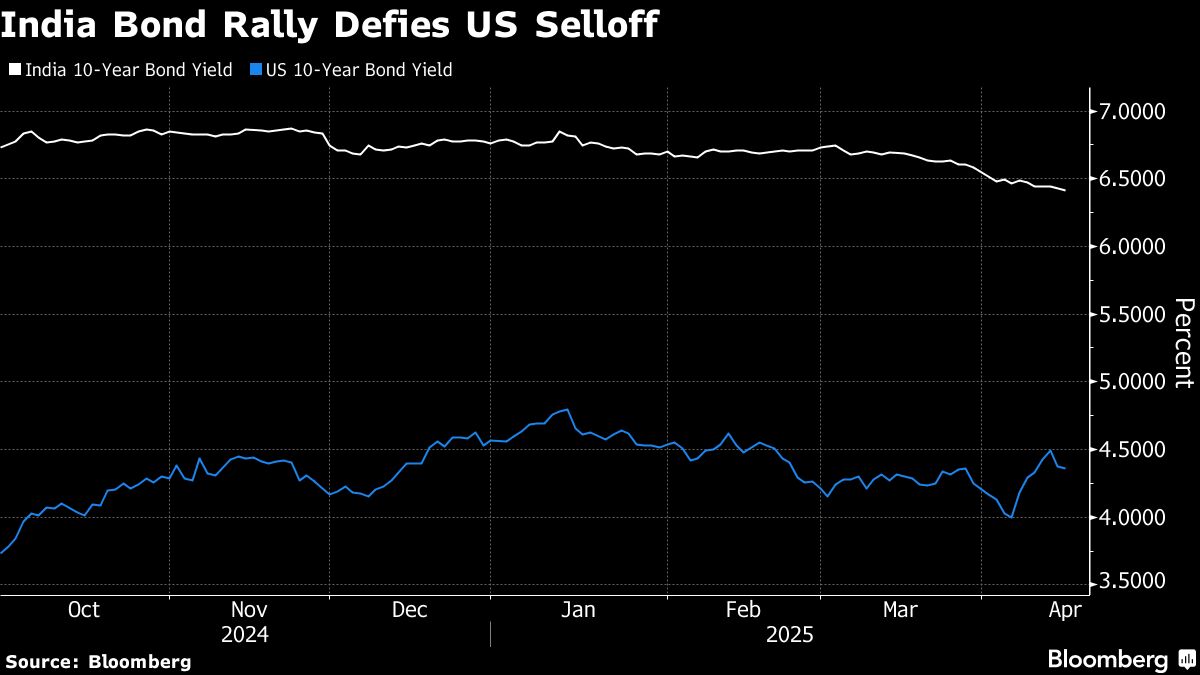

He sees the benchmark 10-year bond yield dropping to 6.20-6.25% from around 6.40% at present, building on an 18-basis-point decline this month.

The rally in Indian bonds is in sharp contrast to a selloff in US bonds that has raised questions about the haven status of American debt. Growing trade uncertainties and market volatility in global markets is bringing India under traders' spotlight.

Indian assets are getting a boost from a range of local factors. The Reserve Bank of India further lowered its key rate last week, while signaling more easing and vowing to provide sufficient liquidity to banks. A big domestic economy, falling crude oil prices and relatively lower exposure to the US compared to peers are helping too.

“Everything points toward Indian yields having room to come down further”, which is particularly attractive for active fund managers, Bagree said.

An increase in government spending and the central bank's dividend transfer to the state in May will add to improving cash conditions in the financial system, he said.

“We expect some steepening in the curve because short-term yields can fall further with rate cuts and adequate system liquidity,” Bagree said. While the turbulence in global markets could make foreign flows volatile, he expects net inflows into Indian debt.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.