The offshore yuan fell to its weakest level on record after China eased its tight grip on the currency and the US pushed ahead with 104% tariffs on many Chinese goods.

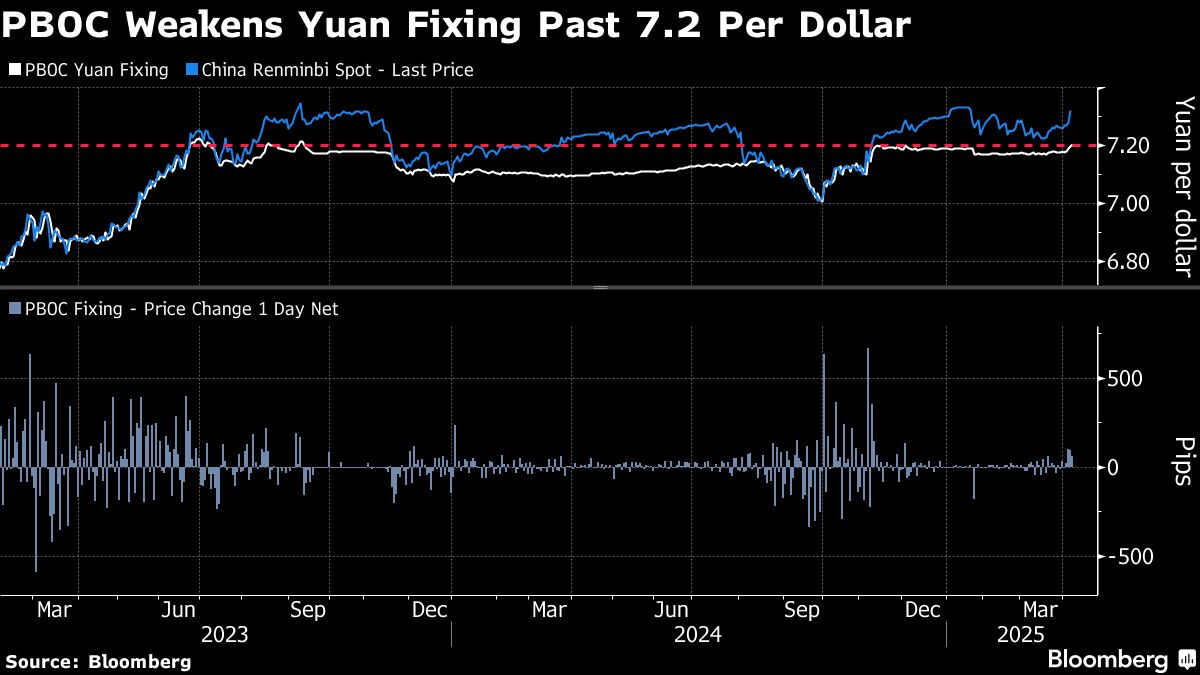

China's offshore currency fell as much as 1.1% to 7.4290 per dollar in New York late trading on Tuesday, setting an all-time low since the creation of the offshore yuan market in 2010, before it inched up on Wednesday. The People's Bank of China had set its daily reference rate for the currency at 7.2038 per dollar on Tuesday, the weakest since September 2023.

It's the first time since President Donald Trump's November election that the so-called fixing breached 7.20, a level seen by investors as a soft-red line for official intentions toward the managed currency. The onshore yuan, which is confined to a 2% trading range around the fixing and thus within tighter control of the PBOC, slid to the weakest level since September 2023 on Tuesday.

“We think the pace of depreciation will accelerate from here, and China is also hinting at greater flexibility” with its so-called fixing, said Aroop Chatterjee, managing director for macro strategy and emerging markets at Wells Fargo in New York.

“This will be a managed and persistent depreciation” that could cause the offshore yuan to weaken to 7.50 per dollar or more, he said.

Weakening its currency is seen as an option for Beijing to raise the appeal of its exports, a key driver of growth now under greater pressure due to the trade tensions. But a decision to allow the yuan to drop sharply is a tough one as it may increase bearish bets on the economy, worsen capital outflows, antagonize the US and dim prospects of any trade negotiations.

On the flip side for China, keeping the exchange rate artificially strong may dampen exports and further hurt the already flailing economy. Also, a potential release of pent-up depreciation pressures later could also result in magnified volatility in the financial markets.

“Where the PBOC would draw the next line of defense remains an open question, but we know at least that the bar is now lifted higher,” said Tiffany Wang, an FX analyst at JPMorgan.

On Monday, President Donald Trump threatened to impose additional 50% import taxes on China if it doesn't withdraw its plans to respond to his already announced levies, following his announcement last week of the steepest American tariffs in a century. The US will move forward with the additional tariffs with the total rate of levies reaching 104%, White House confirmed. The new rate goes into effect starting 12:01am ET on April 9.

China will “fight to the end” if US insists on new tariffs, the Ministry of Commerce said Tuesday. Hopes for a trade deal were also dimmed after Beijing announced retaliation measures including commensurate levies on all American goods and export controls on rare earths earlier.

Chinese Premier Li Qiang said his country has ample policy tools to “fully offset” any negative external shocks, according to an official readout of a call with European Commission President Ursula Von der Leyen. Li criticized the punitive actions by the US as unilateralism, protectionism and economic coercion.

With “tit-for-tat tensions only going up with China, the yuan taking a hit makes sense,” said Monex foreign-exchange trader Helen Given. “We're watching for any signs of intentional devaluation, but it doesn't seem like we're there just yet.”

Devaluation Shock?

A likely recalibration of China's currency strategy had been on the radar for traders since the beginning of Trump's second presidency but policymakers have repeatedly pledged to keep the yuan stable and prevent an overshoot in exchange rates.

Investors are now seeking fresh clues from the central bank on where it stands on the yuan and whether China will resume monetary easing, after the tariff hikes sent shock-waves across global markets.

A growing, but non-consensus, cohort of analysts are predicting a sharper plunge in the yuan in the near future.

There's a 75% chance Beijing will devalue the yuan — and should the PBOC decide to do so, it's likely to “go big, like 20 or 30%,” said Brad Bechtel, global head of FX at Jefferies Financial Group Inc.

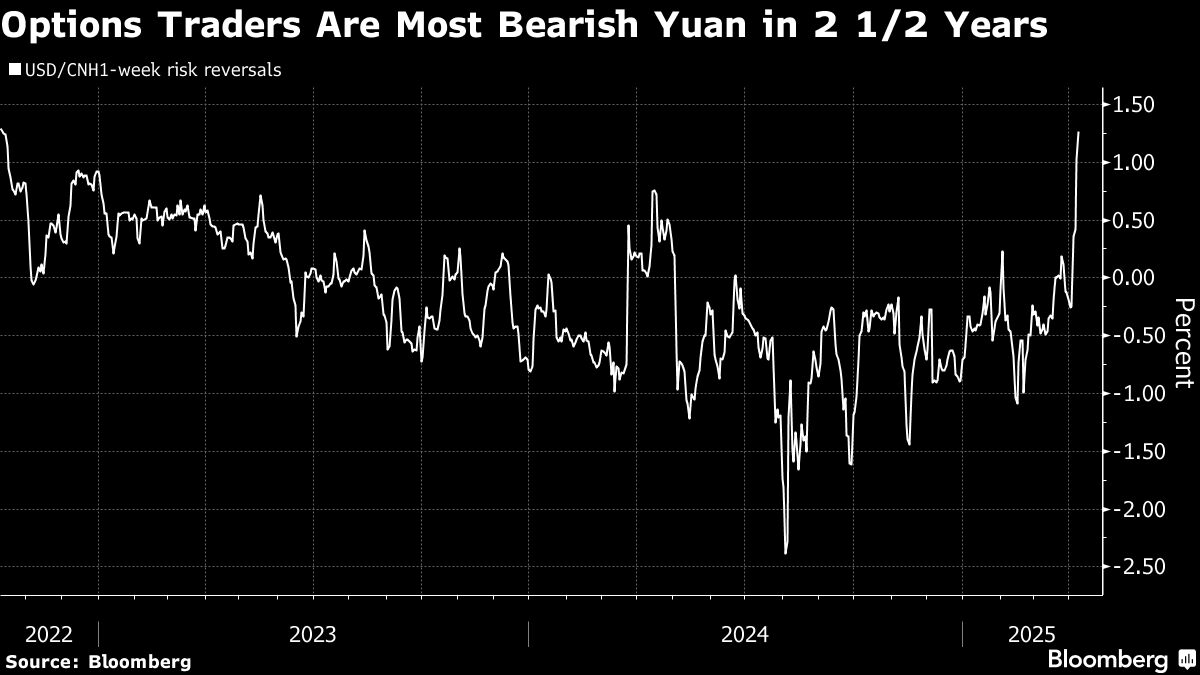

Options traders have also bolstered their expectations on yuan depreciation over the coming week to the highest since 2022. One-week dollar-offshore yuan risk reversals climbed for the fifth trading session to levels last seen two-and-a-half years ago, when the offshore currency fell to a prior nadir.

But most expect to see a less dramatic move as a devaluation might worsen capital outflows and dent investor confidence toward Chinese assets. Even if bearish sentiment starts to take hold, the PBOC has plenty of tools to iron out market volatility. In the past the central bank has deployed tools such as adjusting foreign-exchange liquidity and offshore bill issuance to rein in the yuan's slide.

“We reckon that the PBOC will allow more two-way FX flexibility gradually to adjust the choppy market after the tariff day, but a sharp yuan depreciation is unlikely due to capital outflow risks,” said Ken Cheung, chief Asia FX strategist at Mizuho Bank Ltd. “The PBOC will also opt to preserve FX stability to gain room to resume monetary easing.”

(Updates yuan moves in paragraph 2.)

© 2025 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.