Stocks climbed and bonds traded well off session lows as a solid $39 billion sale of benchmark Treasuries eased fears of financial turmoil after another chaotic day on Wall Street.

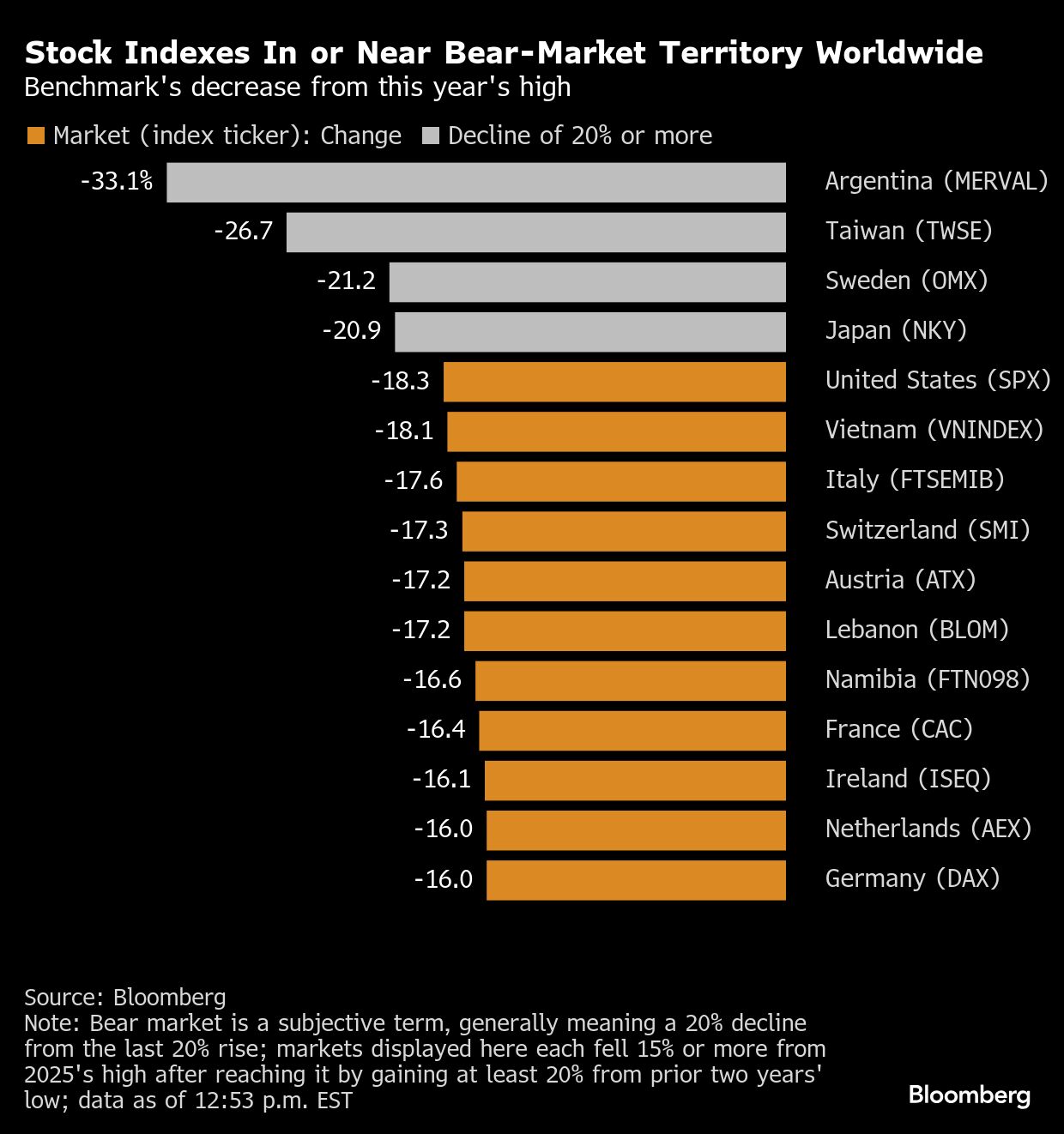

With traders glued to screens awaiting fresh news on tariffs, volatility once again engulfed assets across the globe. Equities pushed away from their bear-market threshold, with the S&P 500 up about 1%. Treasury 10-year yields pared an advance that earlier topped 20 basis points amid a bond a selloff that raised concern about the US status as a safe spot. The dollar slid against most major currencies while the Japanese yen and Swiss franc climbed. Oil plunged.

The minute-by-minute watch of new tariff headlines is making the trading landscape challenging even for market pros.

What was earlier shaping up to be a big down day for equities after China's retaliation quickly reversed into a gains as Treasury Secretary Scott Bessent said he envisions trade agreements with US allies. Trump urged Americans to remain calm and continue investing — an indication the White House is closely monitoring the reaction to the levies.

“In the fog of war, extreme rallies are no healthier than extreme declines, as they are all emotion driven,” said Mark Hackett at Nationwide. “That is why markets rarely have a V-shaped bottom – it takes some churning and clarity to have a sustained recovery.”

Investors are fearing an oncoming breakage in the financial system, with a gauge of fear across the market for investment-grade credit spiking to the highest since 2023. And the prospect of tariff-induced inflation — just as Treasuries misfire as a hedge — complicates the Federal Reserve's policy response.

The escalating conflict in international commerce has now spurred Wall Street to ramp up recession warnings, with JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon saying it's a “likely scenario.” Ray Dalio, the billionaire founder of Bridgewater Associates, added to the chorus of warnings, citing the risk of “once-in-a-lifetime” breakdown in the monetary and geopolitical order.

There's a growing discussion on Wall Street that the Fed may need to step in to stabilize the Treasury market if the rout that briefly propelled long-term US borrowing costs above 5% continues.

“If recent disruption in the US Treasury market continues, we see no other option for the Fed but to step in with emergency purchases of US Treasuries to stabilize the bond market,” said George Saravelos at Deutsche Bank.

“It feels like we've gone from shock, to panic, via a mini relief rally, to now worrying that the speed of recent market moves might've broken something under the surface,” said Michael Brown at Pepperstone.

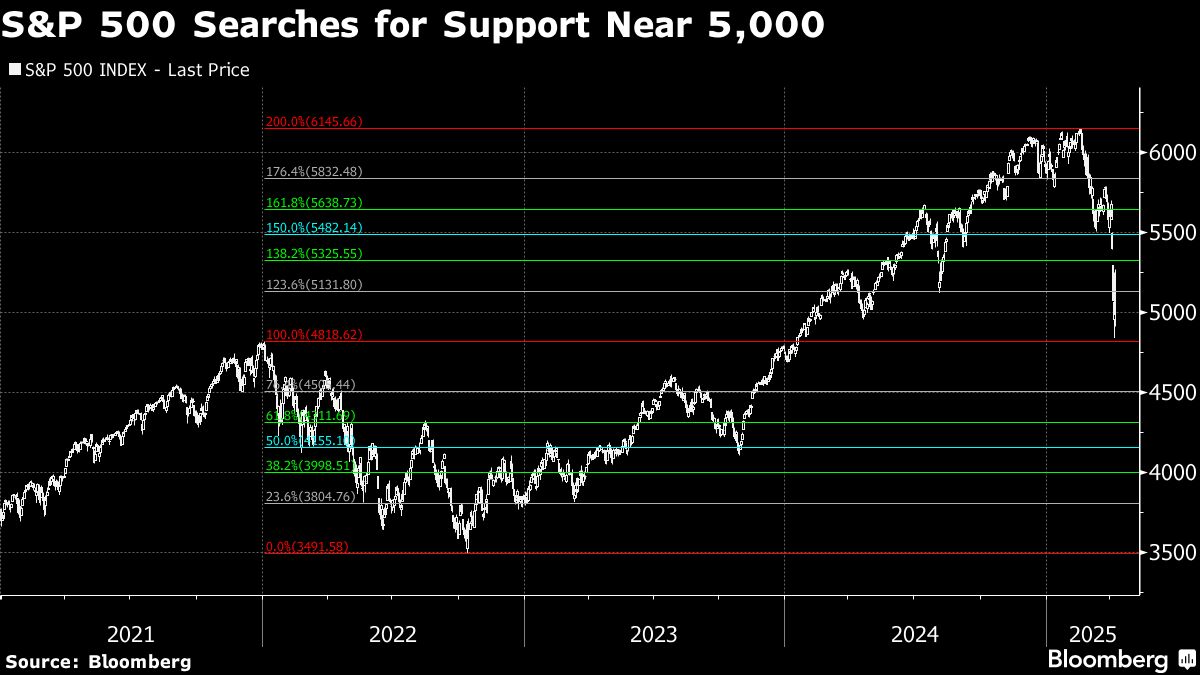

There are signs of support for the S&P 500 around 5,000. Goldman Sachs Group Inc. partner John Flood said this is a level where long-term investors are starting to buy the dip. “From my conversations with longer-duration investors, it feels like they will start scale buying the S&P 500 at 5,000 and get more aggressive in the mid-4,000s,” Flood wrote in a note to clients.

“It's hard to trust any rally,” according to Mark Newton, head of technical strategy at Fundstrat Global Advisors. “Stocks are getting close to bottoming after being massively oversold, but we still haven't seen the final low, and there's still room to fall even further. No one knows what's happening with tariffs.”

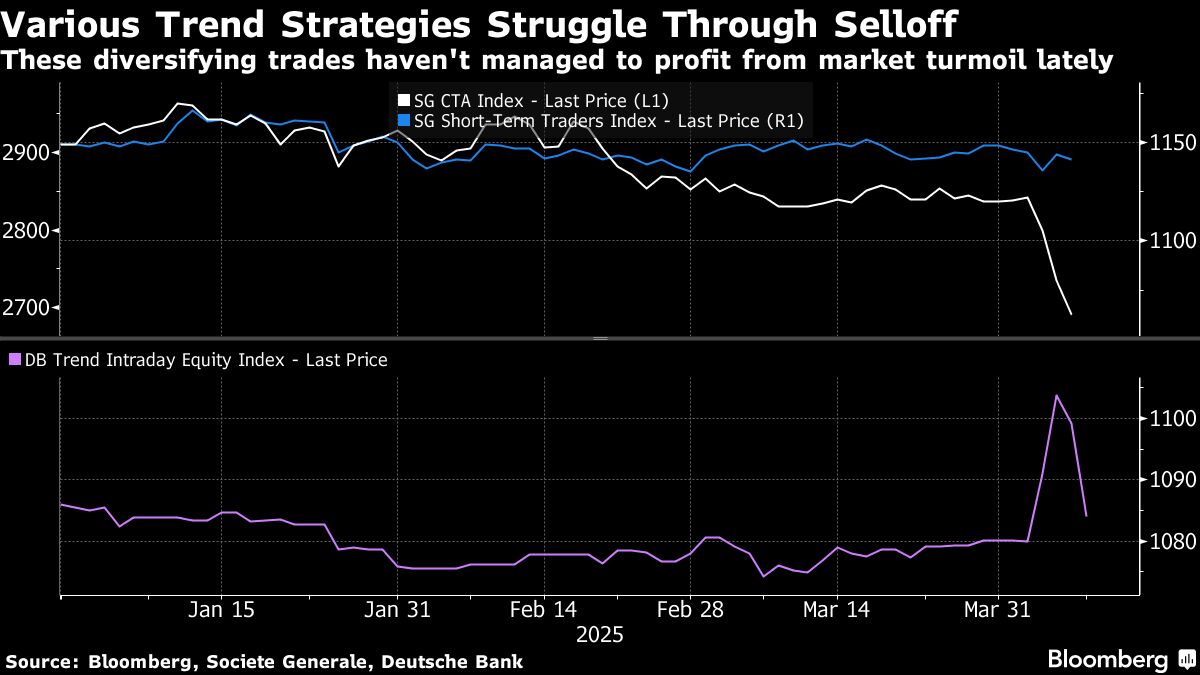

A slew of supposedly diversifying investment strategies are also failing to live up to their defensive billing.

Trend followers — a breed of quantitative fund who tout “crisis alpha,” or outperformance at times of market stress — have extended their worst losses in two years. A strategy that goes long steady stocks and short volatile ones is down on the week. Hedge funds, whose defensive pitch is right in their name, also appear to be struggling.

In short, the protective approaches often relied on by institutional investors have been faltering just when they're needed most. These could all be signs traders are dashing for the exits or being forced to offload more of their holdings. That's derailed all the usual market relationships from which defensive strategies try to profit.

Corporate Highlights:

Delta Air Lines Inc. withdrew its full-year financial guidance due to uncertainty surrounding global trade, a stark sign of the turmoil rippling across corporate America from President Donald Trump's tariffs.

As tariff-spooked shoppers begin pulling back on spending, Walmart Inc. is prepping for a worsening economy by using its massive footprint to keep prices low and hunt for ways to take market share.

Amazon.com Inc. has canceled orders for multiple products made in China and other Asian countries, according to a document reviewed by Bloomberg and people familiar with the matter, suggesting the company is reducing its exposure to tariffs imposed by President Donald Trump.

Morgan Stanley is no longer involved in providing financing for KKR & Co.'s purchase of Swedish consumer-health company Karo Healthcare, according to people familiar with the matter.

Peabody Energy Corp. said it's reviewing a deal worth up to $3.78 billion to buy Anglo American Plc's steel-making coal business after a fire at an Australian mine.

Airbus SE delivered 136 commercial aircraft in the first quarter, enough to edge out Boeing Co. after stepping up its pace of handovers in March

ThyssenKrupp AG is exploring exit options for its materials trading unit that could be valued at as much as €2 billion ($2.2 billion) in a deal, people familiar with the matter said, as the sprawling industrial conglomerate looks to streamline operations.

Key Events This Week:

US CPI, jobless claims, Thursday

Fed's Michelle Bowman's nomination hearing in Senate for the position of vice chair for supervision, Thursday

Fed's Austan Goolsbee, Patrick Harker, Lorie Logan, Jeff Schmid speak, Thursday

US PPI, University of Michigan consumer sentiment, Friday

Major banks reporting earnings include JPMorgan, Bank of New York Mellon, Morgan Stanley, Wells Fargo, Friday

Fed's John Williams and Alberto Musalem speak, Friday

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.