Shares of CarTrade Tech Ltd. rallied in early trade on Wednesday after B&K Securities initiated coverage on the automobile company on Tuesday, with a target price of Rs 1,878, projecting a 21% upside.

The brokerage identified the company as a "classic non-linear business" with robust cash flows, especially post its acquisitions of SAMIL and OLX India. These moves have expanded its vertical and horizontal reach, while fortifying its cash-cow operations, like vehicle auctions and classifieds, as per the report.

The company also commands a substantial share in India's online automobile classifieds segment with platforms like CarWale and BikeWale, supported by 47 million MAUs, 93% of which are organic.

Growth Drivers

Here are the key growth catalysts, as per the report:

OLX India Acquisition: This has significantly boosted the company's horizontal reach across 12 non-auto categories, including furniture and real estate.

SAMIL Auctions: Offers counter-cyclical benefits, capitalising on asset repossessions.

Financial Forecast

The brokerage projects a revenue CAGR of 15% over fiscals 2019 to 2024, with an EPS growth of 491% in fiscal 2025 and consistent gains thereafter.

The stock is currently trading at 47 times the price to earnings value of fiscal 2026, as per the report.

Key Risks

Dependency on auto advertising budgets, which remain under-indexed in India's digital landscape.

Cyclicality in the auction business tied to macroeconomic trends.

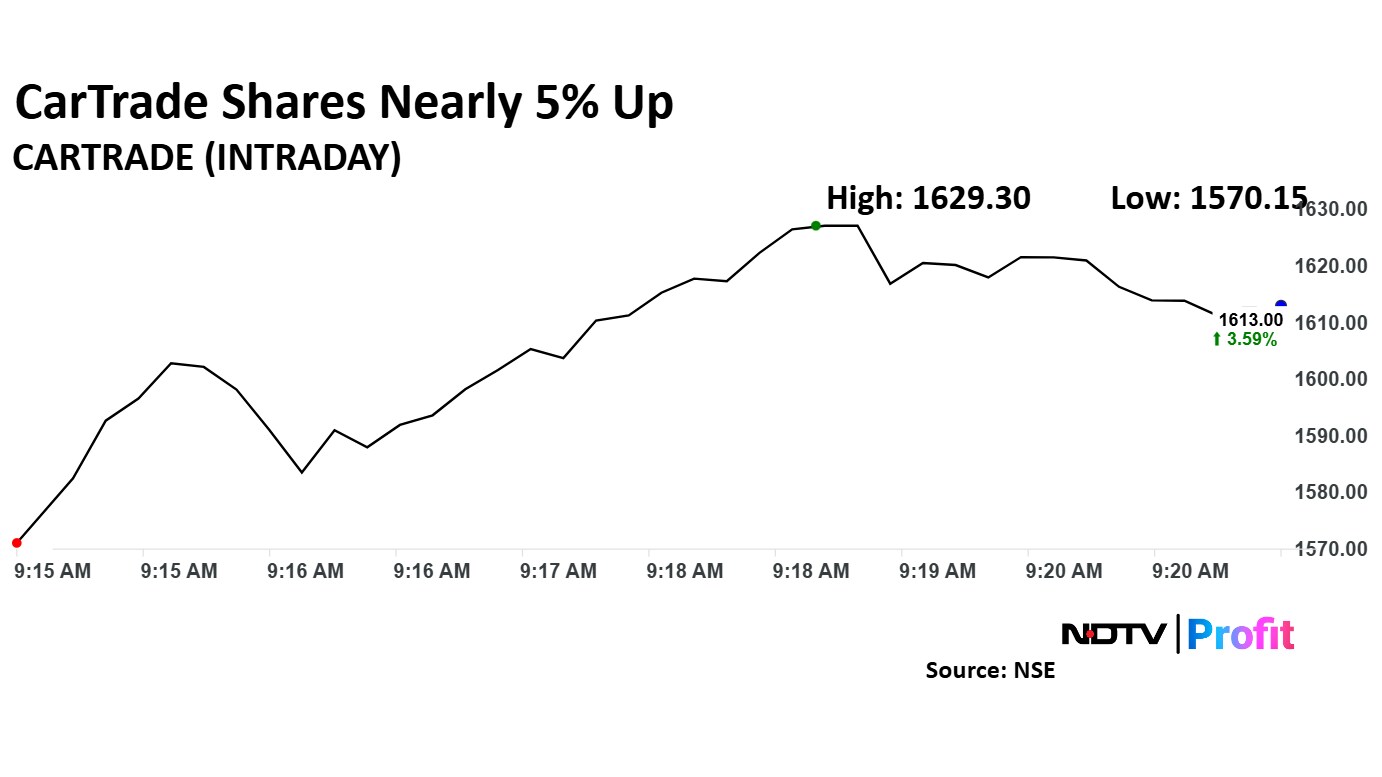

CarTrade Tech Share Price Today

The scrip rose as much as 4.64% to Rs 1,629 apiece, the highest level since Jan. 6, 2025. It pared gains to trade 3.98% higher at Rs 1,619.10 apiece, as of 9:20 a.m. This compares to a 0.16% advance in the NSE Nifty 50.

It has risen 124.6% in the last 12 months. The relative strength index was at 58.17.

Out of six analysts tracking the company, five maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 14.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.