Computer Age Management Services Ltd. share price declined during early trade on Wednesday after a regulatory proposal in mutual funds triggered concerns for the sector.

The Securities and Exchange Board of India on Tuesday proposed measures restructuring the way mutual fund fees are paid, among other related measures. The agency published a consultation paper stating that mutual funds should exclude brokerage and tax charges from the annual fee that customers have to indirectly pay to them to access their services.

CAMS is India's largest mutual fund transfer agency that provides MF services and statements. It acts as a service partner to AIFs, insurance companies, banks and NBFCs.

The company's second-quarter results showed positive momentum. Revenue rose by 6.4% year-on-year for the three months ended September, reaching Rs 377 crore. Profit rose 5.4% to Rs 115 crore.

MF revenue grew 6.4% Q-o-Q and 3.2%. The total assets under management crossed a new milestone of Rs 52 lakh crore in September. The companmy retained its market leadership with 68% share by AUM.

CAMS won two Registrar and Transfer Agent mandates in Q2 – ASK Asset Managers and Alphagrep Asset managers. This takes the MF RTA client count to 28.

Over the past nine months, the company also onboarded six AMCs oincluding Angel One and JioBlackRock.

The board approved an interim dividend of Rs 14 per equity share for the fiscal 2026.

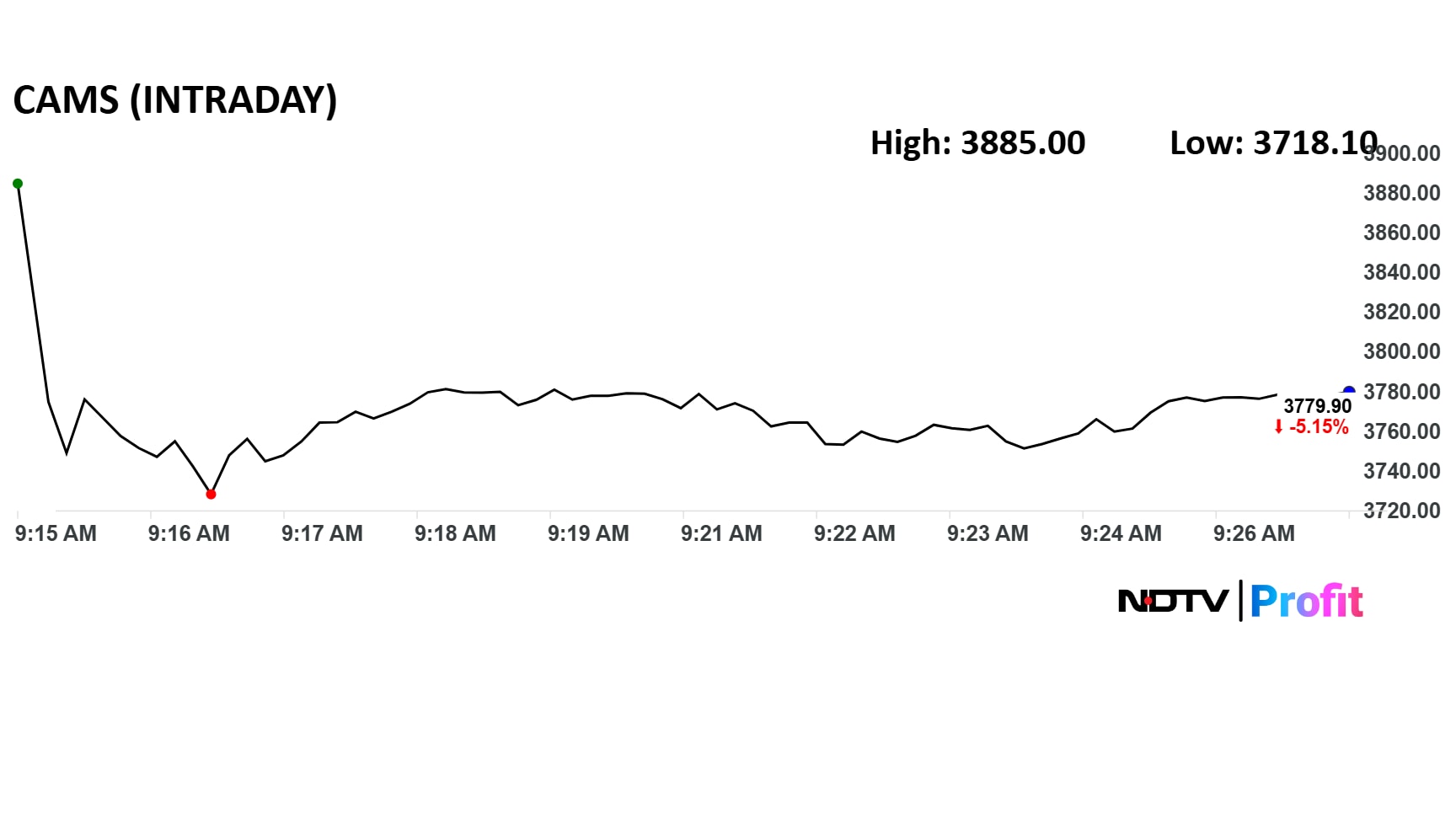

CAMS Share Price Today

CAMS shares fell as much as 6.7% to Rs 3,718 apiece on the NSE, compared to a 0.1% advance in the benchmark Nifty 50. The relative strength index stood at 47.

The stock has fallen 12% in the last 12 months and 25% so far this year.

Out of 17 analysts tracking the company, 13 maintain a 'buy' rating, three recommend a 'hold', and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target of Rs 4,307.25 implies an upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.