The shares of Bank Of India rose as much as 2.71% in trade so far after the bank posted its second quarter update. The bank's total domestic deposits grew 8.5% year-on-year to Rs 7.3 lakh crore in the second quarter of the current financial year from Rs 6.73 lakh crore in the year-ago period, the lender said in its provisional quarterly business updates on Monday.

The public sector bank's gross domestic advances rose 14.62% to Rs 5.97 lakh crore in the September quarter from Rs 5.65 lakh crore in the same period in the last fiscal, according to an exchange filing.

BOI's global business grew 11.8% to Rs 15.62 lakh crore, including a 13.94% rise in the global gross advances to Rs 7.09 lakh crore. The total global deposits grew 10.08% to Rs 8.53 lakh crore, it said.

The banks domestic retail term deposit rose 14.15% to Rs 3.45 lakh crore from Rs 3.02 lakh crore.

Bank of India's standalone net profit during the quarter ended June rose 32% to Rs 2,252.1 crore, compared to Rs 1,702.7 crore in the year-ago period.

The net interest income — the difference of interest earned and interest paid — for the quarter fell 3% to Rs 6,068.1 crore. This compares to Rs 6,275.8 crore reported in the corresponding quarter of the previous fiscal.

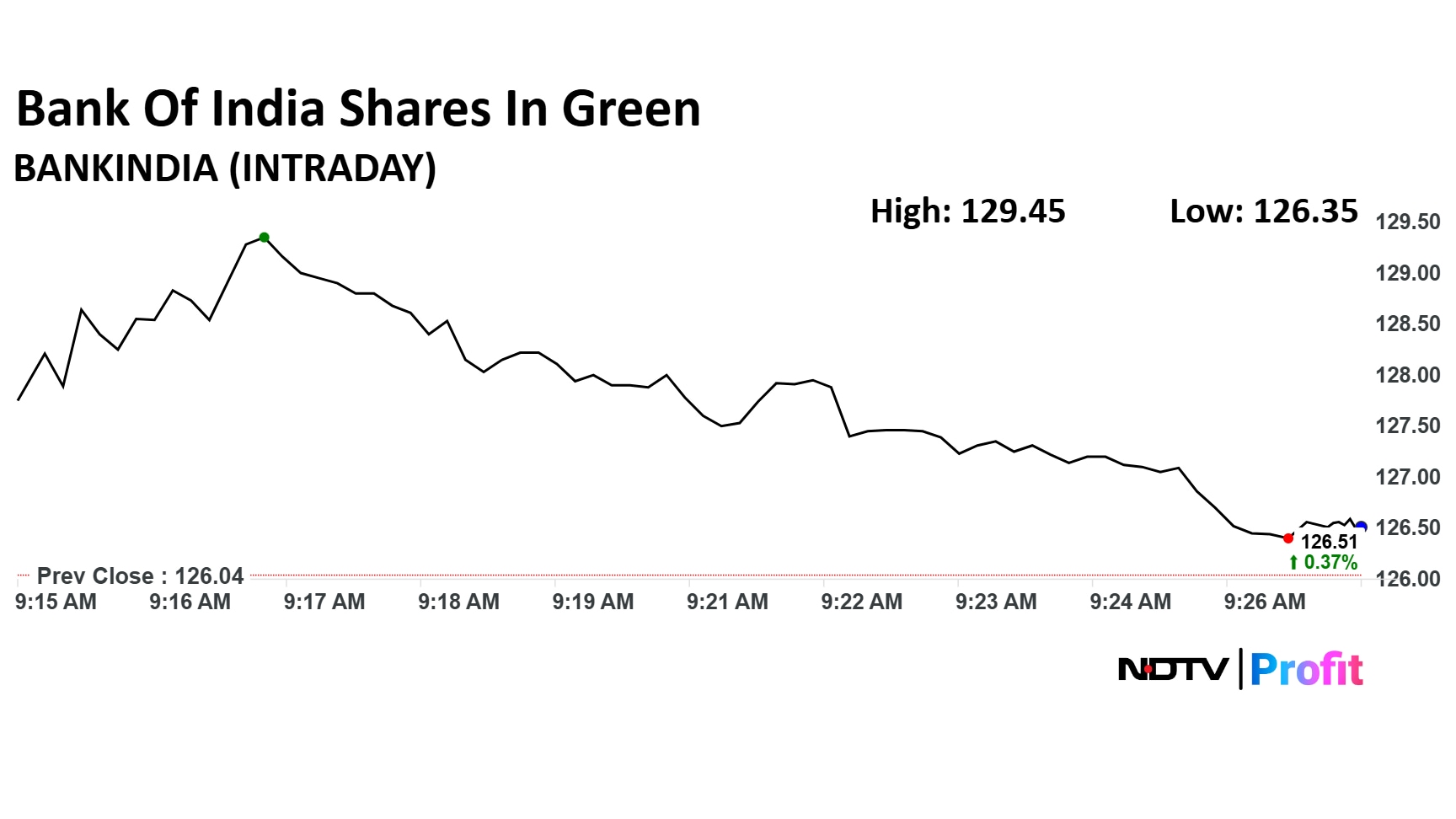

Bank Of India Share Price

Bank of India stock rose as much as 2.71% during the day to Rs 129.45 apiece on the NSE. It was trading 0.78% higher at Rs 127.02 apiece, compared to an 0.46% advance in the benchmark Nifty 50 as of 9:58 a.m.

It has risen 19.86% in the last 12 months and 24.12% on a year-to-date basis. The relative strength index was at 56.10.

Five out of the seven analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and one suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 133.5, implying a upside of 5.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.