Bajaj Housing Finance Ltd. shares rose nearly 6% during the early session on Thursday, Aug. 14, amid a surge in trading volume due to a likely offer for sale by the promoter company Bajaj Finance Ltd.

NDTV Profit reported a day ago that dealers indicate Bajaj Finance has started the OFS to pare stake. The pricing is expected to be at a 10% discount compared to Wednesday's closing price.

The OFS is being conducted to meet SEBI norms regarding the minimum public shareholding that warrants a free float of at least 25%. Promoter Bajaj Finance owns 88.7% equity as of June. Retail investors holding nominal share capital up to Rs 2 lakh have a stake of 7.9%.

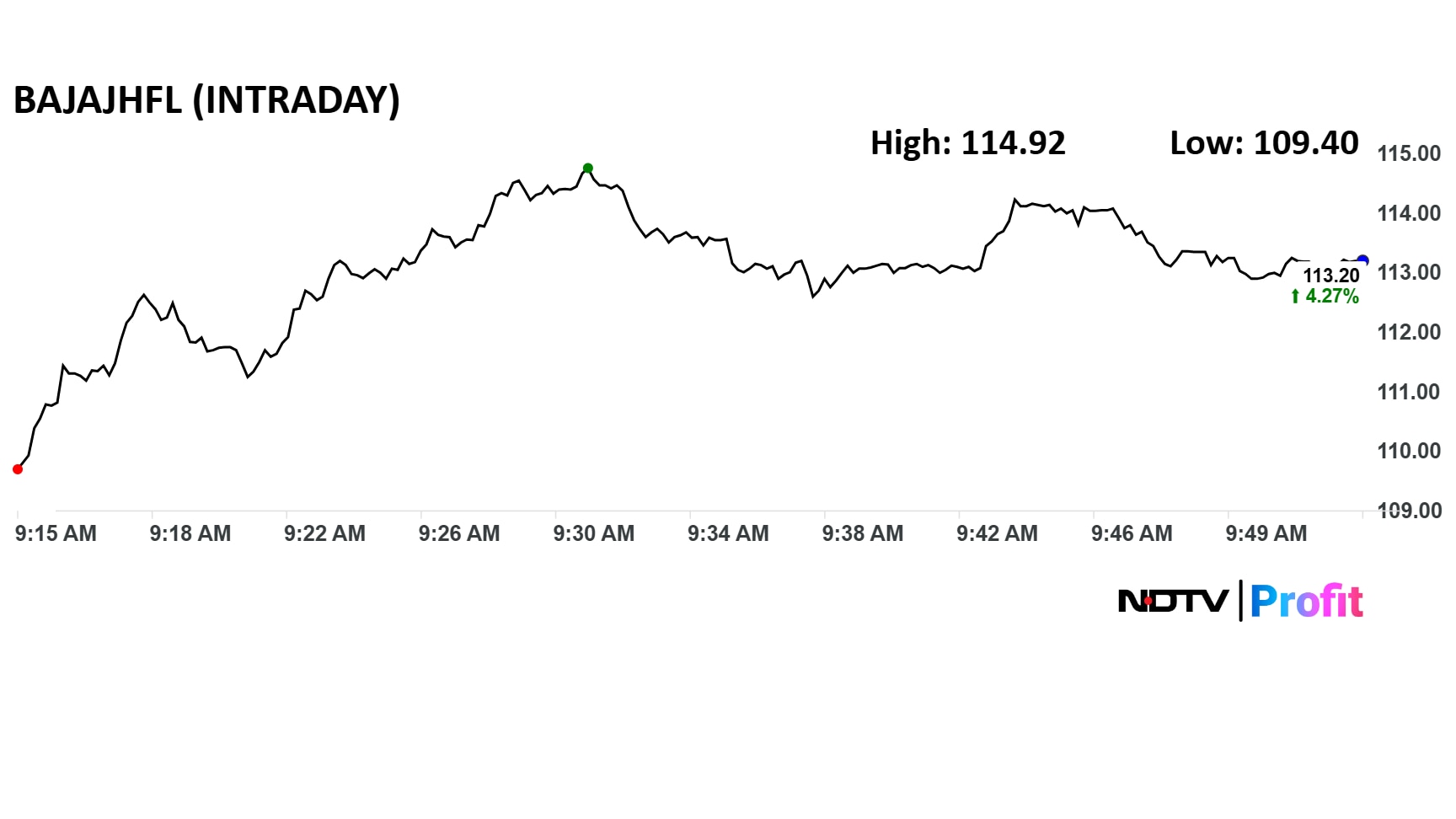

Bajaj Housing share price rose as much as 5.9% to Rs 114.92 apiece on the NSE. The total traded volume stood at 9.4 times the 30-day average. The value of the traded shares on the NSE was Rs 140.29 crore. The relative strength index was 42.

The stock has declined 31% since listing in September 2024. Out of the 10 analysts tracking Bajaj Housing Finance, six have a 'sell' rating on the stock, and two each recommend 'buy' and 'hold', as per Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.