Shares of Indian non-banking financial companies received a fresh bullish price target from multinational investment firm JPMorgan, which updated its coverage on various stocks.

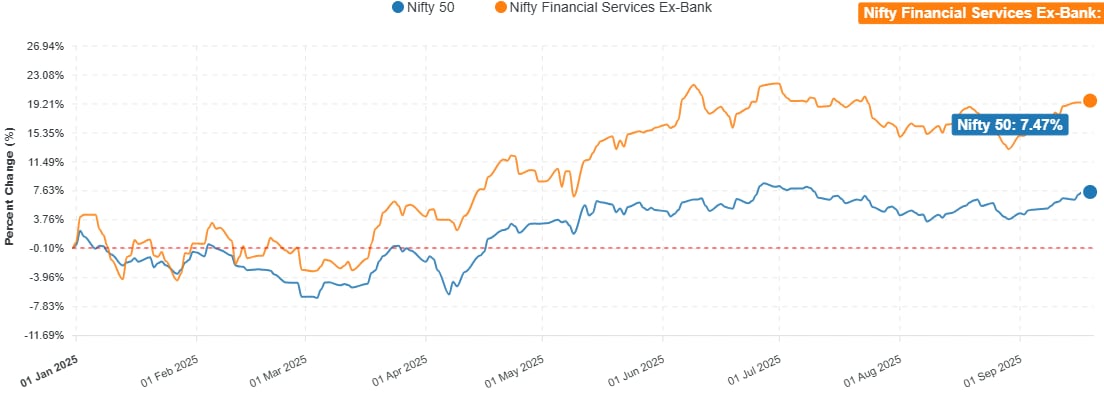

Analysts said NBFCs' 29% year-to-date outperformance compared to banks has been driven primarily by a valuation re-rating of 27% due to the RBI liquidity pivot and rate cut cycle.

"We believe the valuation re-rating is justified by earnings tailwinds from potential NIM expansion, as liabilities reprice faster than fixed-rate loans. The valuation re-rating is in line with past rate cut cycles, where India NBFCs re-rated by 41% on average," a JPMorgan note said.

Despite these factors, earnings support has been limited thus far on a weak macro, slower-than-expected transmission of rate cuts in NBFC earnings, and asset quality issues in select segments. With the RBI likely on pause, positive earnings revisions will be important for the sector to re-rate, analysts said.

High valuations in select pockets of the sector may limit upside unless earnings grow to match expectations.

"We remain selective as we await better entry points and prefer stocks that offer value (Shriram Finance and Mahindra & Mahindra Financial Services) along with the positive earnings impact of the normal monsoons, as well as recent GST cuts," JPMorgan said.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Year-to-date performance of Nifty and a broad gauge of NBFCs.

JPMorgan Price Targets

Shriram Finance – Rated 'Overweight'; Hike target price to Rs 740 from Rs 730. The concerns around potential asset quality issues from reduced truck utilisation and a freight rate decline on deferred buying activities due to GST cuts, as well as issues in the SME segment, are likely overdone.

M&M Finance – Rated 'Overweight'; Hike target price to Rs 335 from Rs 300. An uptick in auto sales after GST cuts will flow through and become incrementally positive. Normal monsoons bode well for agri cash flows, paving the way for better tractor volumes and credit outcomes in the second half of current fiscal.

Bajaj Finance – Rated 'Neutral'; Hike target price to Rs 1,070 from Rs 970. The company's well-diversified loan book and strength in consumer credit offer a high beta following recent GST cuts, along with a normalisation in credit costs, analysts said.

Chola Finance – Rated 'Neutral'; Hike target price to Rs 1,620 from Rs 1,600. Growth outlook will be constrained by a tough macro, a muted growth outlook for commercial vehicles and growth headwinds from a conscious contraction in defocused segments. Valuations are seen as pricey.

SBI Cards – Rated 'Underweight'; Hike target price to Rs 830 from Rs 800. Analysts see significant downside risks to earnings due to elevated and sticky credit costs, lackluster loan growth, a moderation in credit card spending and NIM headwinds from asset mix deterioration.

L&T Finance – Upgrade to 'Neutral' from 'Underweight'; Hike target price to Rs 260 from Rs 140. Microfinance delinquencies are normalising, and growth is reviving, yet improving growth and credit outcome visibility could make a more positive case.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.