.jpg?downsize=773:435)

The shares of Avenue Supermarts Ltd. rose on Friday to hit a five-month high after CLSA maintained its 'Outperform' rating on the stock with a target price of Rs 5,360 apiece. The brokerage remains optimistic about DMart's prospects, particularly in light of its robust store expansion strategy and the company's strong position in India's retail market.

As of March 27, DMart had added 15 stores in the fourth quarter of this financial year, taking the total for the fiscal year to 37. The company expects to add 10 more stores in the last few days of the year. Over the past five years, DMart has averaged 38 store openings per year, and it added 41 stores in the previous fiscal, said CLSA in its note.

Investors have expressed concerns over the pace of store additions, but CLSA believes the company is well-positioned to accelerate its expansion. DMart is increasingly opening stores outside Metro and Tier 1 cities, where property costs are lower, and competition is less. So far in fiscal 2025, about 70% of new stores are in smaller towns, where staple consumption remains stable, and stores are likely to generate higher returns.

DMart's store expansion is funded by cash flow generated from prior years, as the company owns most of its store properties, which gives it a cost advantage. This, along with the lower competition in non-Metro areas, enhances the company's prospects for further growth, CLSA added.

CLSA remains confident in DMart's ability to continue expanding, especially in smaller towns, and sees the stock as one of India's top picks.

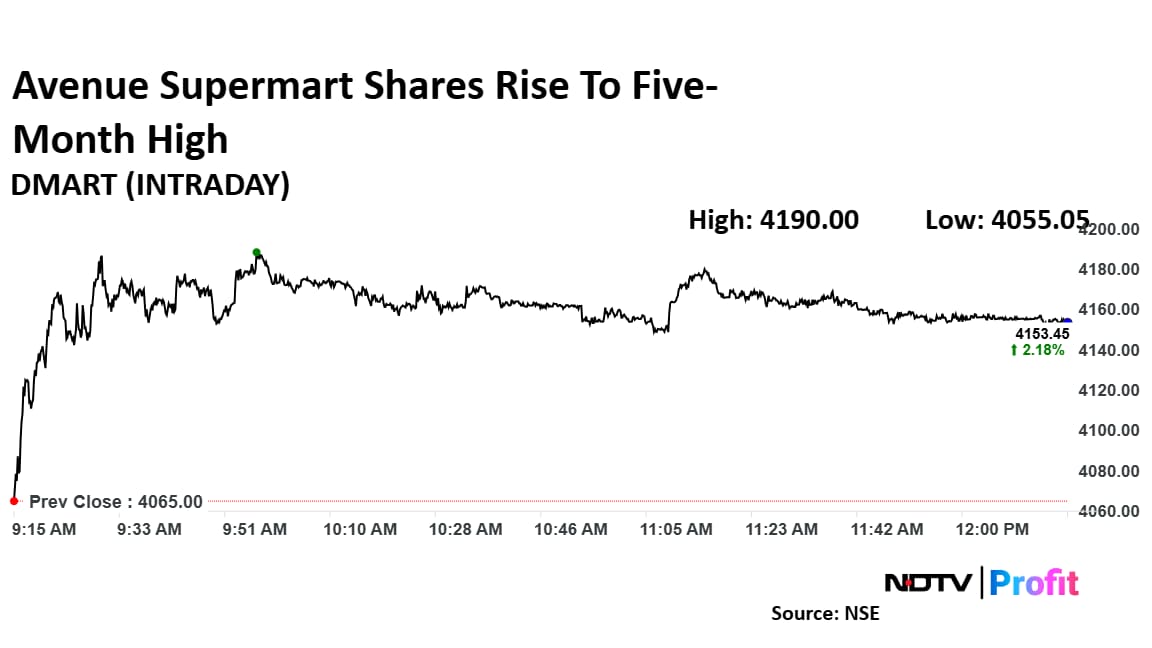

Avenue Supermarts Share Price Rise

The shares of Avenue Supermarts rose as much as 3.08% to Rs 4,190 apiece, the highest level since Oct. 23, 2024. The stock pared gains to trade 2.22% higher at Rs 4,155.35 apiece, as of 12:15 p.m. This compares to a 0.01% advance in the NSE Nifty 50 Index.

It has fallen 8.18% in the last 12 months and risen 16.70% year-to-date. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 77, indicating it was overbought.

Out of 31 analysts tracking the company, 12 maintain a 'buy' rating, nine recommend a 'hold,' and 10 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.