Asian stocks rebounded after three days of losses, as optimism over a potential Federal Reserve interest-rate cut lifted sentiment and outweighed renewed US-China trade tensions.

Shares in Japan, South Korea and Australia all rose at the open after Fed Chair Jerome Powell's concerns about a weakening labor market reinforced investors' expectations for a rate cut in October. Contracts for the S&P 500 edged up after the underlying gauge dropped 0.2% as President Donald Trump said he might stop trade in cooking oil with China.

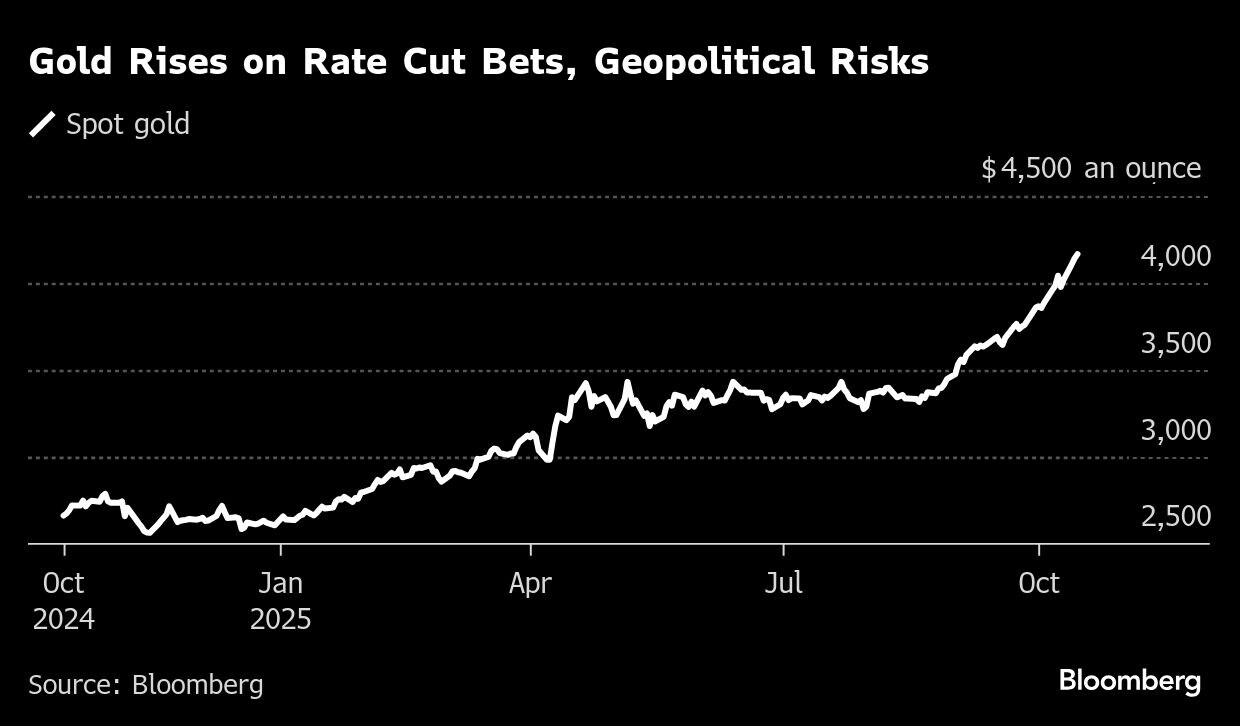

The dollar held its losses and crude oil hovered near a five-month low. Gold traded near its peak while spot silver advanced after a volatile day on Tuesday that saw prices surge to an all-time high above $53.54 an ounce, before tumbling sharply amid signs a historic squeeze is starting to ease. Treasury two-year yields hovered near their lowest levels since 2022.

Since the tariff-fueled selloff in April, global stocks have rebounded sharply, buoyed by optimism over artificial intelligence and expectations of further monetary easing following the Fed's September rate cut. That rally, however, now faces headwinds as trade tensions between the US and China resurface, with both sides stepping up rhetoric and signaling possible new restrictions on key technology.

“Macro uncertainty remains the key overhang for risk assets,” Dilin Wu, a strategist at Pepperstone Group wrote in a note. “With rate-cut bets and solid earnings underpinning sentiment, I believe the downside for US stocks remains limited.”

Powell signaled the US central bank is on track to deliver another quarter-point interest-rate cut later this month, even as a government shutdown significantly reduces its read on the economy.

Swap contracts are pricing in roughly 1.25 percentage points of rate cuts by the end of next year, from the current range of 4%-4.25%.

The Fed chair said that the economic outlook appeared unchanged since policymakers met in September, when they lowered interest rates and projected two more cuts this year. Fed Boston President Susan Collins said the US central bank should continue lowering rates this year to support the labor market.

“Markets viewed Fed Chair Powell's speech as consistent with continued rate cuts over the coming FOMC meetings this year,” ANZ Group Holdings Ltd. analysts Brian Martin and Daniel Hynes said in a note.

Powell's comments that the economic outlook hasn't changed much since the Fed's September meeting, and the labour market perceptions remain on a downward trajectory, are “a signal that further interest rate cuts are likely,” wrote the analysts. They expect two more 25-basis-point cuts this year.

Earlier, US Trade Representative Jamieson Greer predicted that heightened tensions with China over export controls would ease, following talks between representatives of the two countries. That followed the Asian nation's sanctioning of US units of a South Korean shipping giant, escalating a dispute over maritime dominance.

Trump, too, sounded cautiously optimistic a positive outcome could be reached.

“We have a fair relationship with China, and I think it'll be fine. And if it's not, that's OK too,” Trump told reporters Tuesday at the White House. “We have a lot of punches being thrown, and we've been very successful.”

Elsewhere, the European Union is considering forcing Chinese firms to hand over technology to European companies if they want to operate locally, in an aggressive new push to make the bloc's industry more competitive.

“Since the tariff/trade issue is the one issue that has created problems for the stock market this year, we'll all be watching the developments on this one very, very closely,” said Matt Maley at Miller Tabak.

Attention in Asia is on Japan. Investors are cautious going into the country's 20-year government bond auction on Wednesday as the shock collapse of the ruling coalition fuels fresh political uncertainty.

Longer-maturity bonds plunged after Sanae Takaichi's surprise victory in the Liberal Democratic Party election earlier this month, while prospects for her becoming prime minister have diminished after the rupture of the 26-year alliance last week.

Meanwhile, a record share of global fund managers said artificial intelligence stocks are in a bubble following a torrid rally this year, according to a survey by Bank of America Corp.

About 54% of participants in the October poll indicated tech stocks were looking too expensive, an about-turn from last month when nearly half had dismissed those concerns. Fears that global stocks were overvalued also hit a peak in the latest survey.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 10:03 a.m. Tokyo time

Hang Seng futures rose 1%

Nikkei 225 futures (OSE) rose 1%

Japan's Topix rose 1.1%

Australia's S&P/ASX 200 rose 0.7%

Euro Stoxx 50 futures rose 0.8%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1610

The Japanese yen rose 0.2% to 151.57 per dollar

The offshore yuan was little changed at 7.1383 per dollar

The Australian dollar rose 0.2% to $0.6496

Cryptocurrencies

Bitcoin fell 0.2% to $112,779.76

Ether fell 0.6% to $4,095.52

Bonds

The yield on 10-year Treasuries declined one basis point to 4.02%

Japan's 10-year yield declined 3.5 basis points to 1.655%

Australia's 10-year yield was little changed at 4.23%

Commodities

West Texas Intermediate crude fell 0.1% to $58.62 a barrel

Spot gold rose 0.6% to $4,169.52 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.